Explaining An Adjustable Rate Mortgage 5 1 Arm 10 1 Arm Etc

What Is An Adjustable Rate Mortgages Arm Youtube 5 1 arm vs. other arms: other arms, such as a 10 1 or 7 1 arm, work in a similar way to 5 1 arms, except the length of the initial fixed rate period and the interest rate will differ. for a 10 1. A 5 1 arm works in much the same way as a 10 1 arm, but the initial, fixed rate period is shorter – just five years. generally, the interest rate on the 10 1 will be a little higher than the 5 1.

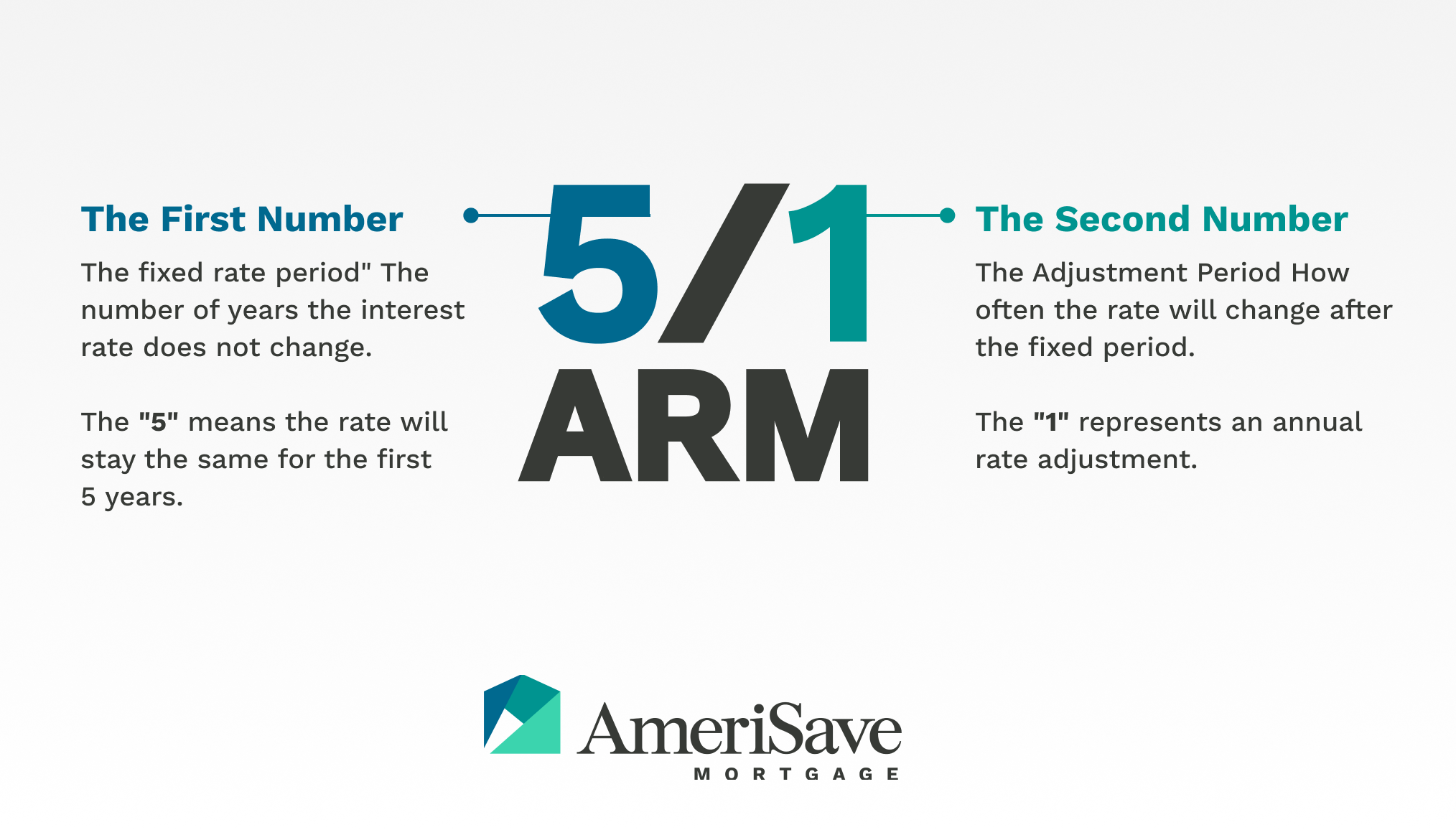

What Is An Adjustable Rate Mortgage Pros Cons For Arms An adjustable rate mortgage has an interest rate that changes periodically with the broader market. an arm starts with a low fixed rate during the introductory period, which typically is three. 5 1 and 5 6 arms. both 5 1 and 5 6 arm loans offer a fixed interest rate for the first 5 years of the loan term. the second number represents the frequency of future rate adjustments after the first 5 years. with a 5 1 arm, the rate adjusts once a year for the remaining loan term. with a 5 6 arm, the rate adjusts every 6 months. 7 1 and 7 6 arms. A 5 1 arm is a type of adjustable rate mortgage loan (arm) with a fixed interest rate for the first 5 years. afterward, the 5 1 arm switches to an adjustable interest rate for the remainder of its term. the words “variable” and “adjustable” are often used interchangeably. when people refer to variable rate mortgages, they likely mean a. 5 1 arm vs. 10 1 arm. a five year arm has a five year low fixed rate followed by 25 years with an adjustable rate. a 10 year arm offers 10 years at a fixed rate, then 20 years of adjustments. in general, the shorter the fixed rate period, the lower the introductory rate. 5 1 vs. 7 1 arm. same song, different verse.

Adjustable Rate Mortgages Learn More About Arm Loans Bankrate A 5 1 arm is a type of adjustable rate mortgage loan (arm) with a fixed interest rate for the first 5 years. afterward, the 5 1 arm switches to an adjustable interest rate for the remainder of its term. the words “variable” and “adjustable” are often used interchangeably. when people refer to variable rate mortgages, they likely mean a. 5 1 arm vs. 10 1 arm. a five year arm has a five year low fixed rate followed by 25 years with an adjustable rate. a 10 year arm offers 10 years at a fixed rate, then 20 years of adjustments. in general, the shorter the fixed rate period, the lower the introductory rate. 5 1 vs. 7 1 arm. same song, different verse. An adjustable rate mortgage, or arm, has an introductory interest rate that lasts for a set period of time and adjusts every six months thereafter for the remaining loan term. introductory periods can range between three and 10 years and most arms have a 30 year term. arms are also known as a variable rate or floating rate mortgage. A 5 1 adjustable rate mortgage (arm) is a type of home loan worth considering if you’re looking for a low monthly payment and don’t plan to stay in your home long. for the first five years, 5 1 arm rates can be lower than 30 year fixed rate mortgages. after that, the interest rate and payments can increase significantly.

Adjustable Rate Mortgage Arm Definition And Guide Sprint Finance An adjustable rate mortgage, or arm, has an introductory interest rate that lasts for a set period of time and adjusts every six months thereafter for the remaining loan term. introductory periods can range between three and 10 years and most arms have a 30 year term. arms are also known as a variable rate or floating rate mortgage. A 5 1 adjustable rate mortgage (arm) is a type of home loan worth considering if you’re looking for a low monthly payment and don’t plan to stay in your home long. for the first five years, 5 1 arm rates can be lower than 30 year fixed rate mortgages. after that, the interest rate and payments can increase significantly.

Adjustable Rate Mortgage Artisan Sotheby S International Realty

Comments are closed.