Different Types Of Audit Akt Associates

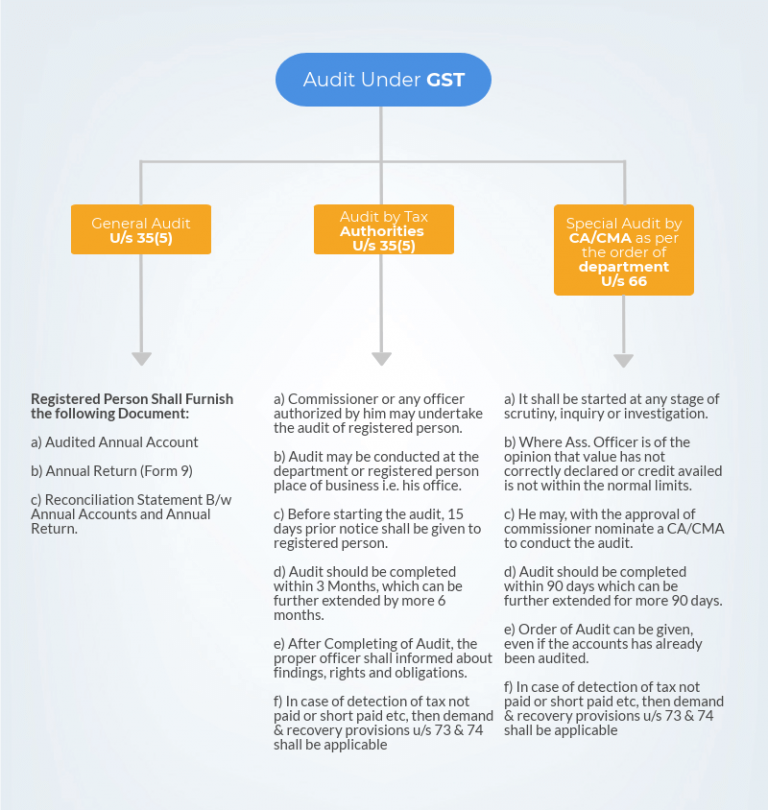

Gst Audits Assessments Applicability Procedure Akt Associates Many types of audit has been prescribed by a specific tax or legal department. now it depends upon the company what provision is applicable mandatory to them. let us take an overview of types of audit may be required to get conduct either by internal or external authority. internal audit:. The department shall initiate the action of demand & recovery as defined u s 73 or 74. this provision is the same as section 65 of the cgst act, 2017. gst audit is mandatory for every business whose turnover is 2cr or above. in this article, you will learn about its applicability, rules, procedure and many more.

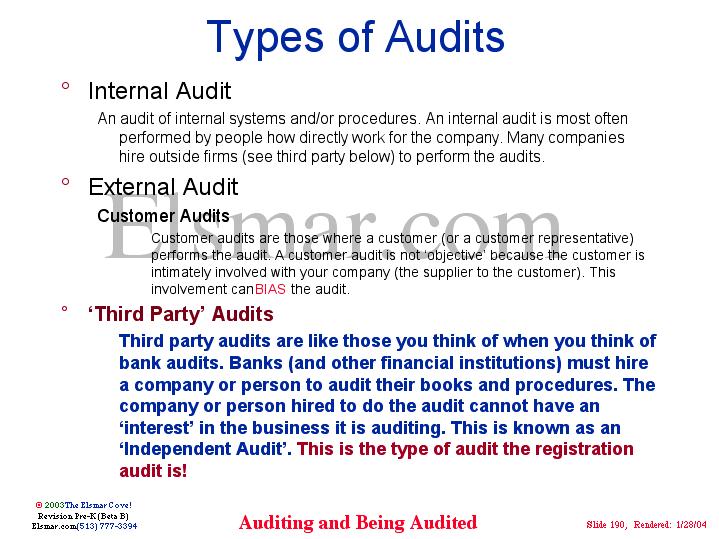

What Is Auditing Audit Types Cycle And Its Significant Overview: the audit is an art of systematic and independent review and investigation on a certain subject matter, including financial statements, management accounts, management reports, accounting records, operational reports, revenues reports, expenses reports, etc. the result of reviewing and investigation will be reported to shareholders and other key internal stakeholders of the entity. Assessment. as per section 2 (11) of gst act, assessment means the computation of tax liability under this act and includes. in gst regime, assessment is mainly focused on self assessment by the taxpayers themselves, where every taxpayer furnishes a return as required u s 39 of gst act by self assessing the taxes payable by him. 4 types of audit report overview. audit report is the report that auditors express an opinion on financial statements whether they faithfully present the company’s financial position, financial performance, and cash flows in accordance with the applicable financial reporting framework, such as us gaap, ifrs or local gaap. And, tax auditors review possible errors on your small business tax return. auditors usually conduct irs audits randomly. irs audits can be conducted via mail or through in person interviews. 4. financial audit. a financial audit is one of the most common types of audit. most types of financial audits are external.

Know All About Secretarial Audit Akt Associates 4 types of audit report overview. audit report is the report that auditors express an opinion on financial statements whether they faithfully present the company’s financial position, financial performance, and cash flows in accordance with the applicable financial reporting framework, such as us gaap, ifrs or local gaap. And, tax auditors review possible errors on your small business tax return. auditors usually conduct irs audits randomly. irs audits can be conducted via mail or through in person interviews. 4. financial audit. a financial audit is one of the most common types of audit. most types of financial audits are external. We look at the 7 core types of auditing mostly undertaken at the behest of the caretakers of a business (though other stakeholders may also require them) in the life of a dynamic organization. external audit 5. operational audit. internal audit 6. information systems (is) audit. Looks at financial reports that have been produced using auditing standards, like gaaps, for example. when combined with analytical audit procedures, this audit method can be used to look for fraud by reviewing the company’s financial statements and comparing them with what is expected when audit standards are applied. 6. inspection of assets:.

Types Of Internal Audit We look at the 7 core types of auditing mostly undertaken at the behest of the caretakers of a business (though other stakeholders may also require them) in the life of a dynamic organization. external audit 5. operational audit. internal audit 6. information systems (is) audit. Looks at financial reports that have been produced using auditing standards, like gaaps, for example. when combined with analytical audit procedures, this audit method can be used to look for fraud by reviewing the company’s financial statements and comparing them with what is expected when audit standards are applied. 6. inspection of assets:.

Comments are closed.