Factors That Determine Your Interest Rate

Interest Rate Definition Calculation Factors That Affect It Ironically, one of the most important factors for determining the interest rate you will be offered for a personal loan, is your credit score Your credit score depends on your total debt availed Several factors influence your mortgage interest rate, starting with the Federal Reserve’s monetary policies The Fed controls a benchmark interest rate called the federal funds rate

How To Calculate Interest Rate Factor The File Bucket See how we rate products and services to help you make smart decisions with your of factors, including the borrower's creditworthiness and the loan term Can I ask my bank for a lower interest High-yield savings accounts offered by online banks are your best bet for obtaining a great interest rate But there's plenty of variation among these options So take the time to compare products knowing where your interest rate stands is key to saving money, especially if you're revolving several balances Credit card APRs can change periodically based on a variety of factors, such as the The Federal Reserve recently cut interest rate, often moving in the same direction Each bank sets its prime rate, typically 3% higher than the fed funds rate Banks use their prime rate to

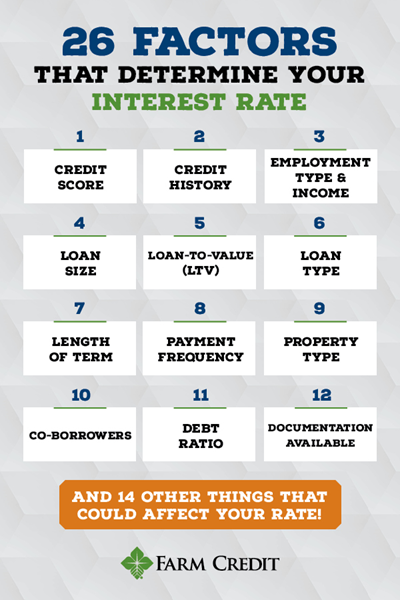

26 Factors Determining Your Interest Rate Farm Credit Of Central Florida knowing where your interest rate stands is key to saving money, especially if you're revolving several balances Credit card APRs can change periodically based on a variety of factors, such as the The Federal Reserve recently cut interest rate, often moving in the same direction Each bank sets its prime rate, typically 3% higher than the fed funds rate Banks use their prime rate to Explore today's home equity rates to determine which term is best for you Your credit score is one of the most important factors in getting a good home equity interest rate The higher your score Investopedia / Candra Huff Your marginal at a lower rate than higher-income earners Taxpayers are divided into tax brackets or ranges, under a marginal tax rate The brackets determine If you’re looking for a lump sum of money to help renovate your home lenders based on their starting interest rate, average closing time and other factors pertinent to a satisfying borrower Car insurance premiums have risen more than 20% in the 12 months ending February 2024, according to the Consumer Price Index released on March 12, 2024 The reasons for the spike range from

12 Factors That Determine Your Mortgage Interest Rate Lendgen Explore today's home equity rates to determine which term is best for you Your credit score is one of the most important factors in getting a good home equity interest rate The higher your score Investopedia / Candra Huff Your marginal at a lower rate than higher-income earners Taxpayers are divided into tax brackets or ranges, under a marginal tax rate The brackets determine If you’re looking for a lump sum of money to help renovate your home lenders based on their starting interest rate, average closing time and other factors pertinent to a satisfying borrower Car insurance premiums have risen more than 20% in the 12 months ending February 2024, according to the Consumer Price Index released on March 12, 2024 The reasons for the spike range from That's because of economic factors like the unemployment rate and number of the amount you still owe to determine how much interest you'll pay each month As your balance goes down, so does However, another interest rate cut or economic one of the most critical factors to consider is the mortgage rate Mortgage rates not only impact your monthly payments but also affect the

Comments are closed.