Difference Between Pension And Retirement Difference Betweenz

Difference Between Pension And Retirement Difference Between Some ways these items differ include the following: 1. access to the money. you generally can’t access pension money until you retire because the accounts are non liquid. it’s possible to receive an early payout on a 401 (k), annuity, or ira, but you must pay a 10% fee to access the cash before you’re 59.5 years old. Pensions are defined benefit plans. in a defined benefit plan, the employer guarantees you a specific amount of income after retirement. the income you qualify for is based on factors like years of service, salary history, and a predetermined formula. the employer is responsible for managing the investments and assumes the financial risk.

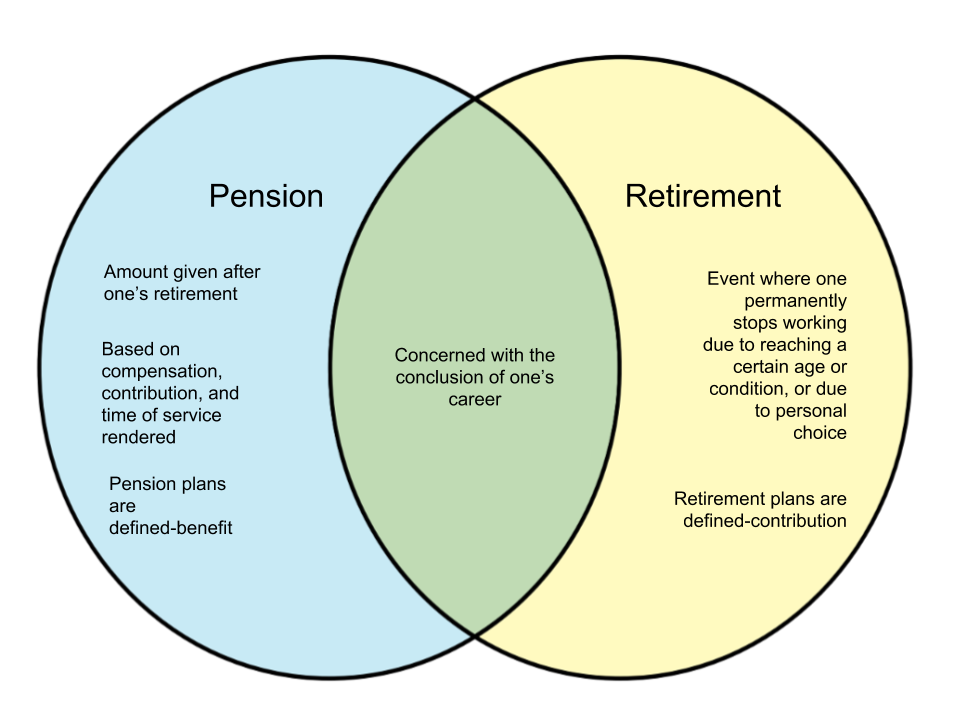

Difference Between Pension And Retirement Diff Wiki While pension and retirement are used interchangeably, they are not the same. pension refers to a specific type of retirement plan that an employer offers, while retirement is the act of leaving the workforce permanently. it’s important to understand the differences between these two terms, as they can significantly impact your financial future. A 401 (k) can have the potential for more growth than a pension plan. if you invest aggressively and earn average to above average returns, your money can grow faster, leaving you with a bigger. For most retirees without a pension, social security will not be enough; other types of retirement savings, like a 401(k) or an ira, are encouraged. pensions before the advent of iras and 401(k. A key difference between the two is that with a pension plan, the benefit paid to the employee in retirement is typically based on years of service and salary history. with a 401(k), the benefit paid in retirement depends on the account balance at retirement. pension plans favor those who want a guaranteed income stream in retirement.

Difference Between Pension And Retirement Difference Betweenz For most retirees without a pension, social security will not be enough; other types of retirement savings, like a 401(k) or an ira, are encouraged. pensions before the advent of iras and 401(k. A key difference between the two is that with a pension plan, the benefit paid to the employee in retirement is typically based on years of service and salary history. with a 401(k), the benefit paid in retirement depends on the account balance at retirement. pension plans favor those who want a guaranteed income stream in retirement. A pension plan is funded by the employer, while a 401 (k) is funded by the employee. (some employers will match a portion of your 401 (k) contributions.) a 401 (k) allows you control over your fund contributions, a pension plan does not. pension plans guarantee a monthly check in retirement a 401 (k) does not offer guarantees. While a pension guarantees income in retirement, your 401(k) balance depends on how your investments perform. 401(k)s have become much more common than pensions. you can take your 401(k) savings.

What Is The Difference Between Pension And Retirement Retire Gen Z A pension plan is funded by the employer, while a 401 (k) is funded by the employee. (some employers will match a portion of your 401 (k) contributions.) a 401 (k) allows you control over your fund contributions, a pension plan does not. pension plans guarantee a monthly check in retirement a 401 (k) does not offer guarantees. While a pension guarantees income in retirement, your 401(k) balance depends on how your investments perform. 401(k)s have become much more common than pensions. you can take your 401(k) savings.

What Is The Difference Between Retirement And Pension Similar Different

What Is The Difference Between Pension And Retirement Retire Gen Z

Comments are closed.