Fibonacci Extension Levels And The 1 6 8 Resistance And Revsal

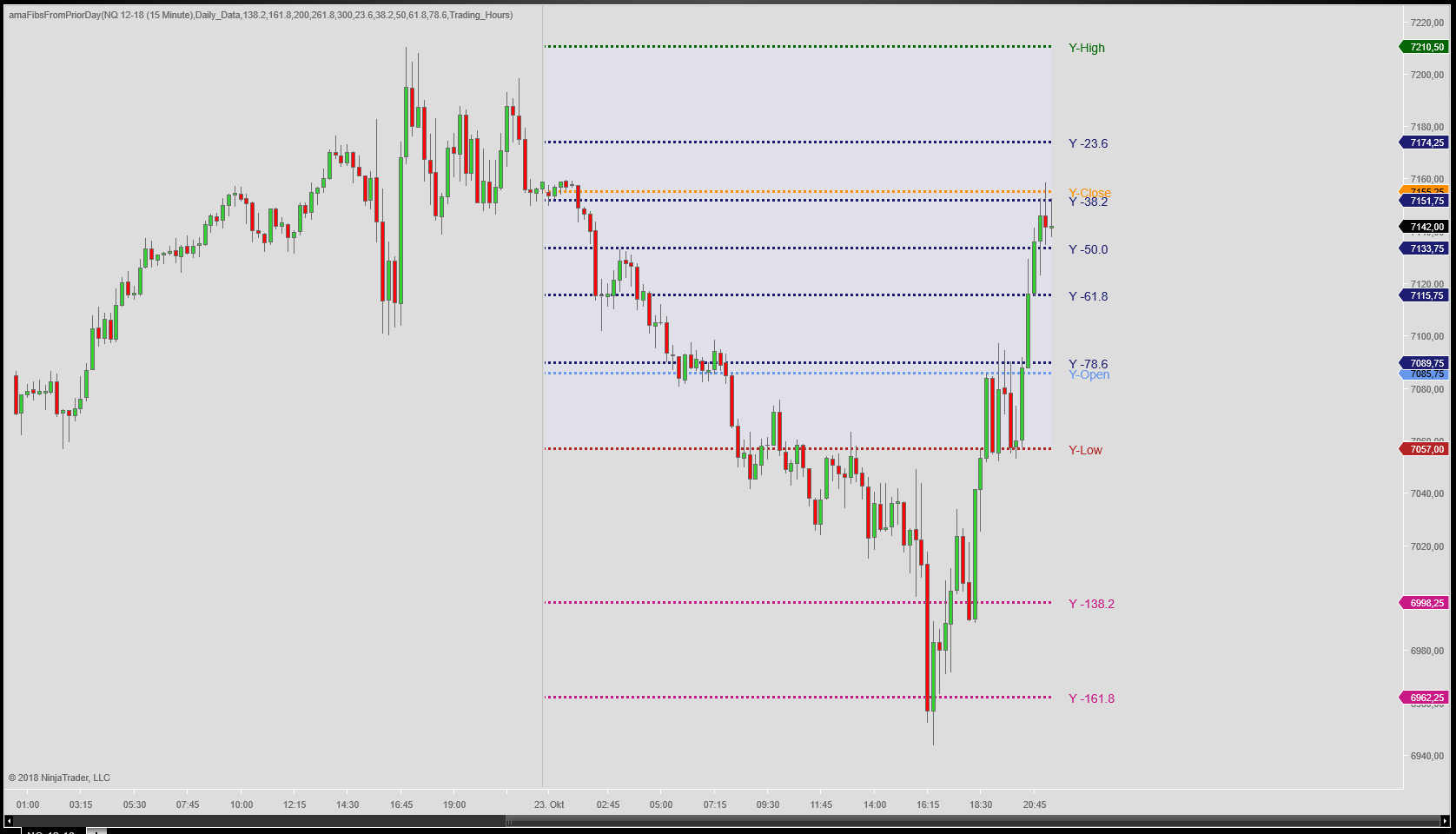

Fibonacci Extension Levels And The 1 6 8 Resistance And Revsal Understanding fibonacci extensions. at the core, fibonacci extensions are drawn as connections to points on a price chart. these points signify possible areas where the price may reverse or establish crucial support and resistance levels. the most commonly used fibonacci extension levels are 61.8%, 100%, 161.8%, 200%, and 261.8%. The fibonacci extension levels commonly regarded as strong support resistance levels and potential price targets to consider are 0.618 (61.8%), 1.000 (100%) and 1.618 (161.8%). an overlap or cluster of “fib extension” levels, combined with other support and resistance, provides a key level that often leads to at least a small reversal.

Fibonacci Extensions Levels And Effective Use For Trading Traders can use these levels to identify potential areas of support and resistance. 3. fibonacci extension levels. there are three main fibonacci extension levels that traders use: 1.618, 2.618, and 4.236. these levels are based on the fibonacci sequence and represent potential price targets based on the size of the previous price movement. What are the fibonacci extension levels? fibonacci extensions are also sometimes referred to as fibonacci expansions, or fibonacci projections and are external levels that go beyond the 100% level. you may already be familiar with these important fibonacci levels – 23.6%, 38.2%, 50.0%, and 61.8%. The fibonacci extension tool works by connecting the first point of an impulse wave to the first pivot to the downside (or upside in a bearish trend) and then to the swing high. common fibonacci extension levels are 61.8%, 100%, 161.8%, 200%, and 261.8%. both retracement and extension levels can serve as areas of support and resistance but. By: sen. bob mensch. date: may 21, 2024. mastering fibonacci extensions involves understanding critical percentage based levels like 61.8%, 100%, 161.8 %, etc., crucial in predicting price movements and managing risk in trading. traders utilize fibonacci extensions for setting profit targets and identifying potential reversal zones strategically.

What Are Fibonacci Extensions Trendspider Learning Center The fibonacci extension tool works by connecting the first point of an impulse wave to the first pivot to the downside (or upside in a bearish trend) and then to the swing high. common fibonacci extension levels are 61.8%, 100%, 161.8%, 200%, and 261.8%. both retracement and extension levels can serve as areas of support and resistance but. By: sen. bob mensch. date: may 21, 2024. mastering fibonacci extensions involves understanding critical percentage based levels like 61.8%, 100%, 161.8 %, etc., crucial in predicting price movements and managing risk in trading. traders utilize fibonacci extensions for setting profit targets and identifying potential reversal zones strategically. Divide a number by two places to the left and the ratio approaches 2.618. divide a number by three to the left and the ratio is 4.236. the key fibonacci extension levels include 23.6%, 38.2%, 50%. Fibonacci retracement levels are calculated by identifying two extreme points on a chart: a high point and a low point. the vertical distance between these two points is divided by the key fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 78.6%) to determine potential levels of support and resistance.

A Beginner S Guide To Fibonacci Retracement Levels Divide a number by two places to the left and the ratio approaches 2.618. divide a number by three to the left and the ratio is 4.236. the key fibonacci extension levels include 23.6%, 38.2%, 50%. Fibonacci retracement levels are calculated by identifying two extreme points on a chart: a high point and a low point. the vertical distance between these two points is divided by the key fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 78.6%) to determine potential levels of support and resistance.

How Do Fibonacci Extensions Work Technical Analysis Altcoin Buzz

Fibonacci Retracement Extension Trading Strategies

Comments are closed.