Fillable Online A Guide To Understanding Your Closing

Fillable Online A Guide To Understanding Your Closing Closing disclosure explainer. use this tool to double check that all the details about your loan are correct on your closing disclosure. lenders are required to provide your closing disclosure three business days before your scheduled closing. use these days wisely—now is the time to resolve problems. This document is the final bill of sale on your home loan and closing costs. it shows you the full cost of the home loan you’ve chosen—including the terms, projected monthly payments, fees, and cash to close. a simple way to think about your closing disclosure is that your loan estimate tells you what you might pay, while a closing.

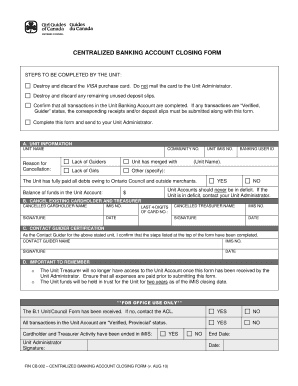

Fillable Online Ont Guidesontario Centralized Banking Account Closing The closing disclosure is a five page form that spells out the final terms and closing costs of a home loan. your lender must provide the closing disclosure at least three business days before the. Getty. the closing disclosure is one of the most important documents you’ll get during the mortgage lending process because it spells out all of the details of your home loan, including how much. A closing disclosure is a five page document that provides key final details about a mortgage loan. issued at least three business days before closing, this document covers loan terms, projected monthly payments, and closing costs. the document ensures transparency and helps buyers understand their financial obligations. A closing disclosure is a vital document in real estate transactions, serving as a comprehensive summary of the financial details involved in closing a mortgage loan. it outlines loan terms, closing costs, and other crucial information related to the transaction. essentially, it provides a breakdown of the final costs and terms that both the.

Understanding Mortgage Closing Costs Neo Home Loans Blog A closing disclosure is a five page document that provides key final details about a mortgage loan. issued at least three business days before closing, this document covers loan terms, projected monthly payments, and closing costs. the document ensures transparency and helps buyers understand their financial obligations. A closing disclosure is a vital document in real estate transactions, serving as a comprehensive summary of the financial details involved in closing a mortgage loan. it outlines loan terms, closing costs, and other crucial information related to the transaction. essentially, it provides a breakdown of the final costs and terms that both the. 4. closing on your new home. submit documents and answer requests from the lender. schedule a home inspection. shop for homeowner's insurance. shop for title insurance and other closing services. look out for revised loan estimates. review documents before closing. close the deal. Page 2 of closing disclosure form is meant to provide a detailed breakdown of the closing costs, including the loan costs (origination charges, discount points, etc.), other costs (appraisal, credit report, title services, etc.), and the total closing costs. it is separated into two parts – loan costs and other costs. fill this page as follows:.

Comments are closed.