Difference Between Pension And Retirement Difference Between

Difference Between Pension And Retirement Diff Wiki Some ways these items differ include the following: 1. access to the money. you generally can’t access pension money until you retire because the accounts are non liquid. it’s possible to receive an early payout on a 401 (k), annuity, or ira, but you must pay a 10% fee to access the cash before you’re 59.5 years old. Pensions are defined benefit plans. in a defined benefit plan, the employer guarantees you a specific amount of income after retirement. the income you qualify for is based on factors like years of service, salary history, and a predetermined formula. the employer is responsible for managing the investments and assumes the financial risk.

Difference Between Pension And Retirement Difference Between A 401 (k) can have the potential for more growth than a pension plan. if you invest aggressively and earn average to above average returns, your money can grow faster, leaving you with a bigger. For most retirees without a pension, social security will not be enough; other types of retirement savings, like a 401(k) or an ira, are encouraged. pensions before the advent of iras and 401(k. A key difference between the two is that with a pension plan, the benefit paid to the employee in retirement is typically based on years of service and salary history. with a 401(k), the benefit paid in retirement depends on the account balance at retirement. pension plans favor those who want a guaranteed income stream in retirement. Pensions can provide substantial retirement income, but 401(k) two of the most common are pensions and 401(k)s, but there are major differences between the two offerings.

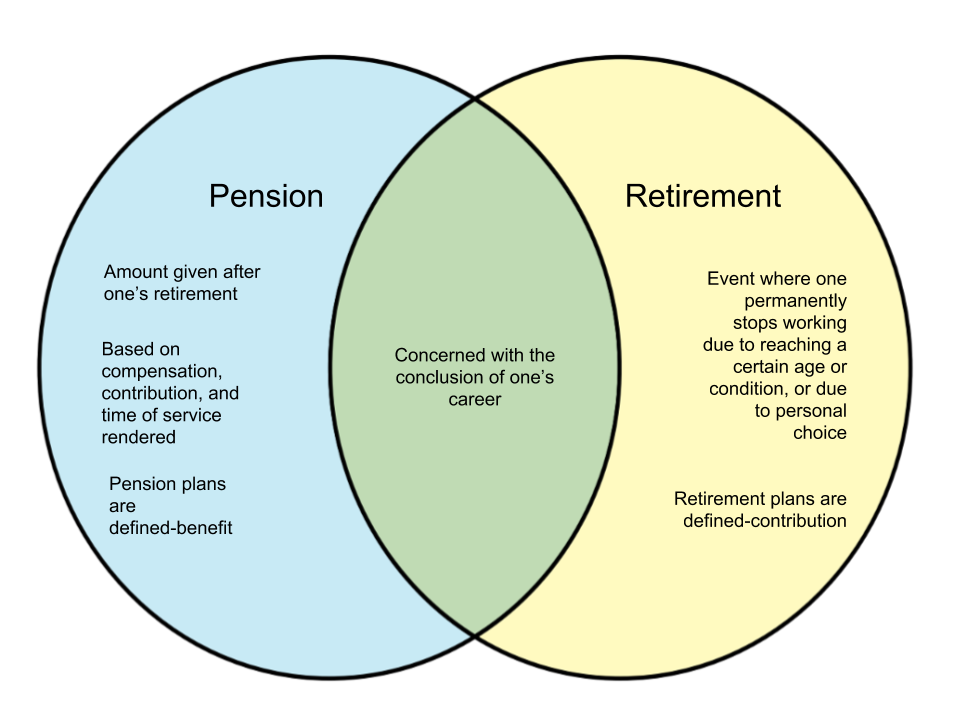

Difference Between Pension And Retirement Difference Betweenz A key difference between the two is that with a pension plan, the benefit paid to the employee in retirement is typically based on years of service and salary history. with a 401(k), the benefit paid in retirement depends on the account balance at retirement. pension plans favor those who want a guaranteed income stream in retirement. Pensions can provide substantial retirement income, but 401(k) two of the most common are pensions and 401(k)s, but there are major differences between the two offerings. The major differences between pensions and 401 (k) plans can be summed up as follows: pensions are primarily funded by employers, while 401 (k) plans are primarily funded by employees. pension. While pension and retirement are used interchangeably, they are not the same. pension refers to a specific type of retirement plan that an employer offers, while retirement is the act of leaving the workforce permanently. it’s important to understand the differences between these two terms, as they can significantly impact your financial future.

Comments are closed.