Difference Between Variable And Fixed Rate Student Loans Difference

.png?format=1500w)

Fixed Vs Variable Rate For Student Loans Infolearners Advantages of variable rate loans. you can get a lower interest rate. variable rates typically are lower than fixed rate loans, particularly at the start of your repayment term. as of january 2021. Fixed student loan rates are the safer bet. fixed rates are locked in for the life of the loan. the only way to change a fixed interest rate is through student loan refinancing. pros. there’s no.

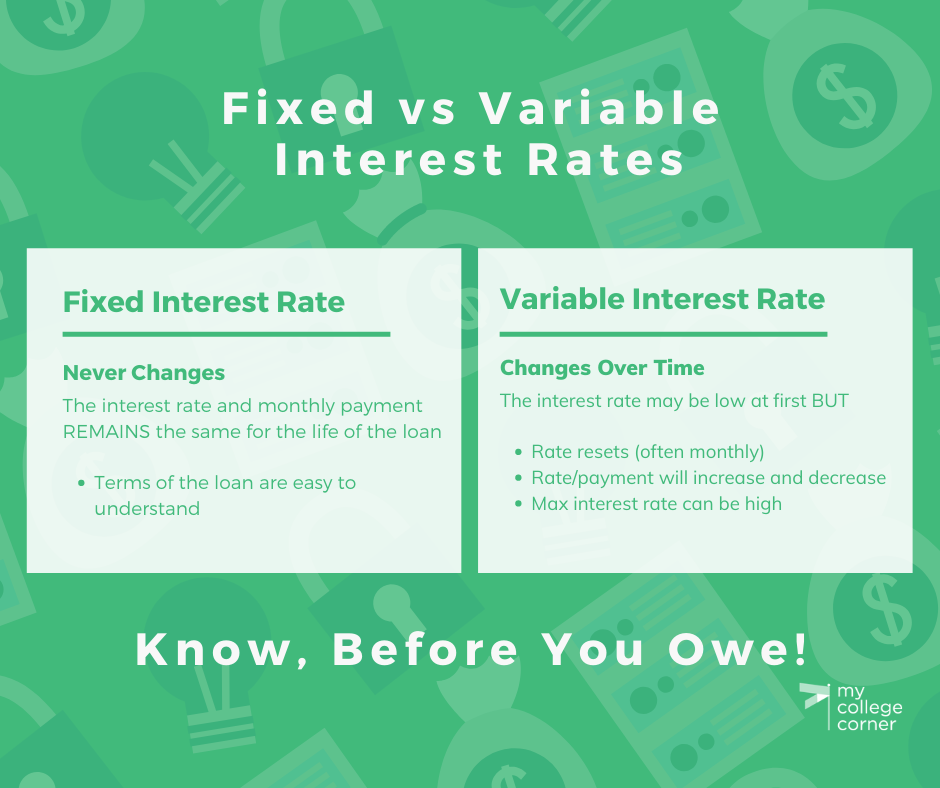

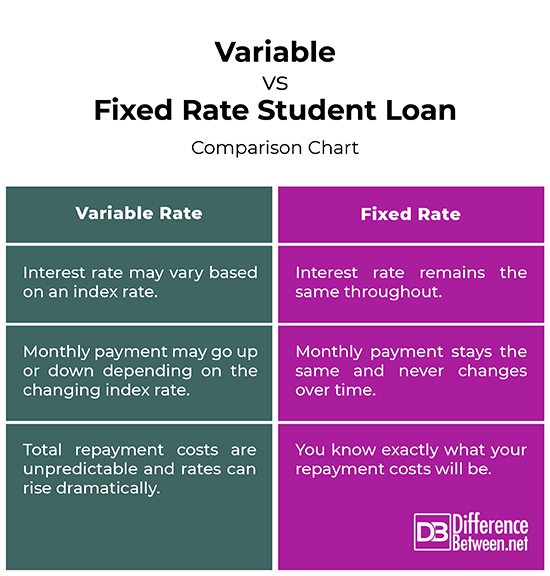

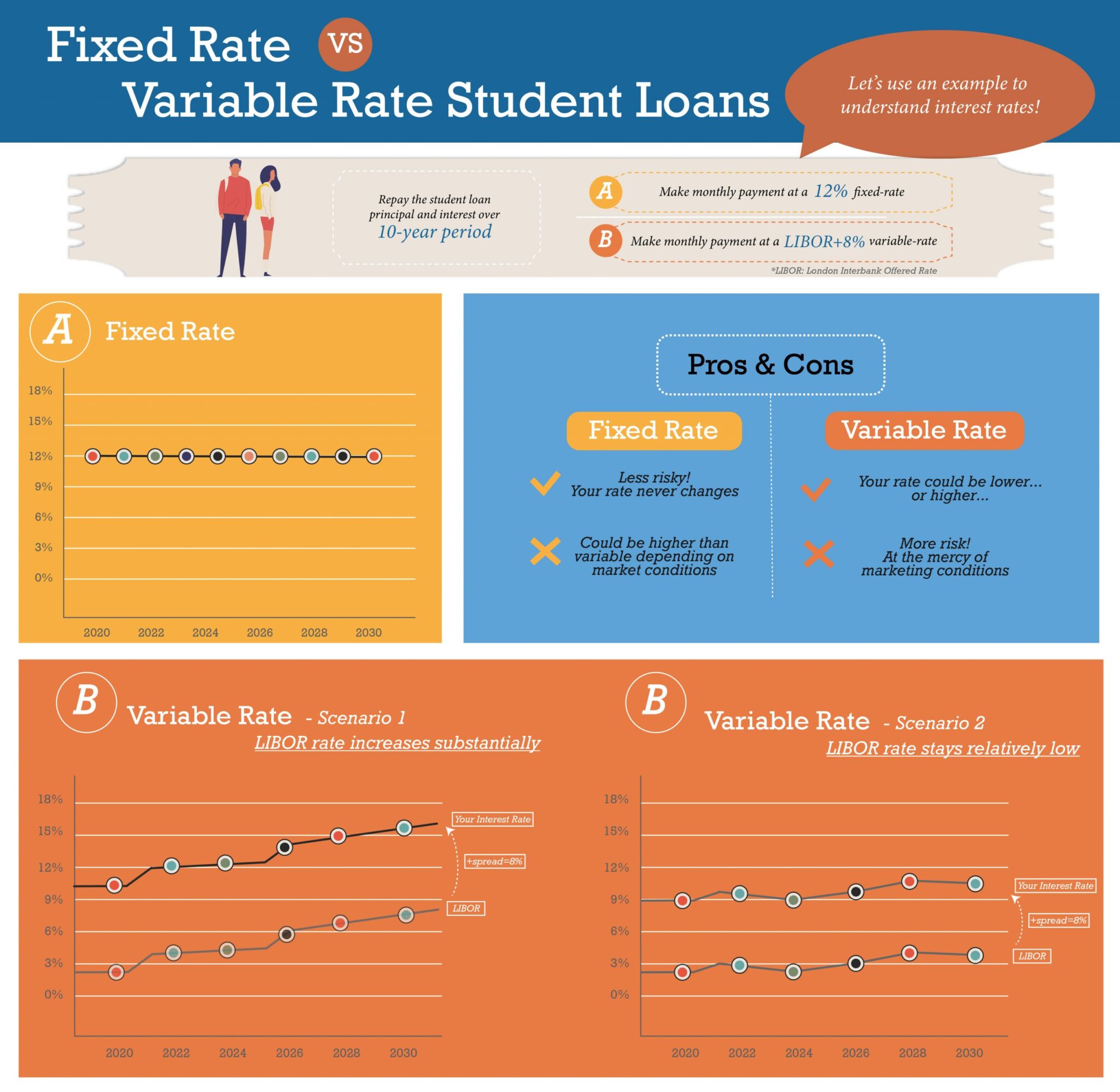

Copy Of Fixed Vs Variable Png A fixed rate stays the same over the life of your student loan, while a variable rate can fluctuate over time. here are the main pros and cons of these two rate types: fixed rate. variable rate. The main difference between fixed and variable student loans is whether the interest rate can change. however, there are some other areas your rate can affect, including your budget, your student. Fixed rate student loan: assuming a 6.5% interest rate, you'd pay $146.93 per month and repay $35,263.93.; variable rate student loan with rising rates: let's say you start at 5% and rise as high. Variable rate loans often look appealing compared with fixed rate loans, because their advertised interest rates tend to be lower. if you had the choice of a 6.50% fixed rate or a 4.75% variable rate, the lower rate might seem to be a great deal. but risk is involved, as the variable rate has the potential to rise during the term of your loan.

Difference Between Variable And Fixed Rate Student Loans Difference Fixed rate student loan: assuming a 6.5% interest rate, you'd pay $146.93 per month and repay $35,263.93.; variable rate student loan with rising rates: let's say you start at 5% and rise as high. Variable rate loans often look appealing compared with fixed rate loans, because their advertised interest rates tend to be lower. if you had the choice of a 6.50% fixed rate or a 4.75% variable rate, the lower rate might seem to be a great deal. but risk is involved, as the variable rate has the potential to rise during the term of your loan. The interest rate outlook: if interest rates are expected to remain low or increase gradually over the life of the loan, variable rate loans are often more desirable, and vice versa. risk tolerance: if you prefer stability, accurate planning, and low risk fixed rate loans are a better choice. The answer is both. federal student loans are fixed, but private loans can be fixed or variable. understanding the difference between a student loan with a variable interest rate vs. a fixed interest student loan is important. to put it simply, variable interest rates change, while fixed interest rates stay the same. on this page:.

Fixed Or Variable Rate International Student Loan Edupass The interest rate outlook: if interest rates are expected to remain low or increase gradually over the life of the loan, variable rate loans are often more desirable, and vice versa. risk tolerance: if you prefer stability, accurate planning, and low risk fixed rate loans are a better choice. The answer is both. federal student loans are fixed, but private loans can be fixed or variable. understanding the difference between a student loan with a variable interest rate vs. a fixed interest student loan is important. to put it simply, variable interest rates change, while fixed interest rates stay the same. on this page:.

Difference Between Variable And Fixed Rate Student Loans Difference

Comments are closed.