Factors Affecting Mortgage Rates

:max_bytes(150000):strip_icc()/factors-affect-mortgage-rates_final-e70ed5b382434255928bf3246b6f4b8f.png)

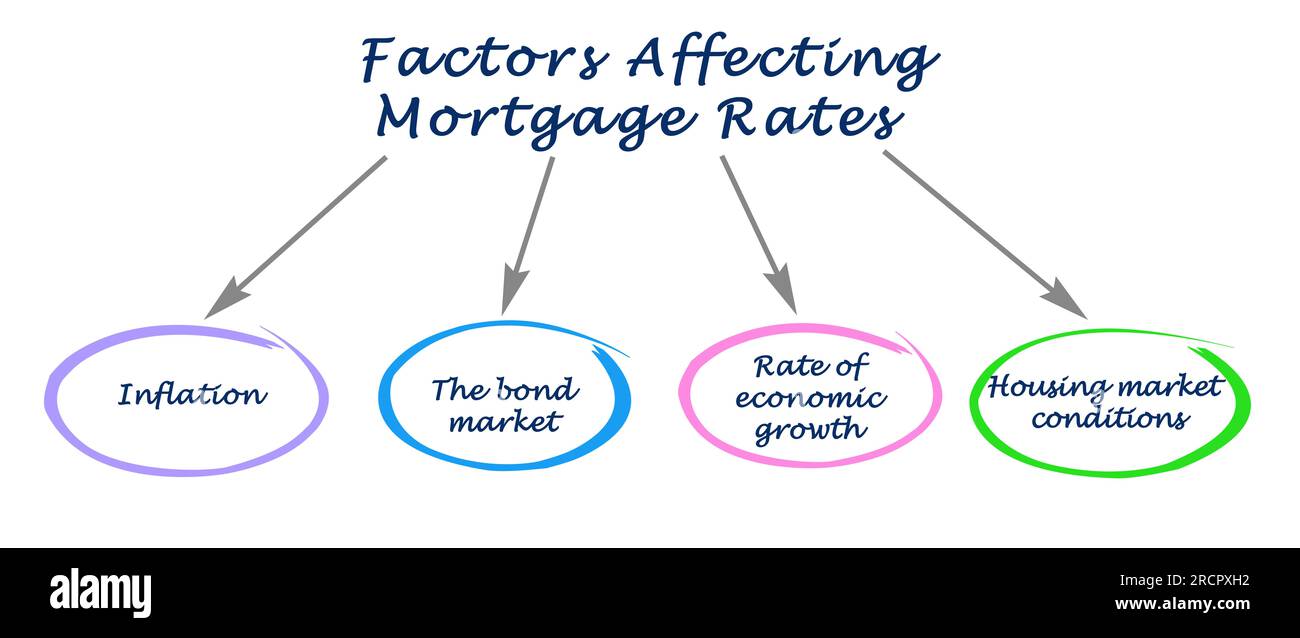

The Most Important Factors Affecting Mortgage Rates Key takeaways. mortgage rates are affected by market factors like inflation, the cost of borrowing, bond yields and risk. mortgage rates are also affected by personal financial factors, such as. The bottom line. mortgage rates are tied to the basic rules of supply and demand. factors such as inflation, economic growth, the fed’s monetary policy, and the state of the bond and housing.

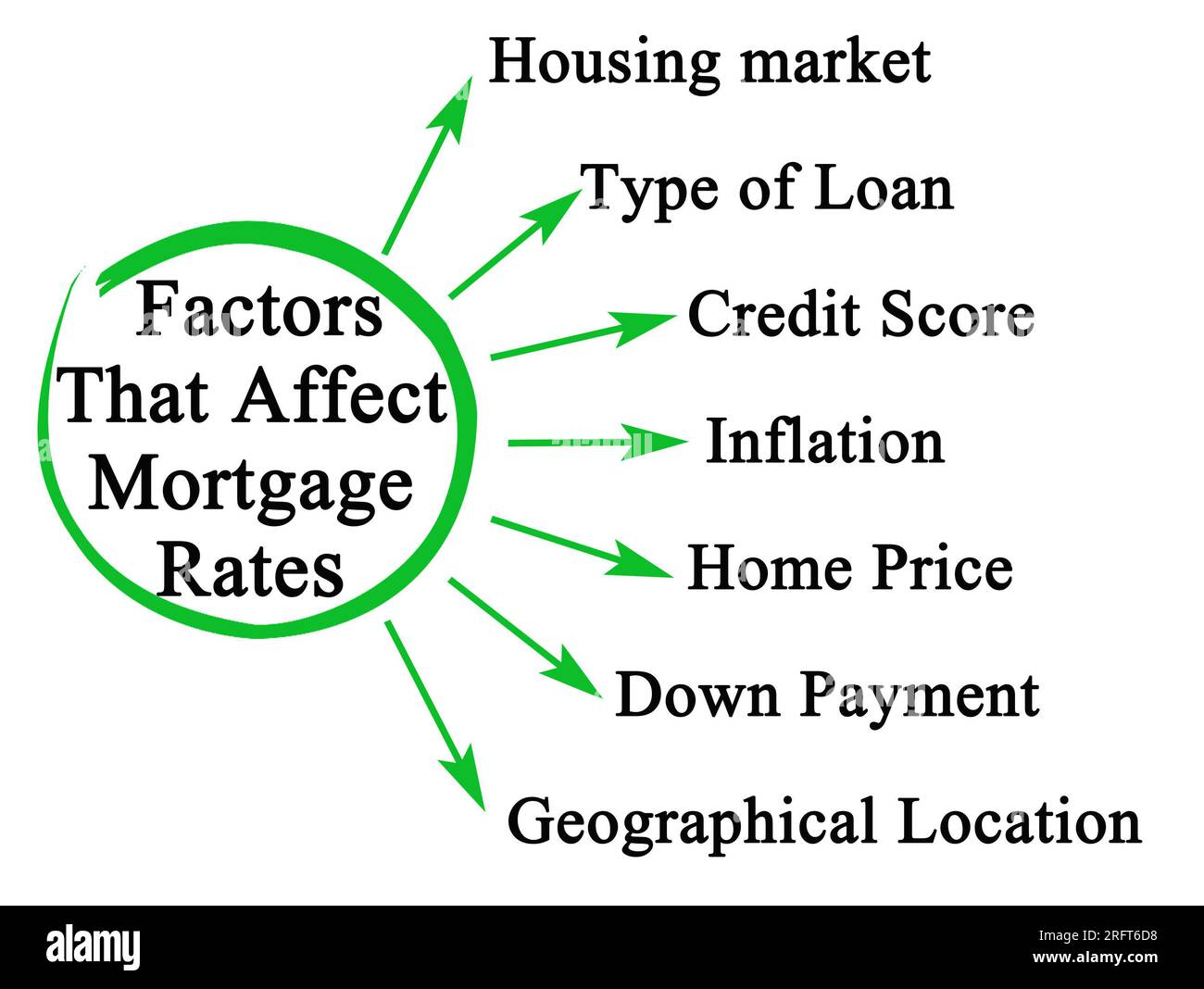

Seven Factors Affecting Mortgage Rates Stock Photo Alamy Several factors affect how mortgage rates are determined today, but you can only control one aspect: your personal qualifying factors for a mortgage. lenders look at your credit score, income, debt to income (dti) ratio, assets and other financial information to determine your risk level. the better your qualifying factors, the better the. Here are seven key factors that affect your interest rate that you should know. 1. credit scores. your credit score is one factor that can affect your interest rate. in general, consumers with higher credit scores receive lower interest rates than consumers with lower credit scores. lenders use your credit scores to predict how reliable you. Individual factors determine whether you're on the high or low end of the mortgage rate spectrum. for instance, say the economy is in a low rate period, averaging around 3% for a 30 year loan. 6.750%. 7.561%. 5 6 arm. 6.625%. 7.227%. *arm rates are expressed as a fixed term (during which the interest rate won't change), followed by how often the rate can charge after that. a 10 6 arm.

9 Factors Affecting Interest Rates On Mortgages New Venture Escrow Individual factors determine whether you're on the high or low end of the mortgage rate spectrum. for instance, say the economy is in a low rate period, averaging around 3% for a 30 year loan. 6.750%. 7.561%. 5 6 arm. 6.625%. 7.227%. *arm rates are expressed as a fixed term (during which the interest rate won't change), followed by how often the rate can charge after that. a 10 6 arm. The loan to value ratio measures the mortgage amount compared with the home's price or value. let's say you make a $20,000 down payment on a $100,000 house. the mortgage will be $80,000. you're. For conventional loans, borrowers who want to avoid paying private mortgage insurance will generally need to make a down payment of 20% of the value of the home. fha purchase loans will allow you to have a loan to value ratio of up to 96.5%. usda, va and other specialty loan types may allow for a 100% ltv for a purchase loan.

Understanding Mortgage Rates What Homeowners Need To Know The loan to value ratio measures the mortgage amount compared with the home's price or value. let's say you make a $20,000 down payment on a $100,000 house. the mortgage will be $80,000. you're. For conventional loans, borrowers who want to avoid paying private mortgage insurance will generally need to make a down payment of 20% of the value of the home. fha purchase loans will allow you to have a loan to value ratio of up to 96.5%. usda, va and other specialty loan types may allow for a 100% ltv for a purchase loan.

Four Factors Affecting Mortgage Rates Stock Photo Alamy

Ppt Most Important Factors Affecting Current Mortgage Rates

Comments are closed.