Fillable Online Here S Why You May Be Denied A Checking Or Savings

Fillable Online Here S Why You May Be Denied A Checking Or Savings Consumers can access a free copy of their chexsystems report once every 12 months, as well as whenever they get denied for a bank account if the reason stems from the report. to obtain yours, go. Common reasons for account denials include: it is possible that the bank simply cannot verify your identity. many banks use multi factor verification, like asking you to identify a street you’ve.

What To Do When You Re Denied A Checking Or Savings Account When a potential customer applies to open a new checking account, the bank or credit union asks chexsystems to run a search against the service’s database to see if any problems have been. Fortunately, in a lot of cases, you may be able to take steps to fix the situation. keep reading to learn about five reasons you can be denied a bank account and what you can do. 1. your. These companies include chex systems and early warning services. you may have been denied a bank account because a checking account screening company has negative information in its files about your checking history. you may have negative information in your file if, for example, you have had a checking account before and you: you can get free. 2. check your banking report. you can obtain a copy of your chexsystems report once a year and whenever you are denied a bank account if the report is the cause of your rejection. visit the chexsystems’ website or call 800 428 9623. 3.

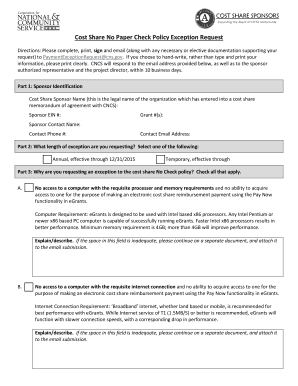

Fillable Online Cost Share No Paper Check Policy Exception Vista These companies include chex systems and early warning services. you may have been denied a bank account because a checking account screening company has negative information in its files about your checking history. you may have negative information in your file if, for example, you have had a checking account before and you: you can get free. 2. check your banking report. you can obtain a copy of your chexsystems report once a year and whenever you are denied a bank account if the report is the cause of your rejection. visit the chexsystems’ website or call 800 428 9623. 3. If you're turned down for opening a new checking or savings account, you're entitled to learn the reason why. as a matter of fact, anyone is eligible to view their chexsystem report once per year or anytime following a rejection. to do so, you'll need to visit chexsystem's website and input your personal information to initiate the request. A savings account is a place where you can store money securely while earning interest. 4.20% sofi members with direct deposit or $5,000 or more in qualifying deposits during the 30 day evaluation.

Comments are closed.