Fillable Online Business Organization Name Taxpayer Identification

Fillable Online Business Organization Name Taxpayer Identification Step 1: determine your eligibility. you may apply for an ein online if your principal business is located in the united states or u.s. territories. the person applying online must have a valid taxpayer identification number (ssn, itin, ein). you are limited to one ein per responsible party per day. An employer identification number (ein) is also known as a federal tax identification number, and is used to identify a business entity. generally, businesses need an ein. you may apply for an ein in various ways, and now you may apply online. this is a free service offered by the internal revenue service and you can get your ein immediately.

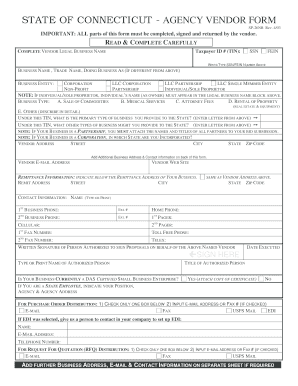

Fillable Online Ct Complete Vendor Legal Business Name Taxpayer Id If your principal place of business is in the u.s., you can get an ein in these ways: apply online. get an ein now, free, direct from the irs. fax form ss 4, application for employer identification number to 855 641 6935. you’ll get your ein in 4 business days. mail form ss 4 to internal revenue service, attn: ein operation, cincinnati, oh 45999. An employer identification number, or ein, is a nine digit number assigned to your company by the irs. you’ll use it when filing your business's income tax return or payroll tax return. not all. Create document. updated december 11, 2023. form ss 4 is an application for an employer identification number (ein), also known as a federal tax identification number, from the irs. the irs assigns a unique nine digit number to businesses, other entities, and certain individuals for tax and legal purposes. a single responsible party must submit. Only international applicants can apply for an ein by phone. call 267 941 1099 (not a toll free number) from 6:00 a.m. to 11:00 p.m. et, monday through friday. the person calling must be authorized to receive the ein and can answer the questions on irs form ss 4, application for employer identification number.

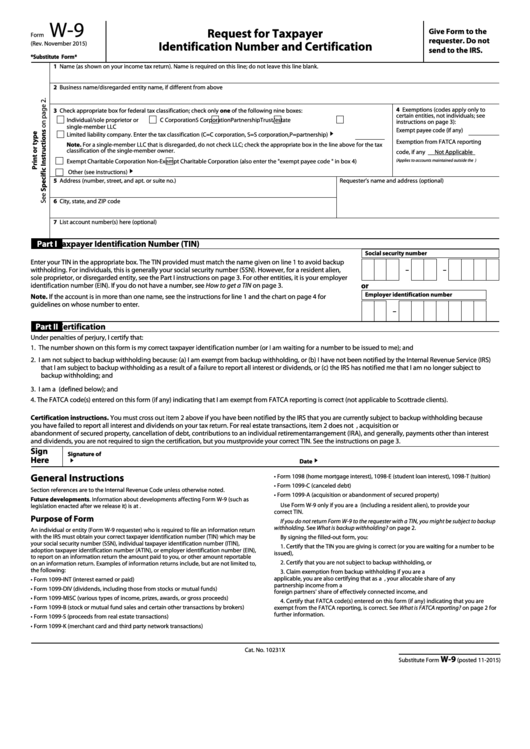

Fillable Online Business Organization Name Taxpayer Identification Create document. updated december 11, 2023. form ss 4 is an application for an employer identification number (ein), also known as a federal tax identification number, from the irs. the irs assigns a unique nine digit number to businesses, other entities, and certain individuals for tax and legal purposes. a single responsible party must submit. Only international applicants can apply for an ein by phone. call 267 941 1099 (not a toll free number) from 6:00 a.m. to 11:00 p.m. et, monday through friday. the person calling must be authorized to receive the ein and can answer the questions on irs form ss 4, application for employer identification number. A w 9 form is an internal revenue service (irs) tax form that is used to confirm a person's name, address, and taxpayer identification number (tin) for employment or other income generating. To fill out form w 9, follow these steps: provide your personal information: at the top, fill in your name (or business name, if applicable), and check the box for your appropriate federal tax classification (e.g., individual sole proprietor, llc). enter your taxpayer identification number (tin): this is likely either your social security.

Fillable Form W 9 Request For Taxpayer Identification Number And A w 9 form is an internal revenue service (irs) tax form that is used to confirm a person's name, address, and taxpayer identification number (tin) for employment or other income generating. To fill out form w 9, follow these steps: provide your personal information: at the top, fill in your name (or business name, if applicable), and check the box for your appropriate federal tax classification (e.g., individual sole proprietor, llc). enter your taxpayer identification number (tin): this is likely either your social security.

Fillable Online Business Name Taxpayer Name Exact Legal Name Fax

Comments are closed.