Financial Stability And Interest Rates Liberty Street Economics

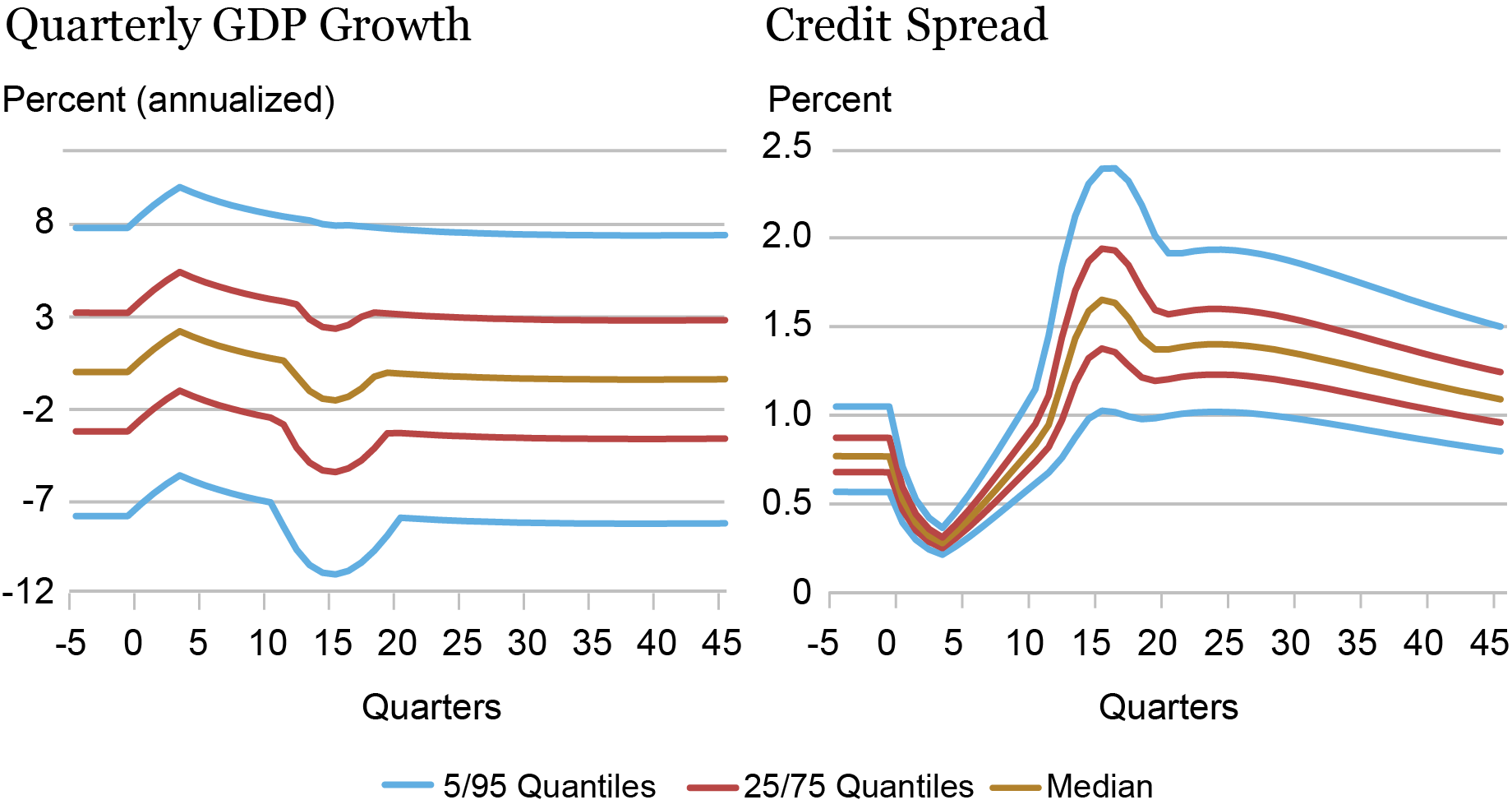

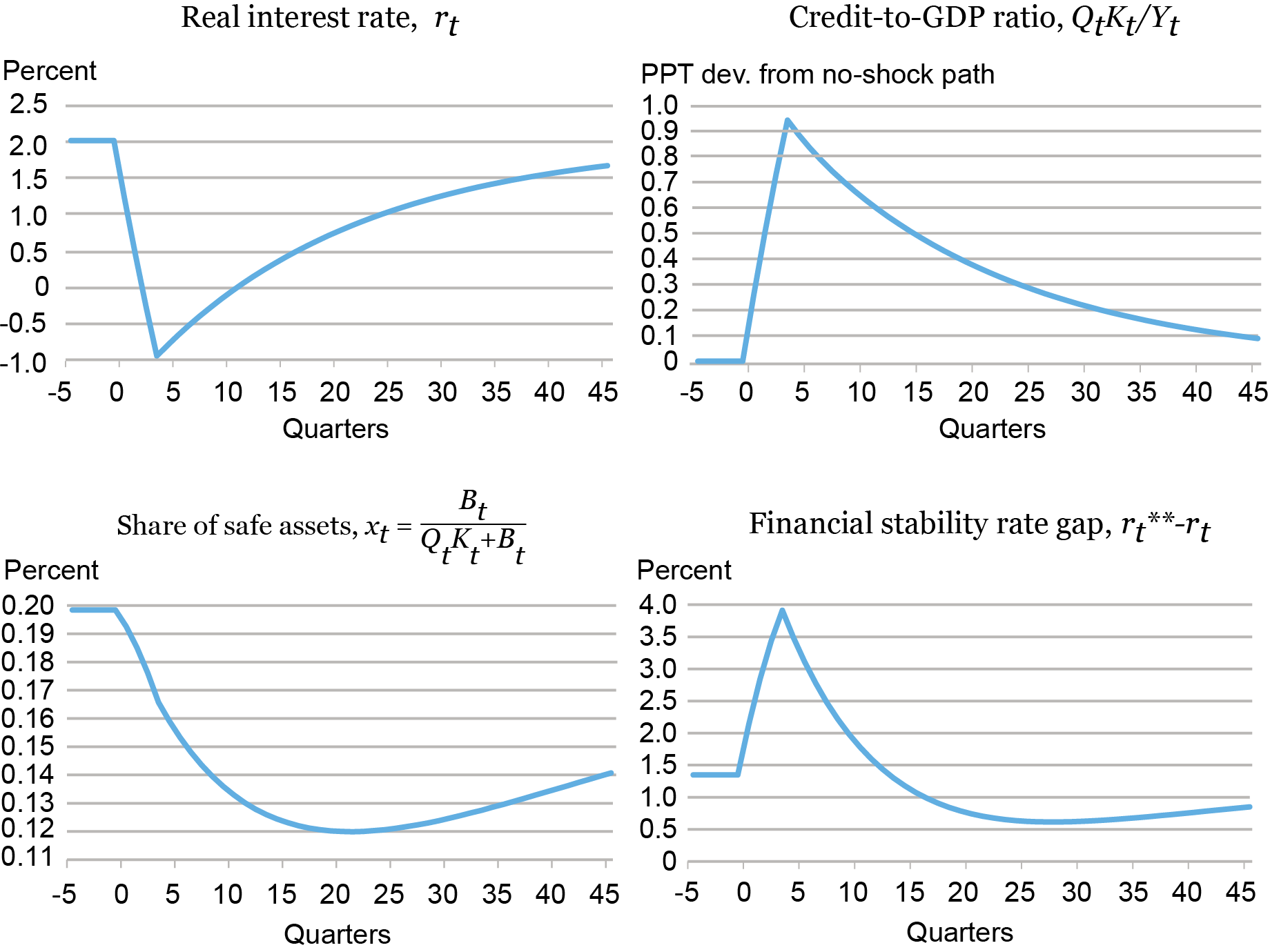

Financial Stability And Interest Rates Liberty Street Economics In a recent research paper we argue that interest rates have very different consequences for current versus future financial stability. in the short run, lower real rates mean higher asset prices and hence higher net worth for financial institutions. in the long run, lower real rates lead intermediaries to shift their portfolios toward risky assets, making them more vulnerable over time. in. Liberty street economics features insight and analysis from new york fed economists working at the intersection of research and policy. launched in 2011, the blog takes its name from the bank’s headquarters at 33 liberty street in manhattan’s financial district.

Measuring The Financial Stability Real Interest Rate R Liberty Albert queralto is chief of the global modeling studies section in the federal reserve board’s division of international finance. ozge akinci, gianluca benigno, marco del negro, ethan nourbash, and albert queralto, “financial vulnerability and macroeconomic fragility,” federal reserve bank of new york liberty street economics, may 22. Ozge akinci & gianluca benigno & marco del negro & ethan nourbash & albert queraltó, 2023. "financial stability and interest rates," liberty street economics 20230523, federal reserve bank of new york. handle: repec:fip:fednls:96196. 20240820 the disparate outcomes of bank‑ and nonbank‑financed private credit expansions. by nina boyarchenko & leonardo elias. 20240819 an update on the reservation wages in the sce labor market survey. by gizem koşar & davide melcangi & sasha thomas. 20240814 a new set of indicators of reserve ampleness. Abstract. we build a macro finance model with an occasionally binding financing constraint where real interest rates have opposite effects on current and future financial stability, with the contemporaneous impact driven by valuation effects (akin to those triggering the 2023 banking turmoil) and the future impact driven by reach for yield by intermediaries.

Financial Stability And Interest Rates Liberty Street Economics 20240820 the disparate outcomes of bank‑ and nonbank‑financed private credit expansions. by nina boyarchenko & leonardo elias. 20240819 an update on the reservation wages in the sce labor market survey. by gizem koşar & davide melcangi & sasha thomas. 20240814 a new set of indicators of reserve ampleness. Abstract. we build a macro finance model with an occasionally binding financing constraint where real interest rates have opposite effects on current and future financial stability, with the contemporaneous impact driven by valuation effects (akin to those triggering the 2023 banking turmoil) and the future impact driven by reach for yield by intermediaries. Global supply chains and u.s. import price inflation. march 2024. the mission of the applied macroeconomics and econometrics center (amec) is to develop approaches and ideas for answering the most pressing questions in the fields of macroeconomics and applied econometrics. Financial stability and interest rates liberty street economics libertystreeteconomics.newyorkfed.org 83 1 comment.

Financial Stability And Interest Rates Liberty Street Economics Global supply chains and u.s. import price inflation. march 2024. the mission of the applied macroeconomics and econometrics center (amec) is to develop approaches and ideas for answering the most pressing questions in the fields of macroeconomics and applied econometrics. Financial stability and interest rates liberty street economics libertystreeteconomics.newyorkfed.org 83 1 comment.

Comments are closed.