Federal Reserve Interest Rates And Economic Impact Insights And Strategies

Federal Reserve Interest Rates And Economic Impact Insights And Strategies Explore how the federal reserve's interest rate decisions impact the economy, businesses, and individuals, offering insights and adaptive strategies. The moment we’ve spent over a year waiting for has arrived: the federal reserve has officially cut interest rates for the first time since march 2020. the impact of a fed rate cut on money market funds and bonds. with $6.1t still sitting in money market funds and an additional $350b invested in ultra short bond funds, many investors are.

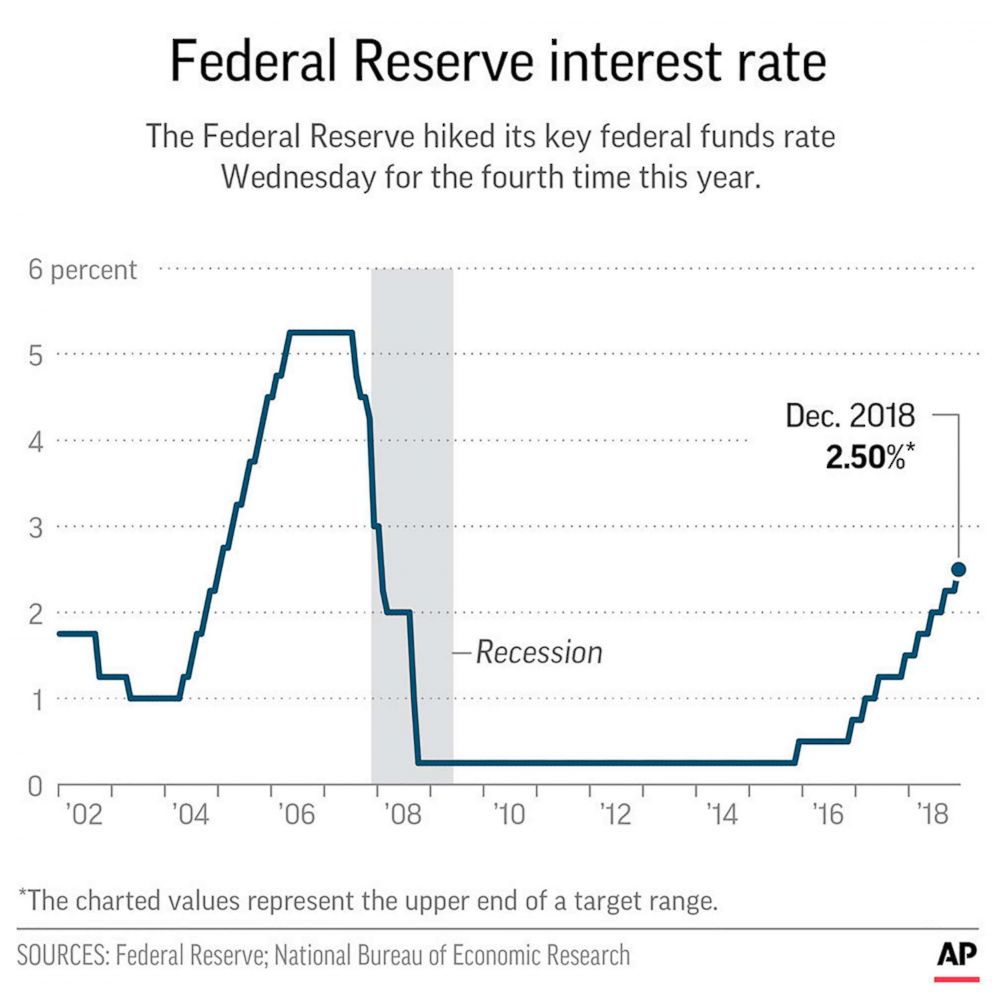

The Federal Reserve And Interest Rates Academy 4sc In response to fiscal downturns, the fed may lower interest rates to encourage borrowing and spending, while in times of high inflation, it may raise rates to slow economic activity. impact of federal reserve policies on markets. the federal reserve's policies can significantly influence investment strategies. The federal reserve announced thursday it was lowering its key interest rate by a quarter point — a widely expected move that coincides with inflation approaching the central bank's 2% goal. Federal open market committee announcement. at the september 2024 federal open market committee (fomc) meeting, the federal reserve (fed) lowered interest rates by 50 basis points, easing monetary policy for the first time in four years due to progress on the fed’s dual mandate. this lowers the interest rate target to a range of 4.75% to 5%. 1. Elana dure. vice president, head of content studio. after putting rate hikes on pause at their june meeting, the central bank bumped up interest rates by 25 basis points in july. following a series of rate increases that now total eleven, the target policy rate is currently a lofty 5.25%–5.5% – the highest it’s been in 22 years.

What Is The Federal Reserve And How Do Interest Rates Affect Me Abc News Federal open market committee announcement. at the september 2024 federal open market committee (fomc) meeting, the federal reserve (fed) lowered interest rates by 50 basis points, easing monetary policy for the first time in four years due to progress on the fed’s dual mandate. this lowers the interest rate target to a range of 4.75% to 5%. 1. Elana dure. vice president, head of content studio. after putting rate hikes on pause at their june meeting, the central bank bumped up interest rates by 25 basis points in july. following a series of rate increases that now total eleven, the target policy rate is currently a lofty 5.25%–5.5% – the highest it’s been in 22 years. According to the committee for a responsible federal budget, the estimated total budget deficit from 2022 to 2031 will be $12.7 trillion. increasing rates by just half a percentage point would. 2019 2020 review: overview. in 2019, the federal reserve launched its first ever comprehensive and public review of the monetary policy framework—the strategy, tools, and communication practices—it employs to achieve its congressionally mandated goals of maximum employment and price stability. at the time the fed announced its review.

The Impact Of Interest Rate Changes From Federal Reserve According to the committee for a responsible federal budget, the estimated total budget deficit from 2022 to 2031 will be $12.7 trillion. increasing rates by just half a percentage point would. 2019 2020 review: overview. in 2019, the federal reserve launched its first ever comprehensive and public review of the monetary policy framework—the strategy, tools, and communication practices—it employs to achieve its congressionally mandated goals of maximum employment and price stability. at the time the fed announced its review.

Comments are closed.