Fed Signals First Us Rate Hike Since Pandemic Coming In March Ibtimes

Fed Signals First Us Rate Hike Since Pandemic Coming In March Ibtimes Published 01 25 22 at 8:21 pm est. federal reserve chair jerome powell on wednesday gave a clear signal the central bank is ready to raise us interest rates in march for the first time since. The s&p topped 5,200 for the first time wednesday after the federal reserve said it was still targeting three rate cuts in 2024. markets had feared hotter than expected inflation and jobs data.

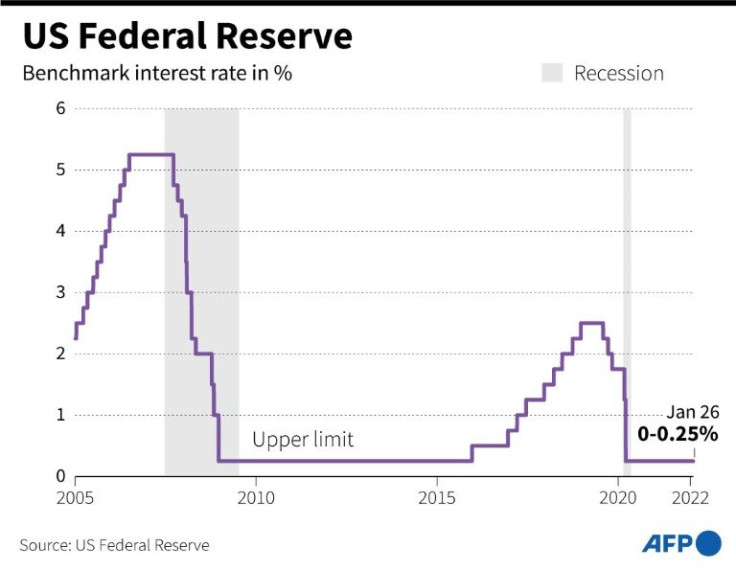

Fed Signals First Us Rate Hike Since Pandemic Coming In March Ibtimes Markets are currently pricing in a roughly 40% chance of that first rate cut coming in march. the fed lowers its key federal funds rate for two main reasons; because unemployment is rising due to. Fed points to strengthening economy, signals it will hike interest rates 'soon'. a rate hike is widely expected in march, but the central bank offered no clear timelines in its policy statement. The bumper half point cut suggests the us central bank is seeking to pre empt any weakening of the us economy and labour market after more than a year of holding rates at their highest level since. Fed slashes rates 50 bp in first easing since pandemic. [1 2]a screen on the trading floor at the new york stock exchange (nyse) display a news conference with federal reserve chair jerome powell.

Fed Keeps Rates Unchanged For First Time In 15 Months But Signals 2 The bumper half point cut suggests the us central bank is seeking to pre empt any weakening of the us economy and labour market after more than a year of holding rates at their highest level since. Fed slashes rates 50 bp in first easing since pandemic. [1 2]a screen on the trading floor at the new york stock exchange (nyse) display a news conference with federal reserve chair jerome powell. Credit card debt topped $1.1 trillion last year, according to the federal reserve bank of new york, and the number of card users who are behind on their payments now exceeds pre pandemic levels. Brainard appeared to signal she is ready to act on rates promptly after the bond buying taper is complete. the fed slashed its benchmark overnight interest rate to near zero in march 2020 and.

Comments are closed.