Difference Between Series A B C Funding Eqvista

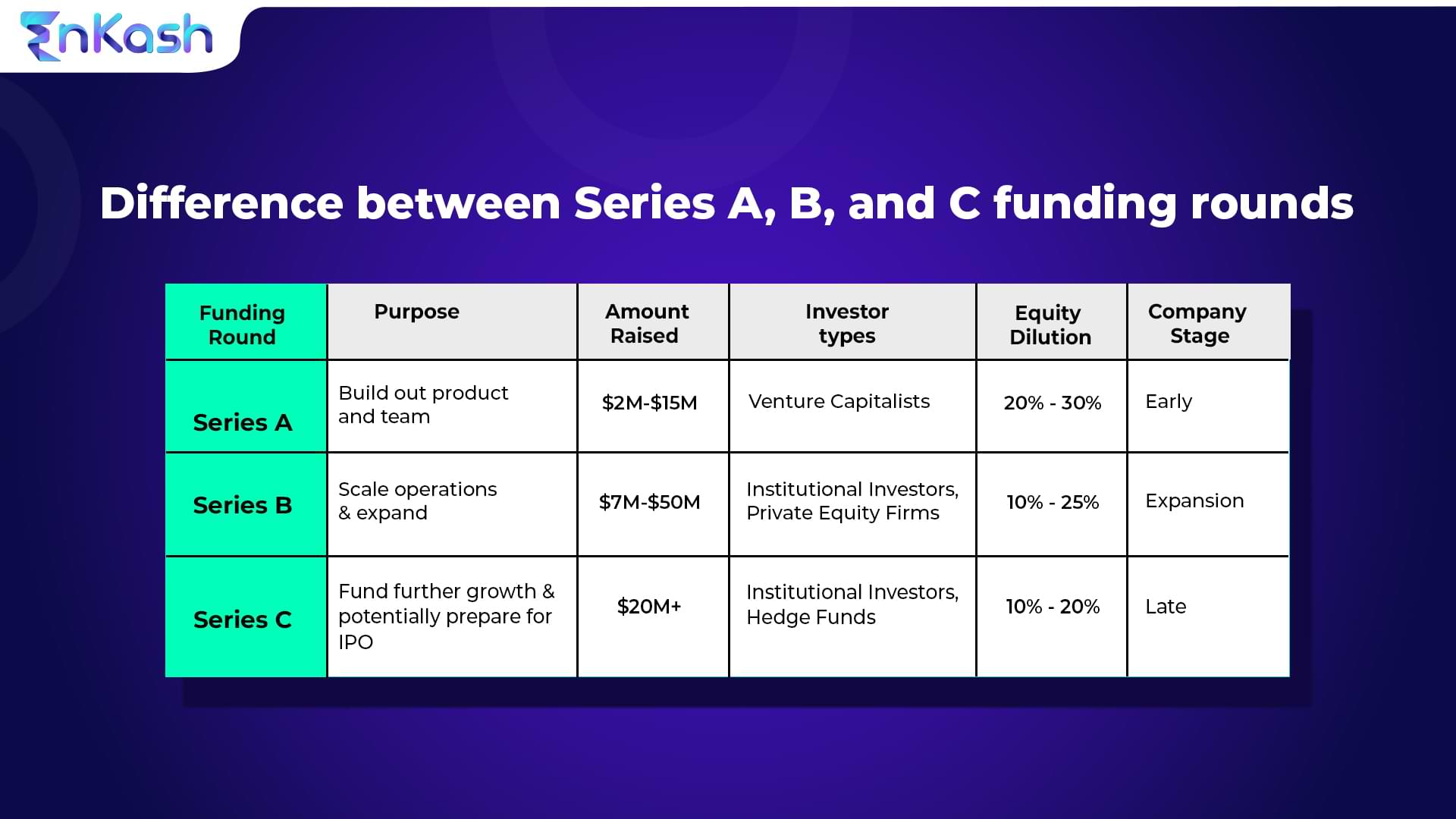

Navigating Pre Seed Funding Securing Series A B And C Funding For However, this quantity has risen as well. a series b round typically raises $33 million in total. series c funding – companies planning to get funding in the c series round are not in the startup category, and they are pretty well successful. they can take funding approx $50 to $80 million. Series a, b, and c venture capital investments are typically made by wealthy individuals, investment banks, and other financial institutions. additionally, e.

Difference Between Series A B C Funding Eqvista Youtube Seed rounds vs series a, b, c funding. seed rounds as the name imply plants a ‘seed’ in the business. but further rounds are identified with the category of equity investors would receive in return for the seed round capital. series a, b, and c indicate the investor’s entitlement to series a, series b, and series c shares in the startup. That is where a company usually opts for the series b funding round. the estimated capital raised is usually similar to series a round, with funds coming from vc firms. series c & so on. companies that reach series c funding rounds are usually highly successful. they need the series c funding mostly to develop new products or to acquire a new. The difference with series b is the addition of a new wave of other venture capital firms specializing in later stage investing. series a, b, and c funding rounds are stages in the investment. The basics of series funding rounds. series funding is a process through which startups and growing companies raise capital in different stages: series a, series b, series c, and so on. it typically begins with pre seed and seed funding, where initial capital for early stage startups is raised from sources like angel investors or accelerators.

Series Of Funding A B C D Definition How It Works The difference with series b is the addition of a new wave of other venture capital firms specializing in later stage investing. series a, b, and c funding rounds are stages in the investment. The basics of series funding rounds. series funding is a process through which startups and growing companies raise capital in different stages: series a, series b, series c, and so on. it typically begins with pre seed and seed funding, where initial capital for early stage startups is raised from sources like angel investors or accelerators. Series funding projected growth & valuation. at each stage of funding, your business valuation will grow as will your projected funding amounts. below are the 2020 averages for both valuations and funding round sizes: series a: $23 million average valuation, $15.6 million average funding. series b: $59 million average valuation, $33 million. Is it hard to get series c funding? it is very hard to get series c funding. few companies reach series b funding, and fewer still reach the series c stage as they are unable to progress at a safe and steady pace. even without failing, a business may not be particularly innovating, or exponentially growing at legendary levels.

Comments are closed.