Dental Insurance 101 What Is A Deductible

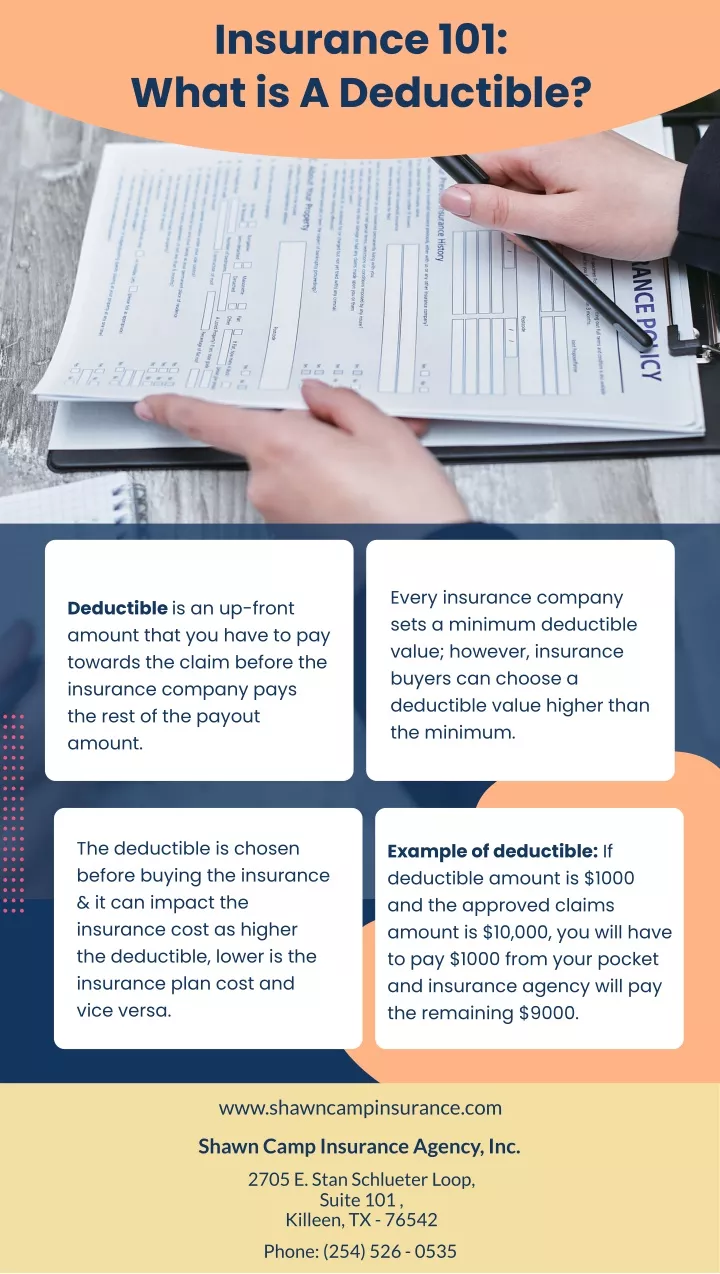

Dental Insurance 101 What Is A Deductible Youtube If you have not yet paid your deductible for the year you will pay the $50 deductible – which will be applied towards the charges for your dental services – prior to receiving coverage. once you have paid the $50 deductible, a $200 balance for the service is left. your remaining balance of $200 is covered at 80%, so your insurance provider. Your deductible for the year is $100 and your plan covers 80% of the cost of fillings after you've paid the deductible. you'll first pay $100 to your dentist, leaving a balance of $200. that remaining $200 is then covered at 80%, meaning your insurance plan will pay $160 to your dentist. this leaves a remaining balance of $40, which you'll pay.

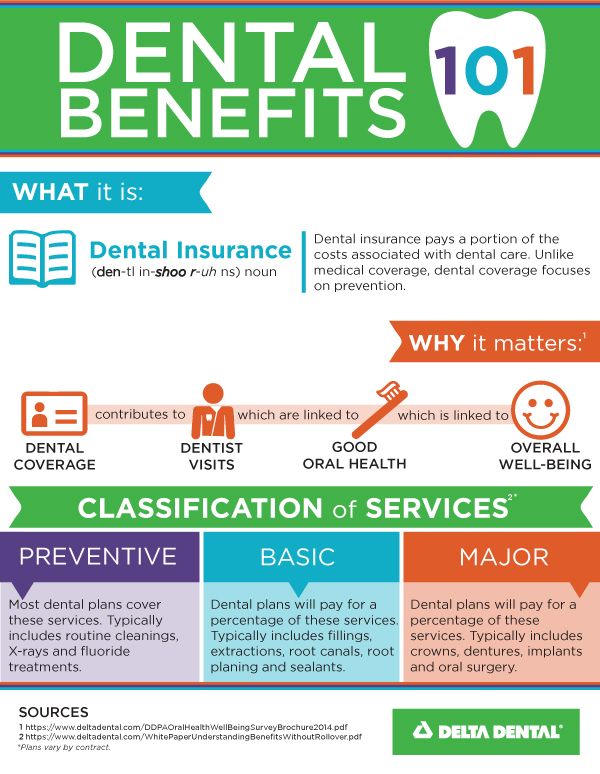

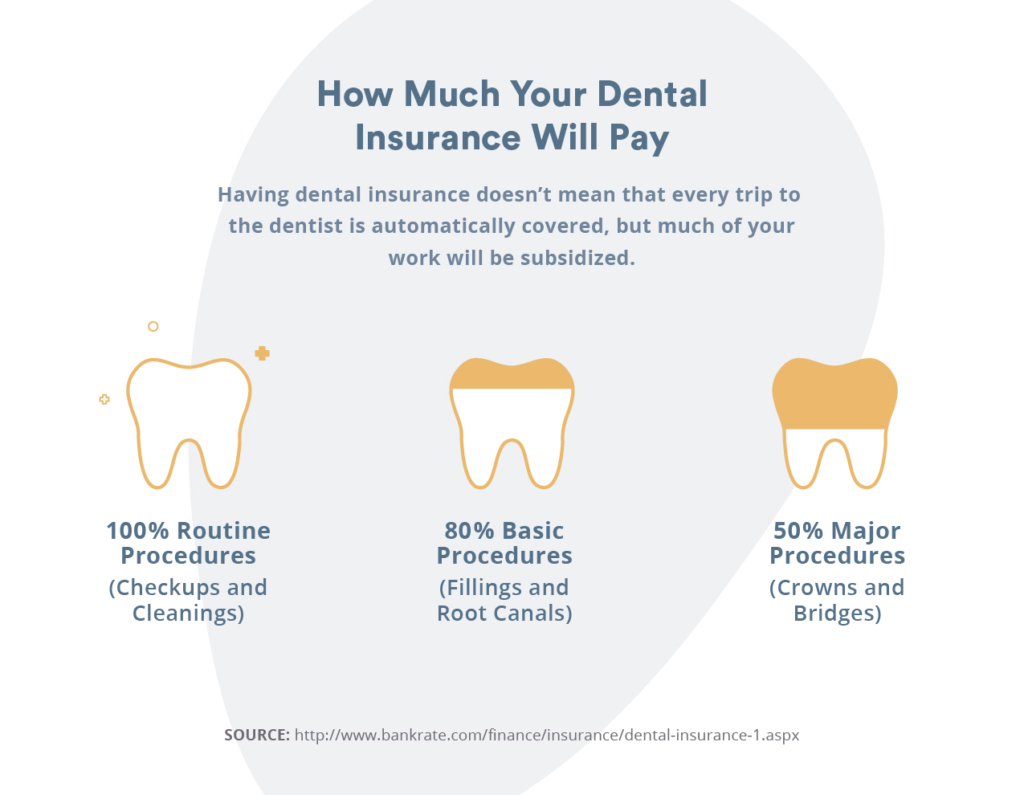

What Is A Dental Insurance Deductible Delta Dental Of Washington One of the key elements to grasp is the concept of a deductible. a deductible is a predetermined amount that a policyholder must pay out of pocket before the insurance coverage kicks in. in simpler terms, it is the portion of the dental treatment expenses that you are responsible for paying. having a clear understanding of what deductibles mean. Many dental plans feature a total annual maximum – a maximum dollar amount that may be reimbursed each year, even if the patient’s dental costs exceed that limit. a common annual maximum is $1,000 or $1,500, but it is not uncommon to see plans with much higher annual maximums of $2,000 or $3,000 to match the rising costs of dental treatment. Here’s a basic insurance deductible definition: this is the amount of money that you’ll be required to pay annually before certain types of coverage will kick in. as you work on calculating how much dental insurance will cost, remember to include the deductible along with the premium. however, unlike a premium, which is what you pay to be. Most dental insurance plans cover routine checkups, cleanings, and x rays at a higher percentage and often waive the deductible for these services. by staying on top of your preventive appointments, you not only maintain your oral health but also save money in the long run by avoiding more costly treatments down the line.

What Is A Dental Insurance Deductible Delta Dental Of Washington Here’s a basic insurance deductible definition: this is the amount of money that you’ll be required to pay annually before certain types of coverage will kick in. as you work on calculating how much dental insurance will cost, remember to include the deductible along with the premium. however, unlike a premium, which is what you pay to be. Most dental insurance plans cover routine checkups, cleanings, and x rays at a higher percentage and often waive the deductible for these services. by staying on top of your preventive appointments, you not only maintain your oral health but also save money in the long run by avoiding more costly treatments down the line. If you have not yet paid your deductible for the year you will pay the $50 deductible – which will be applied towards the charges for your dental services – prior to receiving coverage. once you have paid the $50 deductible, a $200 balance for the service is left. your remaining balance of $200 is covered at 80%, so your insurance provider. Most typical dental insurance plans come with an annual deductible of $50 or so. here is an example of how deductibles work: imagine that your dentist recommends a service that costs $300 total. your insurance coverage rate is 80%, and your deductible is $50. you will pay your deductible, leaving a balance of $250.

Dental Insurance 101 A Visual Guide If you have not yet paid your deductible for the year you will pay the $50 deductible – which will be applied towards the charges for your dental services – prior to receiving coverage. once you have paid the $50 deductible, a $200 balance for the service is left. your remaining balance of $200 is covered at 80%, so your insurance provider. Most typical dental insurance plans come with an annual deductible of $50 or so. here is an example of how deductibles work: imagine that your dentist recommends a service that costs $300 total. your insurance coverage rate is 80%, and your deductible is $50. you will pay your deductible, leaving a balance of $250.

How Does Dental Insurance Work An Overview Of Coverage

Ppt What Is A Deductible Powerpoint Presentation Free Download Id

Comments are closed.