Expert Tips For Choosing Medicare Part D In 2024

Expert Tips For Choosing Medicare Part D In 2024 Youtube Here are some tips. first, using medicare’s plan finder tool, select your usual pharmacy as well as up to four additional ones when prompted, then click “done.”. next, when the results are. We analyzed plans covering nearly 90% of stand alone medicare part d members to pick the best of 2025 based on cost, quality, member satisfaction and more. our picks: for 2025, wellcare’s value.

Medicare Plan D Deductible 2024 Tamra Florance The average member will pay $40 per month for a stand alone medicare part d plan in 2025, down from $41.63 in 2024, according to september estimates by the centers for medicare & medicaid services. The company offers three medicare part d plans: silverscript smartsaver: this plan has the most affordable average monthly premiums. silverscript choice: this mid range plan offers a lower copay. Cms’s announcement is exciting news for the millions of medicare beneficiaries who rely on medicare part d benefits for prescription drug coverage each year. according to the latest projections, the average monthly premium for medicare part d in 2024 is anticipated to be $55.50. this is a nearly 2% decrease from the 2023 average premium of. It is an optional benefit that can be especially helpful for seniors needing financial assistance with their prescription drug costs. a few changes to the medicare part d for 2024 include: the standard deductible increased from $505 in 2023 to $545 in 2024. the initial coverage limit is increasing from $4,660 to $5,030.

+cropped.png?format=2500w)

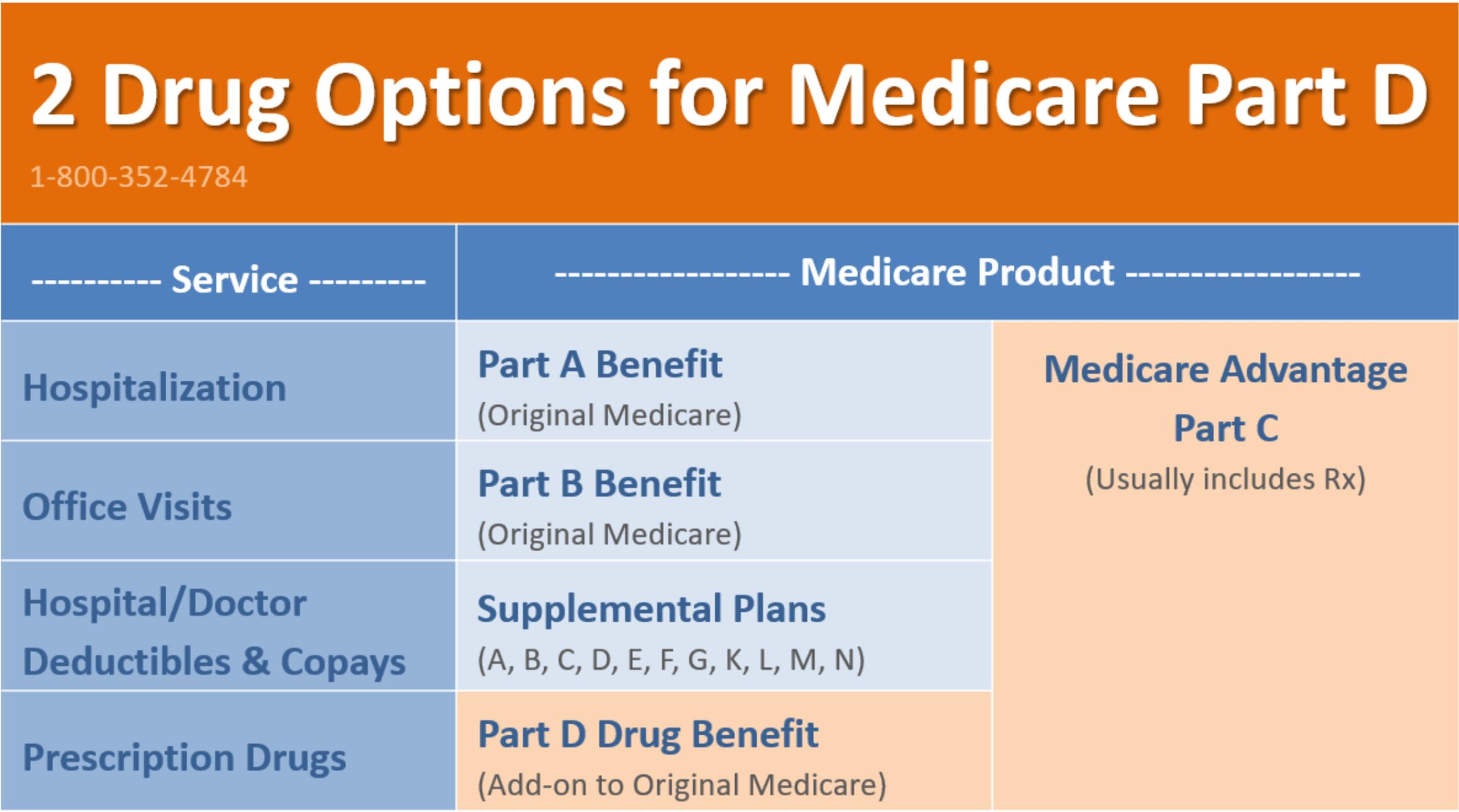

How Medicare Part D Works 2024 Medicare Mindset Llc Cms’s announcement is exciting news for the millions of medicare beneficiaries who rely on medicare part d benefits for prescription drug coverage each year. according to the latest projections, the average monthly premium for medicare part d in 2024 is anticipated to be $55.50. this is a nearly 2% decrease from the 2023 average premium of. It is an optional benefit that can be especially helpful for seniors needing financial assistance with their prescription drug costs. a few changes to the medicare part d for 2024 include: the standard deductible increased from $505 in 2023 to $545 in 2024. the initial coverage limit is increasing from $4,660 to $5,030. Unitedhealthcare’s part d plan in texas earned a 5 star plan rating in 2020, and the company has an overall 3.5 star rating. all three of aarp’s drug plans were in the top 10 for enrollment in 2019: aarp medicarerx preferred, aarp medicarerx saver plus, and aarp medicarerx walgreens. Humana offers three national part d plans for 2024, with weighted average monthly premiums as low as $43 per month and low or $0 copays for tier 1 and tier 2 drugs. humana walmart value rx plan. weighted average monthly premium: $43 1. median standard cost sharing: $0 for preferred generics, $1 for other generics.

Medicare Part D 2024 Medicare Planning Unitedhealthcare’s part d plan in texas earned a 5 star plan rating in 2020, and the company has an overall 3.5 star rating. all three of aarp’s drug plans were in the top 10 for enrollment in 2019: aarp medicarerx preferred, aarp medicarerx saver plus, and aarp medicarerx walgreens. Humana offers three national part d plans for 2024, with weighted average monthly premiums as low as $43 per month and low or $0 copays for tier 1 and tier 2 drugs. humana walmart value rx plan. weighted average monthly premium: $43 1. median standard cost sharing: $0 for preferred generics, $1 for other generics.

Comments are closed.