Fibonacci Basic Tutorial Learn Forex Trading

Fibonacci Basic Tutorial Learn Forex Trading The eurjpy forex pair sells off from 133.75 to 131.05 in just six hours, carving out a vertical trend swing that offers a perfect fit for a fibonacci retracement entry on the short side. The fibonacci forex strategy is a powerful tool for traders of all levels, including beginners. by using fibonacci retracement and extension levels, traders can identify potential support and resistance levels, as well as profit taking levels and potential reversal points. however, it is important to note that the fibonacci forex strategy is.

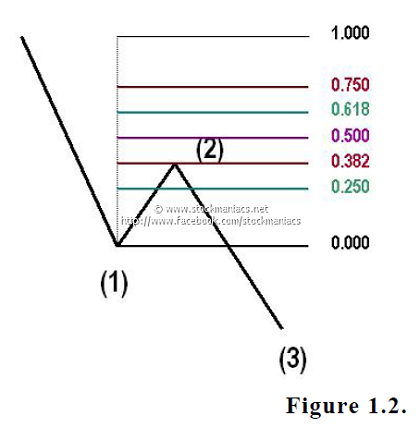

Fibonacci Basic Tutorial Learn Forex Trading The key fibonacci retracement levels to keep an eye on are: 23.6%, 38.2%, 50.0%, 61.8%, and 76.4%. the levels that seem to hold the most weight are the 38.2%, 50.0%, and 61.8% levels, which are normally set as the default settings of most forex charting software. remember that forex traders view the fibonacci retracement levels as potential. The trick is to add the first two numbers, which equals the third (0 1=1), then continue by adding the 2nd and 3rd which equals the 4th number (1 1=2), etc. as the numbers are added a new number is created. the method stays the same for higher numbers as well such as 89 144 = 233, and then 144 233 = 377. The fibonacci trading strategy – how to trade with fibonacci. fibonacci in trading is based on a mathematical sequence and the golden ratio, providing valuable insights into financial markets. key fibonacci tools, including retracement, expansion, fan, and channel, help traders identify support and resistance levels. A fibonacci forex retracement, in general, is a short term price correction during an overall larger upward or downward movement. these price corrections are temporary price reversals and don’t indicate a change in the direction of the larger trend. finding and trading retracements is a method of technical analysis used for short term trades.

Learn The Basic Fibonacci Forex Trading Strategy Forex Blog Investing The fibonacci trading strategy – how to trade with fibonacci. fibonacci in trading is based on a mathematical sequence and the golden ratio, providing valuable insights into financial markets. key fibonacci tools, including retracement, expansion, fan, and channel, help traders identify support and resistance levels. A fibonacci forex retracement, in general, is a short term price correction during an overall larger upward or downward movement. these price corrections are temporary price reversals and don’t indicate a change in the direction of the larger trend. finding and trading retracements is a method of technical analysis used for short term trades. Fibonacci forex trading strategies in action. examples of forex trading strategies that use fibonacci ratios include: buying close to the 50 percent point with a stop loss order just under the 61.8 percent mark. buying close to the 38.2 percent retracement point with a stop loss order just under the 50 percent mark. Fibonacci retracements are levels that indicate where a price might reverse after a significant move. they are calculated based on the fibonacci sequence, which is a series of numbers where each number is the sum of the two preceding ones (1, 1, 2, 3, 5, 8, 13, 21, etc.). these levels are calculated by dividing the distance between the recent.

Fibonacci Forex Trading Strategy For Beginners Youtube Fibonacci forex trading strategies in action. examples of forex trading strategies that use fibonacci ratios include: buying close to the 50 percent point with a stop loss order just under the 61.8 percent mark. buying close to the 38.2 percent retracement point with a stop loss order just under the 50 percent mark. Fibonacci retracements are levels that indicate where a price might reverse after a significant move. they are calculated based on the fibonacci sequence, which is a series of numbers where each number is the sum of the two preceding ones (1, 1, 2, 3, 5, 8, 13, 21, etc.). these levels are calculated by dividing the distance between the recent.

Comments are closed.