Financial Advisor Compensation Flat Fee Aum Model Financial Planning

Financial Planning Pricing Approach Fees Flat Fee Aum Approach Financial We had just signed on a fantastic prospect — a 72 year old surgeon earning almost $750,000 annually with a $2 million rollover ira and another $2 million in his 401 (k) at work. in most aum. Let's dive into the three main ways financial advisors are compensated: aum (assets under management), commission, and flat fee models. by the end of this post, you'll have a clear understanding of each model and be better equipped to choose the right advisor for your needs. the three main fee models. aum (assets under management).

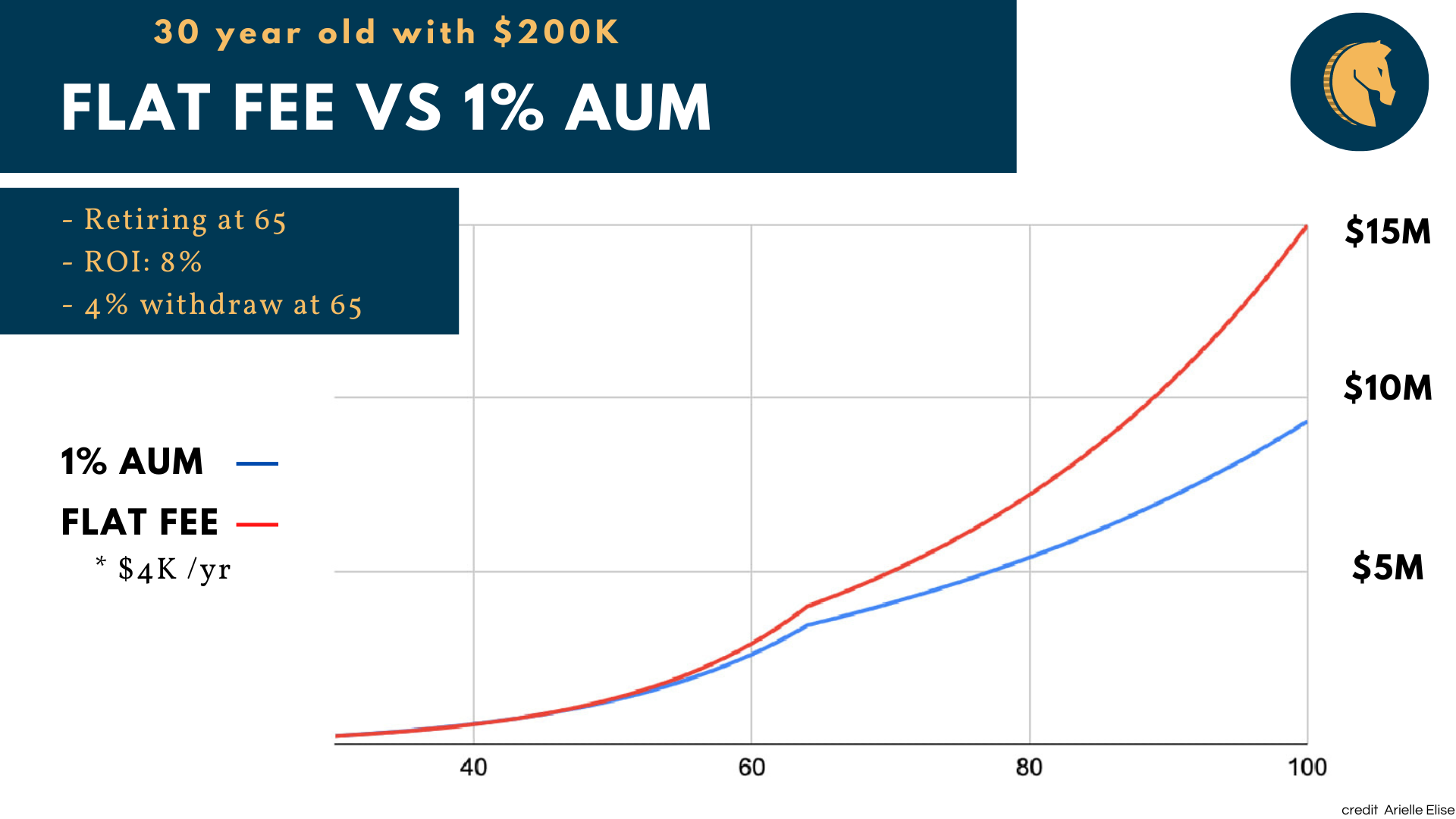

Flat Fee Financial Advisors Rally Financial Flat fee financial advisors earn a flat fee for services. other advisors charge a percent of assets under management (aum). here’s a breakdown of the costs. Haas said edward jones' goal is to have the service rolled out to all of its more than 19,500 advisors by next year. financial planning for a fee is now available only to clients with $250,000 or. Fees paid with advice only flat fee advisor. $26,279. $58,314. $97,363. $144,965. first, you'll notice that with starting assets of $100,000, the fees paid to a flat fee advice only financial advisor could actually be higher than the fees paid to an aum advisor during the first 10 years. actually, it's really during the first 15 years. A few hundred dollars to $6,500 for a financial plan only. $660 to $17,500 for a flat annual fee. anecdotally, i typically see fees around $10,000 or less for advisors who manage assets and provide advice on retirement income planning. however, costs are all over the board. you can see my current pricing here.

Assets Under Management Aum Definition Finance Strategists Fees paid with advice only flat fee advisor. $26,279. $58,314. $97,363. $144,965. first, you'll notice that with starting assets of $100,000, the fees paid to a flat fee advice only financial advisor could actually be higher than the fees paid to an aum advisor during the first 10 years. actually, it's really during the first 15 years. A few hundred dollars to $6,500 for a financial plan only. $660 to $17,500 for a flat annual fee. anecdotally, i typically see fees around $10,000 or less for advisors who manage assets and provide advice on retirement income planning. however, costs are all over the board. you can see my current pricing here. According to the envestnet | moneyguide 2024 state of financial planning & fees study: the average fixed percentage fee for a financial advisor is 1.05%. the average flat fee is $2,554. the average hourly rate is $268. the average annual retainer fee is $4,484. the average subscription fee is $215 month. One of the big misconceptions is flat fees aren’t scalable. while it’s true that it logically won’t be as profitable as a percentage of aum model—especially for advisers who are able to set high aum minimums like $1,000,000—that doesn’t mean you can’t scale it well and make it profitable. honestly, i think a lot of the industry.

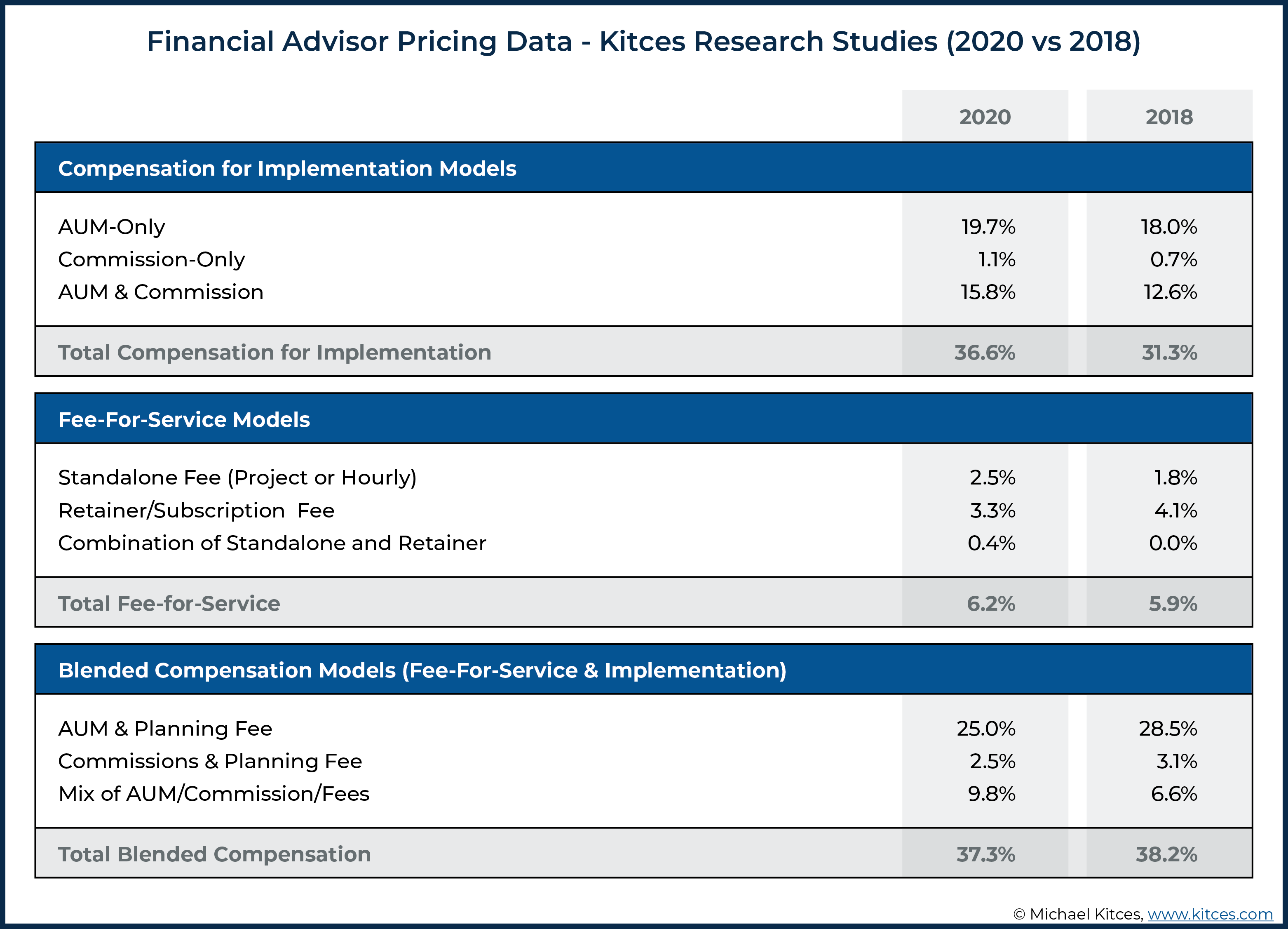

Financial Advisor Fee Trends Still Show No Fee Compression According to the envestnet | moneyguide 2024 state of financial planning & fees study: the average fixed percentage fee for a financial advisor is 1.05%. the average flat fee is $2,554. the average hourly rate is $268. the average annual retainer fee is $4,484. the average subscription fee is $215 month. One of the big misconceptions is flat fees aren’t scalable. while it’s true that it logically won’t be as profitable as a percentage of aum model—especially for advisers who are able to set high aum minimums like $1,000,000—that doesn’t mean you can’t scale it well and make it profitable. honestly, i think a lot of the industry.

Comments are closed.