Financial Literacy Methods Of Payment Needs Vs Wants Debit Vs Credit

Financial Literacy Methods Of Payment Needs Vs Wants Debit Vs Credit This is a slideshow presentation. this covers financial literacy from grade 4 8. it covers methods of payments, when to use a debit card vs credit card, benefits and when to use of each kind of method of payment, making spending decision, smart spending, and money tips. Financial literacy is the ability to understand and make use of a variety of financial skills. use a debit or credit card; use payment apps like venmo or paypal spending 50% on needs, 20%.

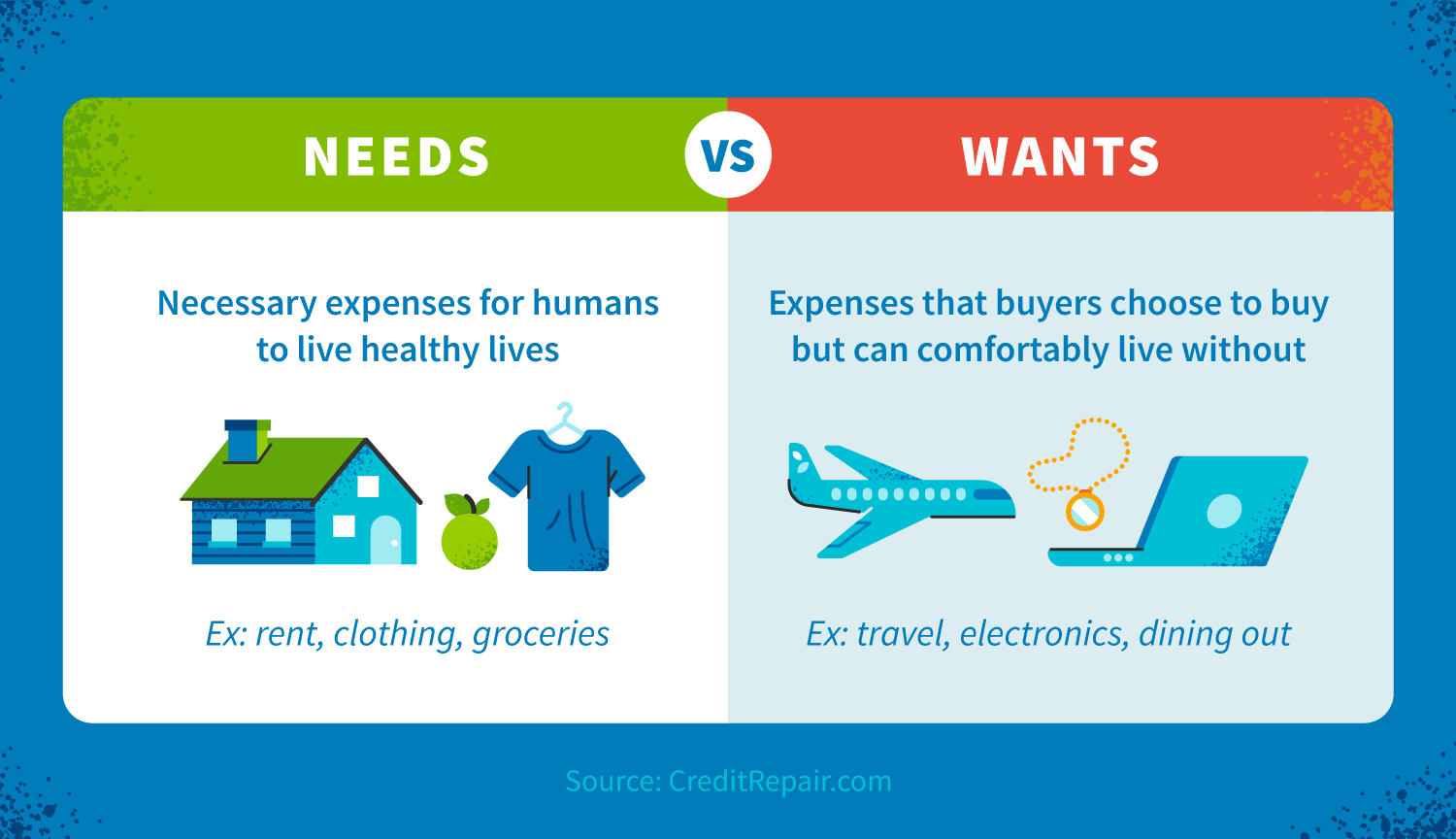

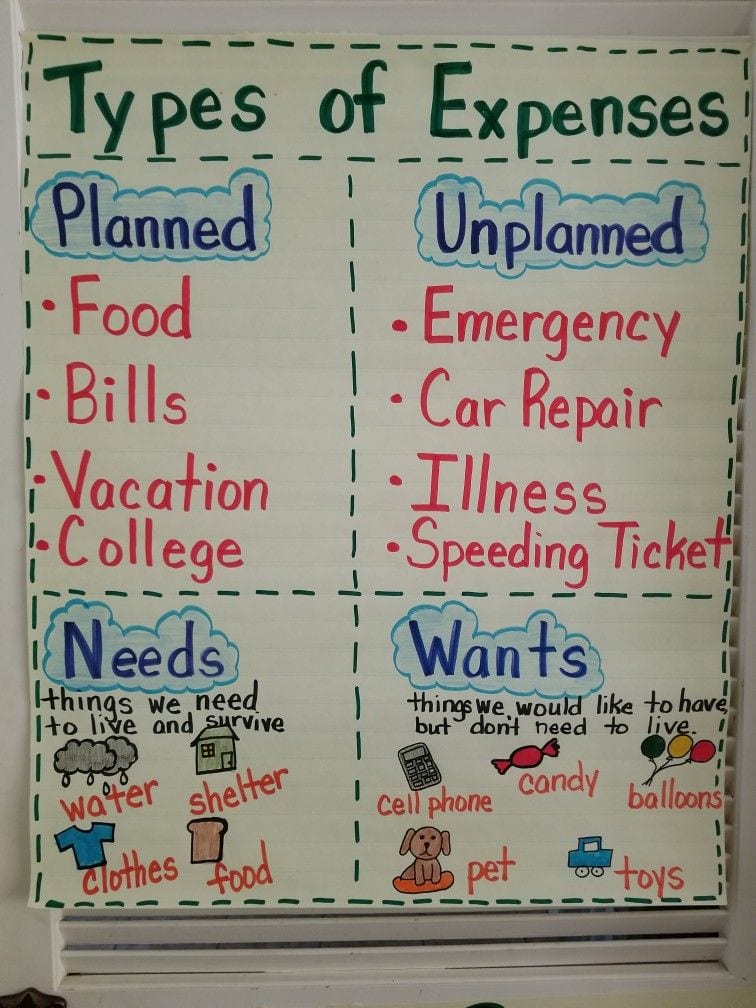

Needs Vs Wants Must Know Differences Creditrepair At nerdwallet, we recommend the 50 30 20 budget. if you distribute your monthly income in this fashion, you would spend 50% on needs, 30% on wants and 20% on savings and paying off debt. plug your. Here’s an example budget for a fixed income of $3,000 based on the 50 30 20 rule: needs: $1,500 (50 percent) transportation (public transit, gas, maintenance): $200. wants: $900 (30 percent. Many financial experts recommend the 50 30 20 rule, which allocates 50% of your after tax income to needs, 30% to wants, and 20% to debt payments beyond the minimum and savings. Governments often accept payments by card, but they may ask for a few percent extra, because "taking" a few percent is how the credit card companies make their money. for example, when you use a card to purchase $100 of stuff from a store, the credit card company only pays the store $97.

Financial Literacy Anchor Charts To Teach Money Skills To Your Students Many financial experts recommend the 50 30 20 rule, which allocates 50% of your after tax income to needs, 30% to wants, and 20% to debt payments beyond the minimum and savings. Governments often accept payments by card, but they may ask for a few percent extra, because "taking" a few percent is how the credit card companies make their money. for example, when you use a card to purchase $100 of stuff from a store, the credit card company only pays the store $97. Financial literacy empowers teens to use financial skills, including personal financial management, budgeting, and investing, to better their financial futures. needs (50%), savings (20%), and. 7. keep building wealth and giving generously. the purpose of financial literacy isn’t just head knowledge. the real goal is to be able to use your money to do the things you truly want to do, like retire with dignity, spend free time with family, and give to other people and worthy causes.

Comments are closed.