Fibonacci Trading Full Guide And Strategies Living From Trading

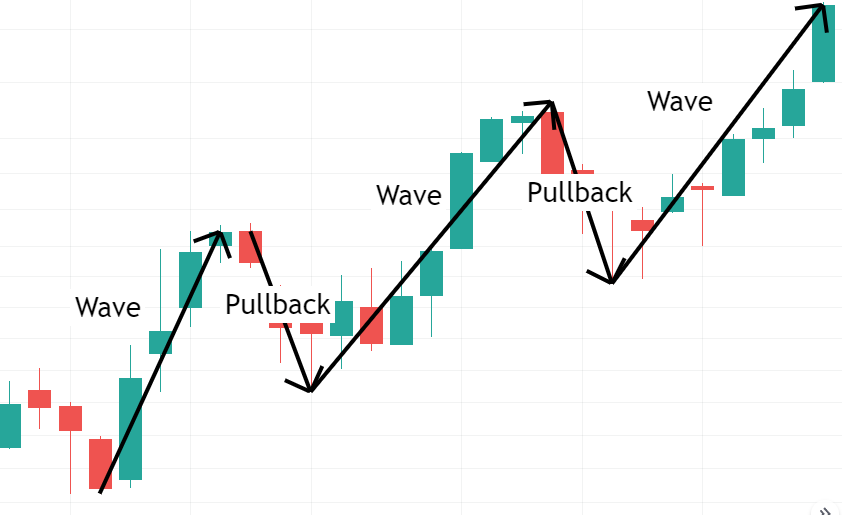

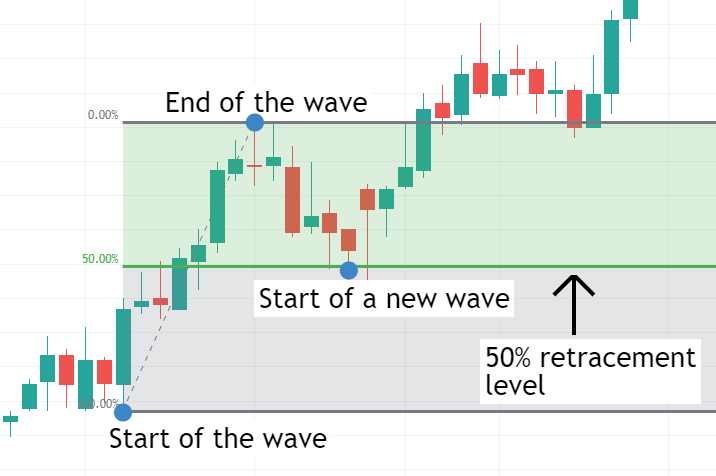

Fibonacci Trading Full Guide And Strategies Living From Trading Fibonacci trading is a way of trading after pullbacks that touched on special levels. the fibonacci retracement levels that we should focus on are the 23.6, 38.2, 50, 61.8 and 78.6% levels. a fibonacci extension tells us how big was the second wave compared to the previous one and can be used to set targets. The fibonacci trading strategy is based on the fibonacci sequence—yes, the same one found in nature! in trading, fibonacci ratios (like 23.6%, 38.2%, 50%, 61.8%, and 100%) are used to identify potential support and resistance levels where prices might reverse. these levels help traders make informed decisions about when to enter or exit trades.

Fibonacci Trading Full Guide And Strategies Living From Trading The fibonacci trading strategy – how to trade with fibonacci. fibonacci in trading is based on a mathematical sequence and the golden ratio, providing valuable insights into financial markets. key fibonacci tools, including retracement, expansion, fan, and channel, help traders identify support and resistance levels. Fibonacci trading strategy 1.draw fibonacci retracement levels: identify market pullback phases. when prices begin to pull back, draw fibonacci retracement levels. avoid chasing prices during rapid upswings or downswings; patiently wait for the price to pull back into key areas. 2.analyze market conditions:. The trick is to add the first two numbers, which equals the third (0 1=1), then continue by adding the 2nd and 3rd which equals the 4th number (1 1=2), etc. as the numbers are added a new number is created. the method stays the same for higher numbers as well such as 89 144 = 233, and then 144 233 = 377. By applying fibonacci retracement, fan, and arc tools from the lowest point of $50 to the highest point of $150, traders can identify key levels around $88.20, $100, and $111.80, where price may stall or reverse. illustrative charts would show how prices react at these fibonacci levels.

Fibonacci Trading Full Guide And Strategies Living From Trading The trick is to add the first two numbers, which equals the third (0 1=1), then continue by adding the 2nd and 3rd which equals the 4th number (1 1=2), etc. as the numbers are added a new number is created. the method stays the same for higher numbers as well such as 89 144 = 233, and then 144 233 = 377. By applying fibonacci retracement, fan, and arc tools from the lowest point of $50 to the highest point of $150, traders can identify key levels around $88.20, $100, and $111.80, where price may stall or reverse. illustrative charts would show how prices react at these fibonacci levels. Step 2: applying fibonacci retracement to a chart. to trade using fibonacci retracements, follow these basic steps: identify a major high and low in the market that is, a swing point. draw the fibonacci retracement tool from low to high for an uptrend or high to low for a downtrend. Any number divided by the second following number – for example, 21 55 – always equalled 0.3819, and any of the numbers in the sequence divided by the third following number equalled 0.263. the major fib levels that are extracted from the list of numbers in fibonacci’s relatively simple list are 1.618, 1.3819, 1.263 and inverted 0.618, 0.

Comments are closed.