Fill And Sign W9 Form Online For Free Digisigner

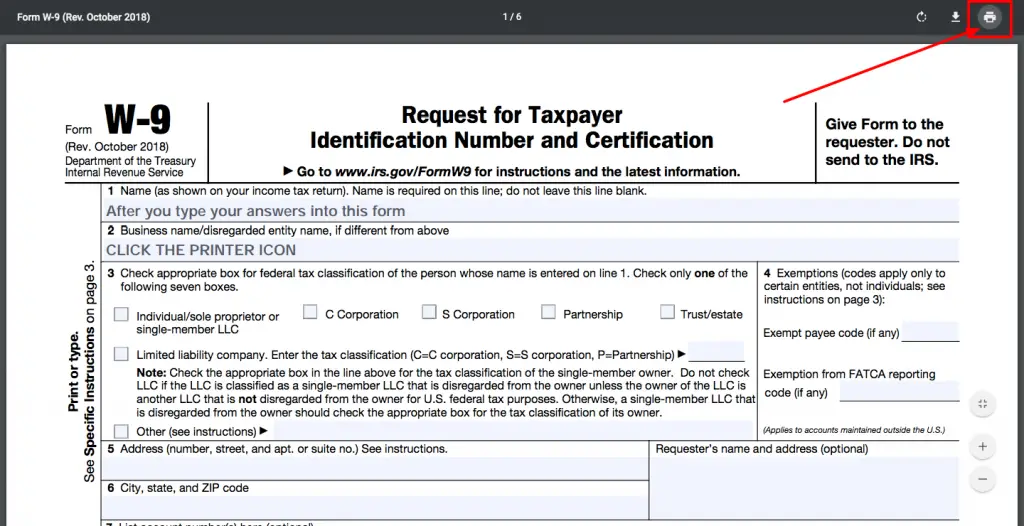

Fill And Sign W9 Form Online For Free Digisigner To sign a w 9 form in digisigner, follow a few steps: register through your email address; upload the prepared and completed w 9 form from the device via the “upload” button or from the cloud storage of dropbox or google drive; when the document is displayed in your account, click sign;. How to sign pdf online. 1. drag & drop pdf. simply drag and drop your pdf into the area above or click on the link to choose your file. the pdf will be displayed in our preview tool. 2. sign pdf online. to sign pdf online, click on the document, select a signature type, create your electronic signature, and add it to the document. 3.

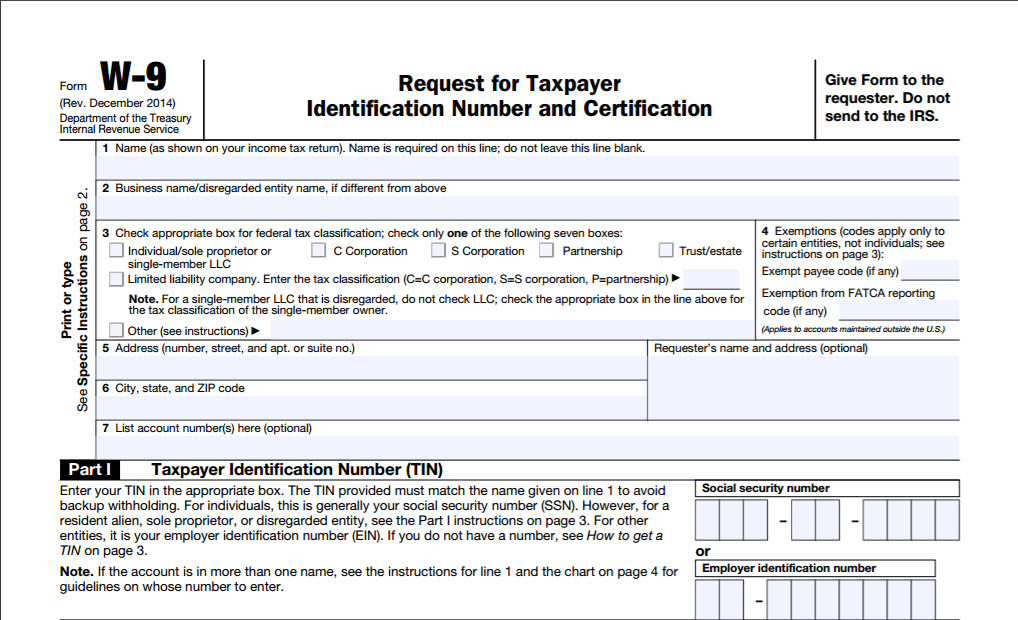

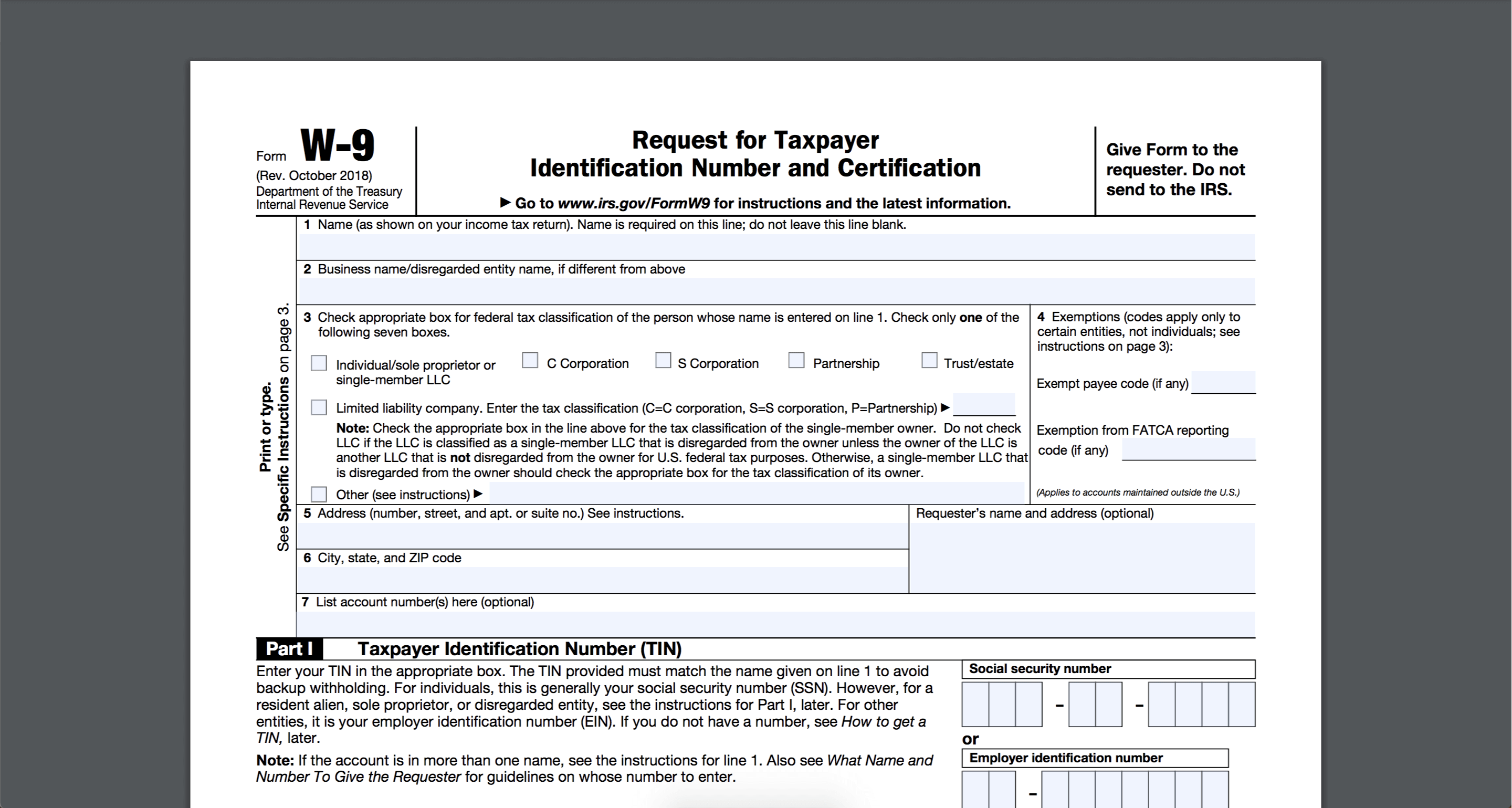

How To Fill Out And Sign Your W 9 Form Online To Get Paid Faster Step 4: click “open with” > “dochub”. step 5: click “sign” > “create your signature. step 6: sign with your computer mouse! step 7: click “sign” and find your signature in the dropdown. step 8: stamp your signature onto the signature line. step 9: download the signed w9. and there you have it — your completed and signed w9. How to sign lease online with digisigner. fill and sign w9 form online for free. how to sign w 9 form online and for free?. An irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. pdf. updated october 24, 2024. Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs.

How To Fill Out Sign And Send A W9 Form All Online For Free Your An irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. pdf. updated october 24, 2024. Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs. All our payments are processed by the reseller and our partner 2checkout. their name and address are printed also on all invoices you will automatically receive. please use their w 9 form for legal. This w 9 electronic signature identifies the payee submitting the form and authenticates the submission the same way it would identify and authenticate the signee on a paper version of the form. the electronic w 9 form must include a perjury statement. the payer must be able to supply the irs with a hard copy of the w 9 form upon request.

Fillable Online Download Printable W9 Form Online Samples In To Fill All our payments are processed by the reseller and our partner 2checkout. their name and address are printed also on all invoices you will automatically receive. please use their w 9 form for legal. This w 9 electronic signature identifies the payee submitting the form and authenticates the submission the same way it would identify and authenticate the signee on a paper version of the form. the electronic w 9 form must include a perjury statement. the payer must be able to supply the irs with a hard copy of the w 9 form upon request.

Comments are closed.