Forex Trading How To Use Rsi Divergence

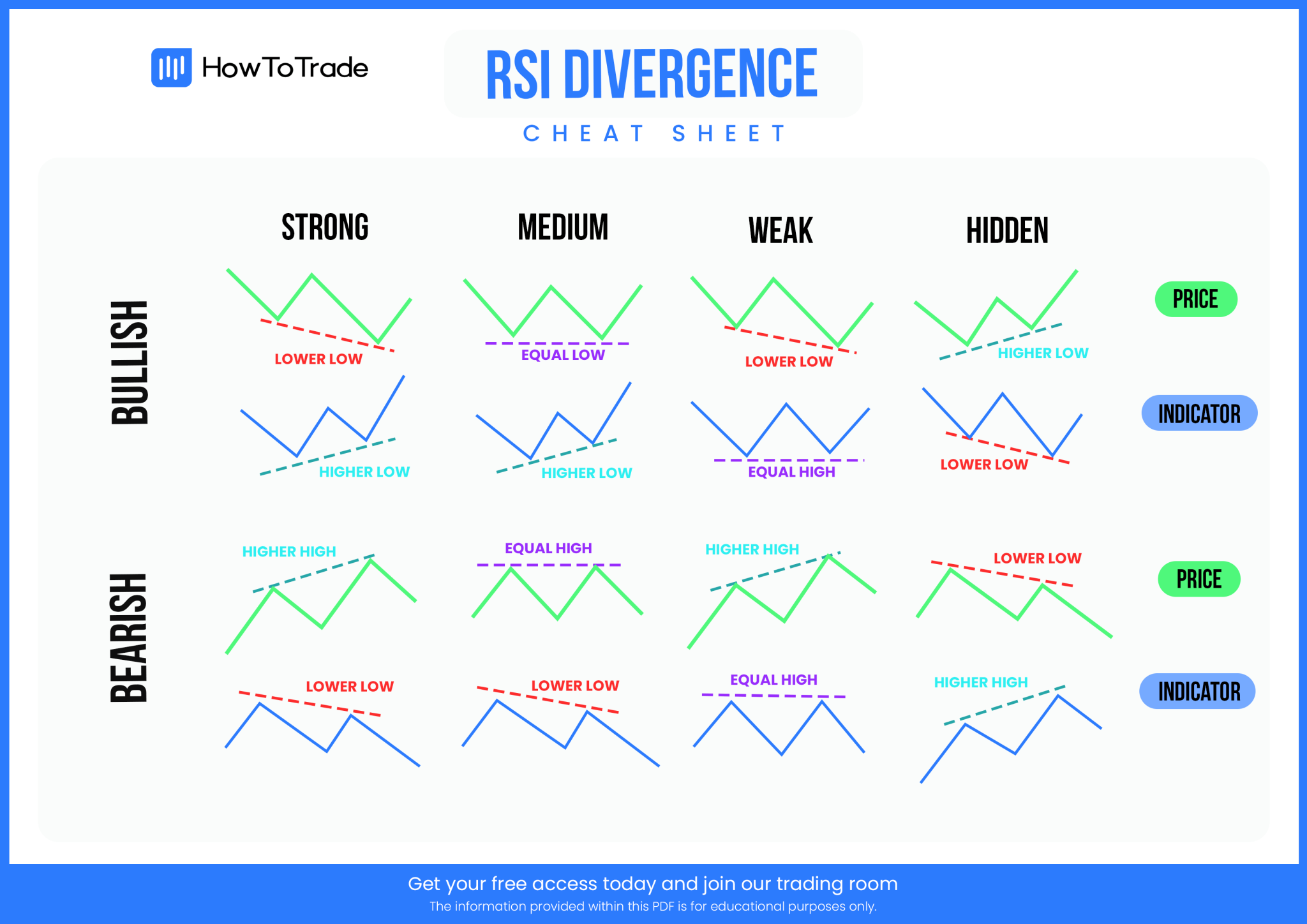

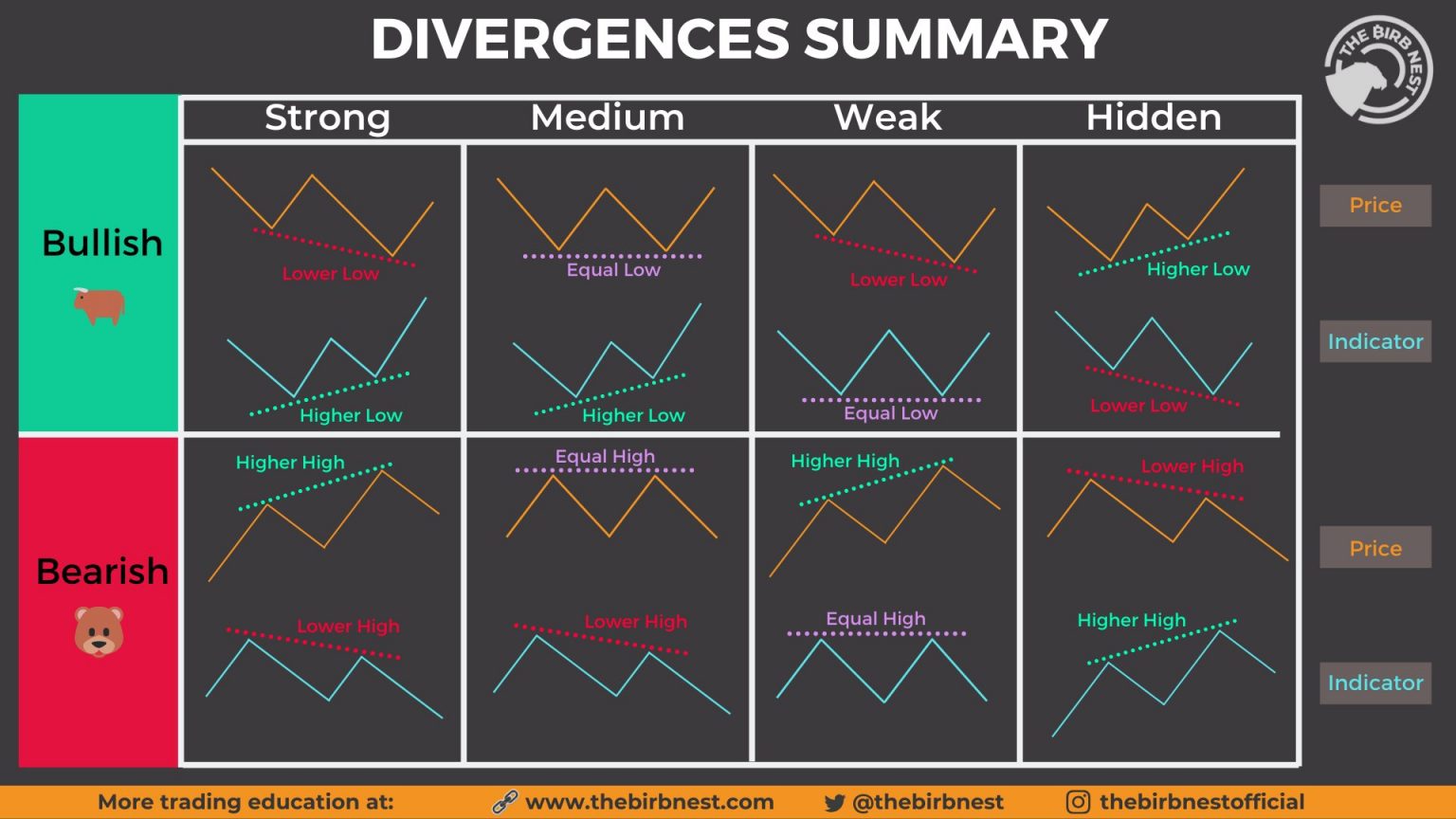

Rsi Divergence Cheat Sheet Pdf Free Download Step 4 – find the divergence = different color lines. the lines have color just to be easier to find the divergence. basically, we just want to find colors that don’t match. that would be, a red line on the price, consecutive lower lows. and a green line on the rsi indicator, consecutive higher lows. Learn ’em, memorize ’em (or keep coming back here), apply ’em to help you make better trading decisions. ignore them and go broke. 1. make sure your glasses are clean. in order for a divergence to exist, the price must have either formed one of the following: higher high than the previous high. lower low than the previous low.

What Is Rsi Divergence Learn How To Spot It When it comes to trading rsi divergence, there are two main types that forex traders should be aware of: bullish divergence and bearish divergence. both types can provide valuable signals for potential trend reversals or continuations. bullish divergence occurs when the price is making lower lows while the rsi indicator is making higher lows. A bearish divergence consists of an overbought rsi reading, followed by lower high on rsi. at the same time, price must make a higher high on the second peak, where the rsi is lower. in a bullish divergence situation, there must be an oversold condition on the rsi, followed by a higher low on the rsi graph. A regular bearish rsi divergence occurs when the rsi indicator shows lower lows while the asset’s price forms higher highs. when this happens, the rsi regular bearish divergence signals the possibility of a trend reversal, and a bearish trend or price correction is very likely to occur. the hidden bearish divergence occurs when the asset’s. It’s called divergence trading. in a nutshell, divergence can be seen by comparing price action and the movement of an indicator. it doesn’t really matter what indicator you use. you can use rsi, macd, stochastic, cci, etc. the great thing about divergences is that you can use them as a leading indicator, and after some practice, it’s not.

Rsi Divergence New Trader U A regular bearish rsi divergence occurs when the rsi indicator shows lower lows while the asset’s price forms higher highs. when this happens, the rsi regular bearish divergence signals the possibility of a trend reversal, and a bearish trend or price correction is very likely to occur. the hidden bearish divergence occurs when the asset’s. It’s called divergence trading. in a nutshell, divergence can be seen by comparing price action and the movement of an indicator. it doesn’t really matter what indicator you use. you can use rsi, macd, stochastic, cci, etc. the great thing about divergences is that you can use them as a leading indicator, and after some practice, it’s not. We have a positive rsi divergence, when the price action accounts for lower lows and lower highs, while the rsi indicator is making the opposite – higher highs and higher lows. the price keeps decreasing, while the rsi indicator starts increasing. the image above shows a positive rsi divergence in mt4. Rsi divergence is considered to be a quite reliable signal of a coming trend violation and change. though newbie traders think that the application of the divergence is quite complicated, in practice, you can easily identify it with the following tips: 💠first of all, let's start with the settings. for the input, we will take 7 close.

Comments are closed.