Everything You Need To Know About The S P Asx 200 Stockspot

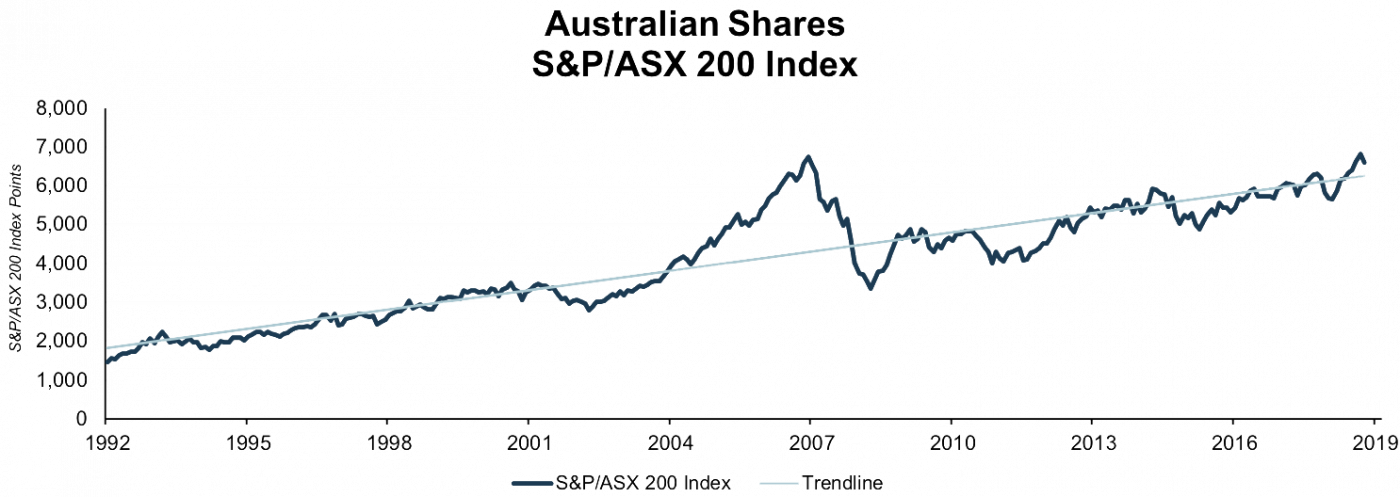

Everything You Need To Know About The S P Asx 200 Stockspot The s&p asx 200 index has been one of the best ways to invest and grow your wealth in australia. with long term returns of about 9% per year including market growth and dividends, understanding how to invest in the asx 200 is important for any investor. in this article, we explain what the s&p asx 200 index is, what’s inside it, the best. An all time market high leads to more all time highs. after a new all time high has been reached, the average number of days before the next one is 30 days. in fact, if you exclude the 12 year wait from 2007 to 2019, the average number of days is just 19! in other words, the first all time high is usually followed by more of them.

Everything You Need To Know About The S P Asx 200 Stockspot Any movements in the s&p asx 200 index itself are expressed in a percentage but also in points. when the asx 200 was created in 2000, it began with a value of 3,133.3 points, equal to the value of the broader all ordinaries index at the time. the all ordinaries index tracks around 500 companies that are listed on the asx and was given a value. The s&p asx 200 index is a market capitalisation weighted and float adjusted stock market index of australian stocks listed on the australian securities exchange from standard & poor's. the 3 letter exchange ticker in australia for the s&p asx 200 is "xjo". the index incorporates total of top 200 companies listed on asx. Like all indices, the asx 200 will either go up or down as investors buy and sell shares in constituent companies and the share prices move accordingly. the movements are expressed in points and it began with 3,133.3 back in 2000. because it tracks the top 200 companies, it can be used as a mechanism for viewing how the market is going. What is the average return on ozr? spdr s&p asx 200 resources fund (ozr) has seen total returns of 3.58% over the past 1 year, 6.89% p.a. over the past 3 years and 7.82% p.a. over the past 5 years, as of 30 june 2024.

S P Asx 200 Chart Hints Australian Stocks Face Major Reversal Like all indices, the asx 200 will either go up or down as investors buy and sell shares in constituent companies and the share prices move accordingly. the movements are expressed in points and it began with 3,133.3 back in 2000. because it tracks the top 200 companies, it can be used as a mechanism for viewing how the market is going. What is the average return on ozr? spdr s&p asx 200 resources fund (ozr) has seen total returns of 3.58% over the past 1 year, 6.89% p.a. over the past 3 years and 7.82% p.a. over the past 5 years, as of 30 june 2024. Europe is trapped between technocracy and democracy nov 04 2024. traders braced for volatility and volume as us election night nears nov 04 2024. data provided by lseg. s&p asx 200 gross total return indexindex chart, prices and performance, plus recent news and analysis. Selected etf. vas vanguard australian shares index etf (fee: 0.07%) second choice. stw spdr s&p asx 200 fund (fee: 0.13%) vas tracks the s&p asx 300 index, offering greater diversification benefits than stw which tracks the s&p asx 200. vas is the largest index etf in the australian market with a lower expense ratio, greater liquidity and.

All You Need To Know About S P Asx 200 Youtube Europe is trapped between technocracy and democracy nov 04 2024. traders braced for volatility and volume as us election night nears nov 04 2024. data provided by lseg. s&p asx 200 gross total return indexindex chart, prices and performance, plus recent news and analysis. Selected etf. vas vanguard australian shares index etf (fee: 0.07%) second choice. stw spdr s&p asx 200 fund (fee: 0.13%) vas tracks the s&p asx 300 index, offering greater diversification benefits than stw which tracks the s&p asx 200. vas is the largest index etf in the australian market with a lower expense ratio, greater liquidity and.

Everything You Need To Know About The S P Asx 200 Stockspot

Everything You Need To Know About The S P Asx 200 Stockspot

Comments are closed.