Fibonacci Retracement Meaning Levels Usage Of Fibonacci Retracement

How To Use Fibonacci Retracement Levels Correctly Pro Trading School The retracement amounts are based on numbers identified in a fibonacci sequence. the fibonacci retracement levels are 23.6%, 38.2%, 61.8%, and 78.6%. while not officially a fibonacci ratio, 50% is. The fibonacci retracement is created by taking two points on a chart and dividing the vertical distance by the key fibonacci ratios of 23.6%, 38.2%, 50 %, 61.8%, and 78.6% (derived from mathematical relationships found in the fibonacci sequence). keep reading to learn how to apply the fibonacci retracement to your trading strategy.

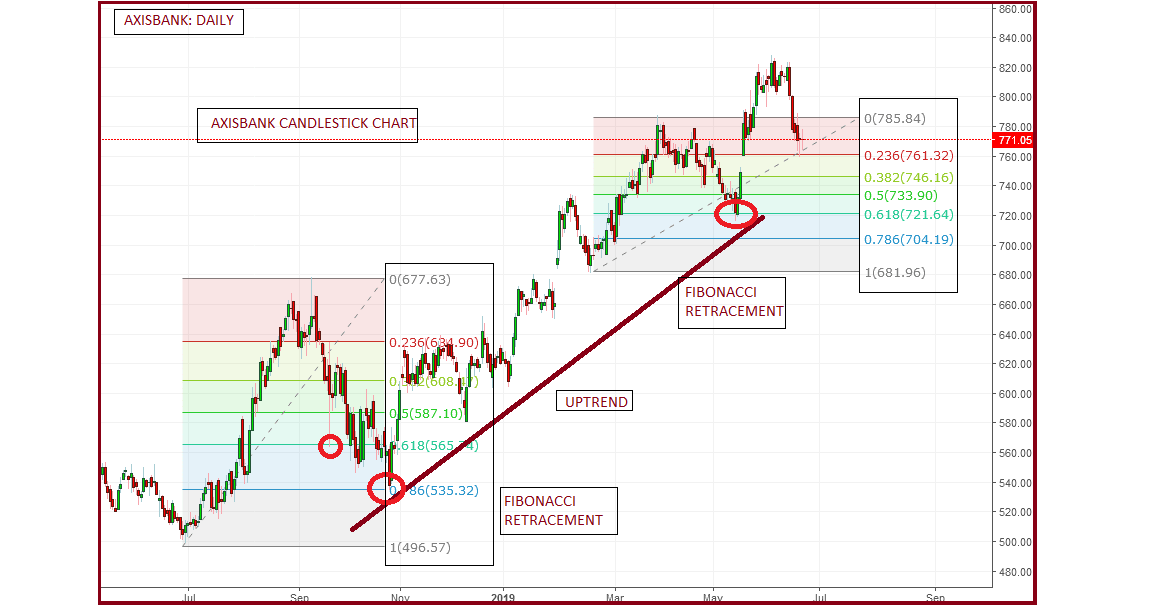

How To Use Fibonacci Retracement Levels Correctly Pro Trading School The charting software automagically calculates and shows you the retracement levels. as you can see from the chart, the fibonacci retracement levels were .7955 (23.6%), .7764 (38.2%), .7609 (50.0%*), .7454 (61.8%), and .7263 (76.4%). now, the expectation is that if aud usd retraces from the recent high, it will find support at one of those. The fibonacci retracement is a trading chart pattern that traders use to identify trading levels and the range at which an asset price will rebound or reverse. the reversal may be upward or downward and can be determined using the fibonacci trading ratio. traders obtain the pattern by drawing horizontal lines for support and resistance levels. Place a fibonacci grid from low to high in an uptrend and high to low in a downtrend. set the grid to display the 0.382, 0.50, 0.618, and 0.786 retracement levels. the first three ratios act as. To plot the retracements, draw a trendline from the low to the high (also known as the swing low to the swing high), or vice versa, high to low, within a continuous price movement trend – fibonacci retracement levels should be placed at 61.80%, 38.20%, and 23.60% of the height of the line for you by the tool itself.

Fibonacci Retracement How It Works How To Use Examples More Place a fibonacci grid from low to high in an uptrend and high to low in a downtrend. set the grid to display the 0.382, 0.50, 0.618, and 0.786 retracement levels. the first three ratios act as. To plot the retracements, draw a trendline from the low to the high (also known as the swing low to the swing high), or vice versa, high to low, within a continuous price movement trend – fibonacci retracement levels should be placed at 61.80%, 38.20%, and 23.60% of the height of the line for you by the tool itself. 78.6%: indicate a significant pullback or reversal zone. 61.8% is also known as the fibonacci retracement golden ratio. when you divide most of the numbers in series with the second number, you will get this ratio, like 21 34 = 0.617, 34 55 = 0.618, and 233 377 = 0.6180. that’s all about fibonacci’s mathematical or statistical aspects. The fibonacci extension tool works by connecting the first point of an impulse wave to the first pivot to the downside (or upside in a bearish trend) and then to the swing high. common fibonacci extension levels are 61.8%, 100%, 161.8%, 200%, and 261.8%. both retracement and extension levels can serve as areas of support and resistance but.

Comments are closed.