Difference Between Pension And Retirement Plan

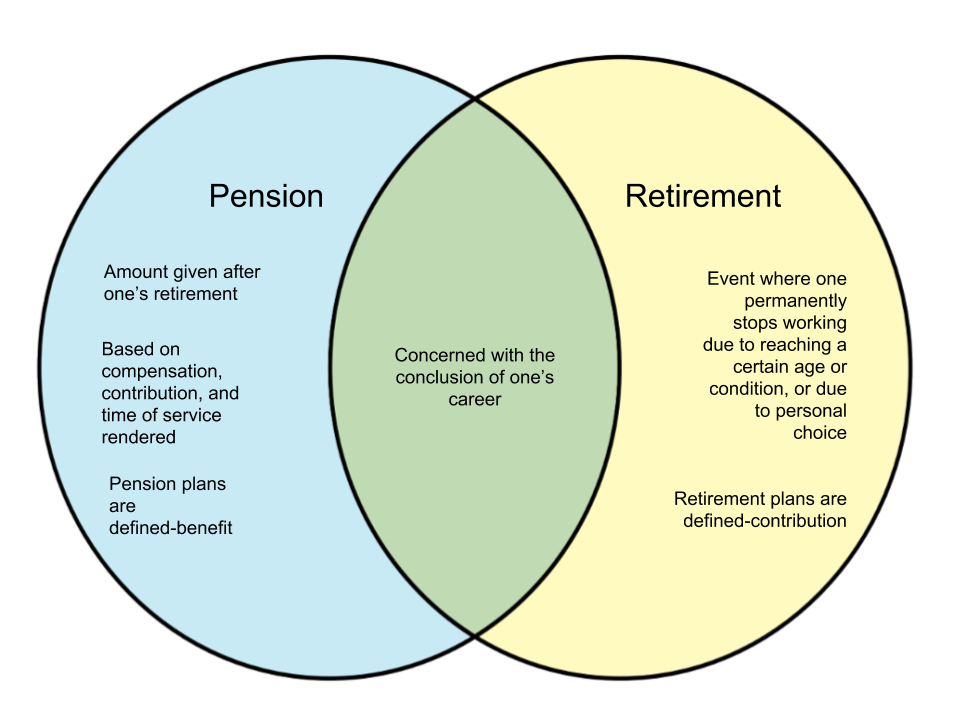

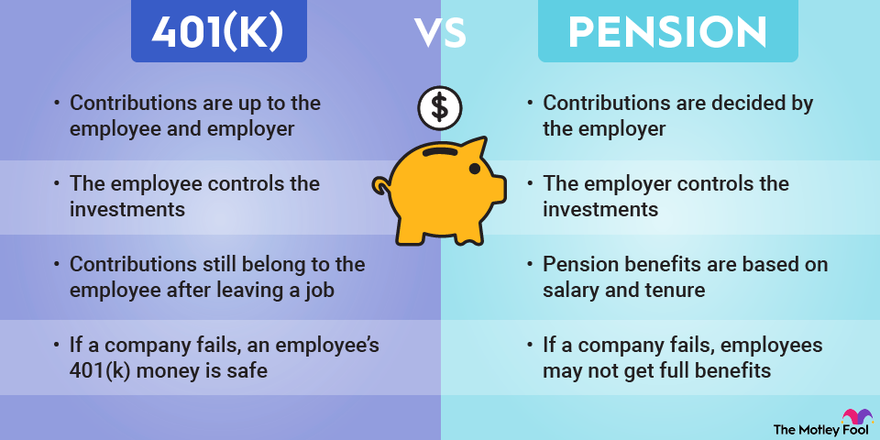

Difference Between Pension And Retirement Whyunlike Com Pensions are defined benefit plans. in a defined benefit plan, the employer guarantees you a specific amount of income after retirement. the income you qualify for is based on factors like years of service, salary history, and a predetermined formula. the employer is responsible for managing the investments and assumes the financial risk. A pension plan is a retirement plan that employers fund for employees. here’s how a pension plan works, how it differs from a 401(k) and which one is better. another difference lies in who.

Difference Between Pension And Retirement Difference Between A 401 (k) can have the potential for more growth than a pension plan. if you invest aggressively and earn average to above average returns, your money can grow faster, leaving you with a bigger. A crucial difference between a 401(k) and a pension plan is in who bears the risk. a 401(k) is turned over to the retiring employee, who takes on the rights and responsibilities of managing the. Pensions may also offer more flexibility in terms of payouts if the plan allows for the choice between payment structures. there are also some reasons social security is better. pensions are tied. The difference between a pension plan and a 401 (k) a traditional pension, or defined benefit plan, is a retirement benefit provided by companies where the employer sets aside the money to invest.

Difference Between Pension And Retirement Plan Pensions may also offer more flexibility in terms of payouts if the plan allows for the choice between payment structures. there are also some reasons social security is better. pensions are tied. The difference between a pension plan and a 401 (k) a traditional pension, or defined benefit plan, is a retirement benefit provided by companies where the employer sets aside the money to invest. A key difference between the two is that with a pension plan, the benefit paid to the employee in retirement is typically based on years of service and salary history. with a 401(k), the benefit paid in retirement depends on the account balance at retirement. pension plans favor those who want a guaranteed income stream in retirement. The major differences between pensions and 401 (k) plans can be summed up as follows: pensions are primarily funded by employers, while 401 (k) plans are primarily funded by employees. pension.

401 K Vs Pension Differences And Which Is Better The Motley Fool A key difference between the two is that with a pension plan, the benefit paid to the employee in retirement is typically based on years of service and salary history. with a 401(k), the benefit paid in retirement depends on the account balance at retirement. pension plans favor those who want a guaranteed income stream in retirement. The major differences between pensions and 401 (k) plans can be summed up as follows: pensions are primarily funded by employers, while 401 (k) plans are primarily funded by employees. pension.

Difference Between Pension Plan And Retirement Plan Compare The

Comments are closed.