Filing 1099s Quickly And Easily Using Tabs3 E File

Filing 1099s Quickly And Easily Using Tabs3 E File Youtube Filing 1099s quickly and easily using tabs3 e file. learn about tabs3 e file, a complete solution to filing your 1099 misc and 1096 forms. videos are available in hd (high definition). if the video appears blurry or low quality, check your settings. we recommend watching these in 720p or higher. Learn about tabs3 e file, a complete solution to filing your irs form 1099 misc, form 1099 nec, and form 1096 documents.

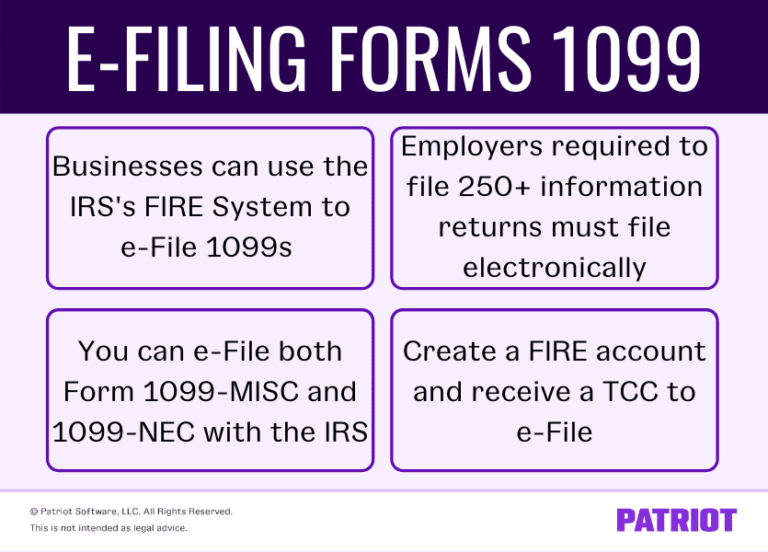

How To E File 1099s Customizing & using quick launch: 2:54 : using and customizing my actions: 4:14: tabbed mode splitscreen: easy filing 1099s using tabs3 e file: 3:31: general. Copy 1: state tax department, if applicable. copy b: recipient (independent contractor or vendor) copy 2: recipient (independent contractor or vendor) copy c: keep in your business records. you can e file both forms with the irs. however, keep in mind that e filing deadlines may vary. file and send copies of form 1099 nec to workers by january. Filers can use the platform to create, upload, edit and view information and download completed copies of 1099 series forms for distribution and verification. with iris, businesses can e file both small and large volumes of 1099 series forms by either keying in the information or uploading a file with the use of a downloadable template. E file through the iris taxpayer portal. this free, web based filing system lets you: e file up to 100 returns at a time. enter manually or by .csv upload. download payee copies to distribute. keep a record of completed, filed and distributed forms. save and manage issuer information.

E Filing 1099s With The Irs Overview Steps More Filers can use the platform to create, upload, edit and view information and download completed copies of 1099 series forms for distribution and verification. with iris, businesses can e file both small and large volumes of 1099 series forms by either keying in the information or uploading a file with the use of a downloadable template. E file through the iris taxpayer portal. this free, web based filing system lets you: e file up to 100 returns at a time. enter manually or by .csv upload. download payee copies to distribute. keep a record of completed, filed and distributed forms. save and manage issuer information. Easily file and deliver 1099, w 2 and aca forms online. get all inclusive print, mail and e file services quickly, efficiently and securely — as low as $1.35 per form. view pricing. see how it works start filing now. Pay contractors fast, e file 1099s, and stay ready for tax time. $15. $750 mo. 50% off for 3 months*. includes 20 contractors $2 additional contractor. buy now.

E Filing 1099s Youtube Easily file and deliver 1099, w 2 and aca forms online. get all inclusive print, mail and e file services quickly, efficiently and securely — as low as $1.35 per form. view pricing. see how it works start filing now. Pay contractors fast, e file 1099s, and stay ready for tax time. $15. $750 mo. 50% off for 3 months*. includes 20 contractors $2 additional contractor. buy now.

Comments are closed.