Fibonacci Setup Part 2 Fibonacci Trading Strategy For Beginners

Fibonacci Setup Part 2 Fibonacci Trading Strategy For Beginners Fibonacci setup part 2 | fibonacci trading strategy for beginners | fibonacci strategy for intraday this video is based on fibonnaci trading strategy for beg. In part 2 of the fibonacci trading series, i'll do a deep dive into the fibonacci retracements tool, one of the more popular fibonacci tools in thinkorswim.

Fibonacci Ratios Metatrader Fibonacci Settings Explained The fibonacci trading strategy is based on the fibonacci sequence—yes, the same one found in nature! in trading, fibonacci ratios (like 23.6%, 38.2%, 50%, 61.8%, and 100%) are used to identify potential support and resistance levels where prices might reverse. these levels help traders make informed decisions about when to enter or exit trades. The fibonacci trading strategy – how to trade with fibonacci. fibonacci in trading is based on a mathematical sequence and the golden ratio, providing valuable insights into financial markets. key fibonacci tools, including retracement, expansion, fan, and channel, help traders identify support and resistance levels. The trick is to add the first two numbers, which equals the third (0 1=1), then continue by adding the 2nd and 3rd which equals the 4th number (1 1=2), etc. as the numbers are added a new number is created. the method stays the same for higher numbers as well such as 89 144 = 233, and then 144 233 = 377. In the stock market, the fibonacci trading strategy traces trends in stocks. when a stock is trending in one direction, some believe that there will be a pullback, or decline in prices. fibonacci traders contend a pullback will most likely happen at the fibonacci retracement levels of 23.6%, 38.2%, 61.8%, or 76.4%.

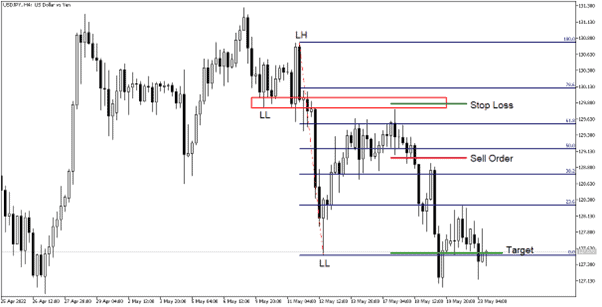

Fibonacci Trading Strategy Beginner S To Advanced Guide For Nse The trick is to add the first two numbers, which equals the third (0 1=1), then continue by adding the 2nd and 3rd which equals the 4th number (1 1=2), etc. as the numbers are added a new number is created. the method stays the same for higher numbers as well such as 89 144 = 233, and then 144 233 = 377. In the stock market, the fibonacci trading strategy traces trends in stocks. when a stock is trending in one direction, some believe that there will be a pullback, or decline in prices. fibonacci traders contend a pullback will most likely happen at the fibonacci retracement levels of 23.6%, 38.2%, 61.8%, or 76.4%. Step 2: applying fibonacci retracement to a chart. to trade using fibonacci retracements, follow these basic steps: identify a major high and low in the market that is, a swing point. draw the fibonacci retracement tool from low to high for an uptrend or high to low for a downtrend. The fibonacci trading strategy is a popular approach for identifying support and resistance levels in financial markets. it uses the fibonacci sequence and key ratios to find potential pullback or reversal areas within a price trend. this article explains how to apply the strategy, including trend identification, swing point selection, drawing retracement levels, and analysis for decision.

Fibonacci Trading Strategy For Beginners Fibonacci R Doovi Step 2: applying fibonacci retracement to a chart. to trade using fibonacci retracements, follow these basic steps: identify a major high and low in the market that is, a swing point. draw the fibonacci retracement tool from low to high for an uptrend or high to low for a downtrend. The fibonacci trading strategy is a popular approach for identifying support and resistance levels in financial markets. it uses the fibonacci sequence and key ratios to find potential pullback or reversal areas within a price trend. this article explains how to apply the strategy, including trend identification, swing point selection, drawing retracement levels, and analysis for decision.

Comments are closed.