Demand Side Response Technology Gridbeyond

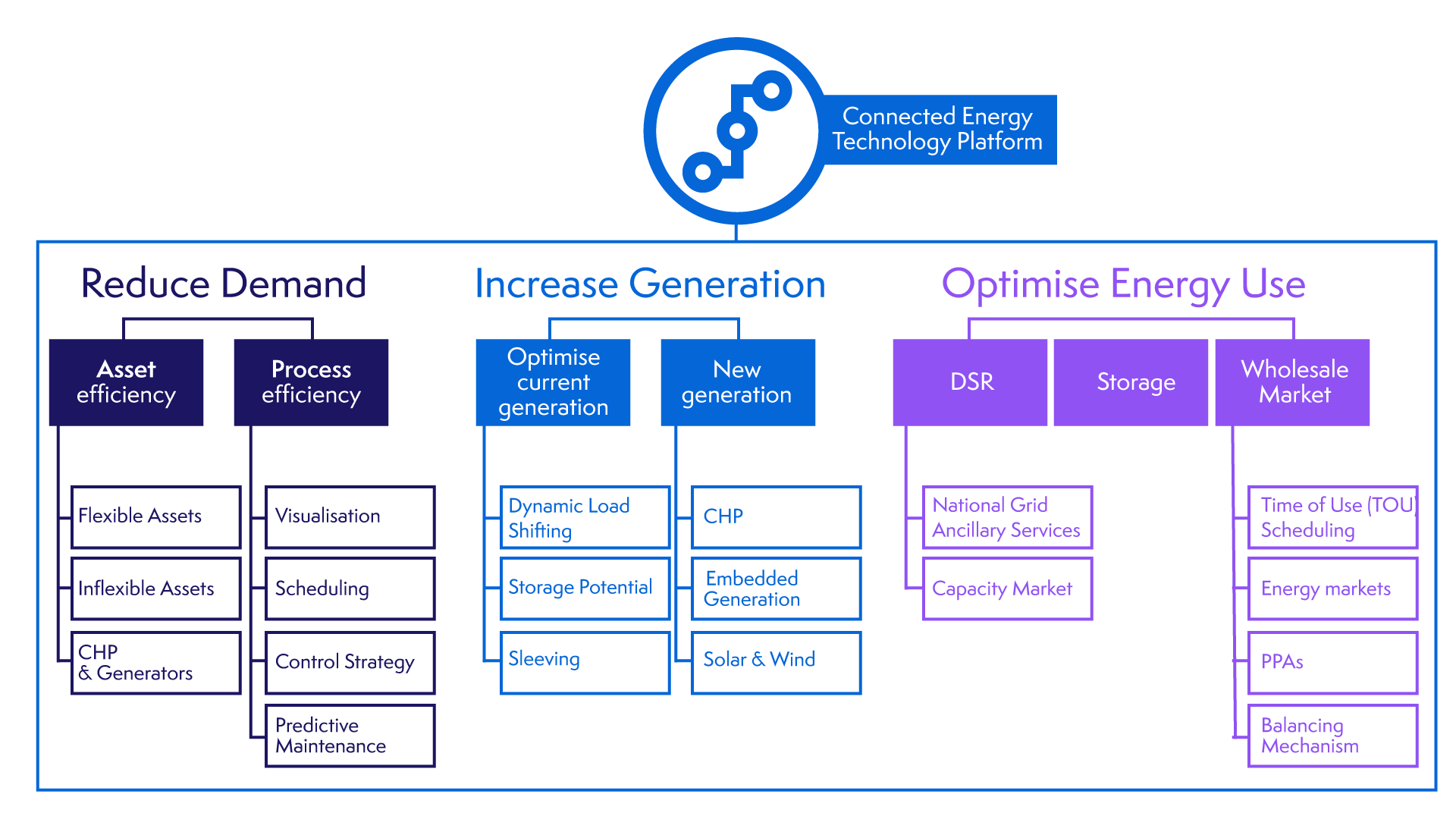

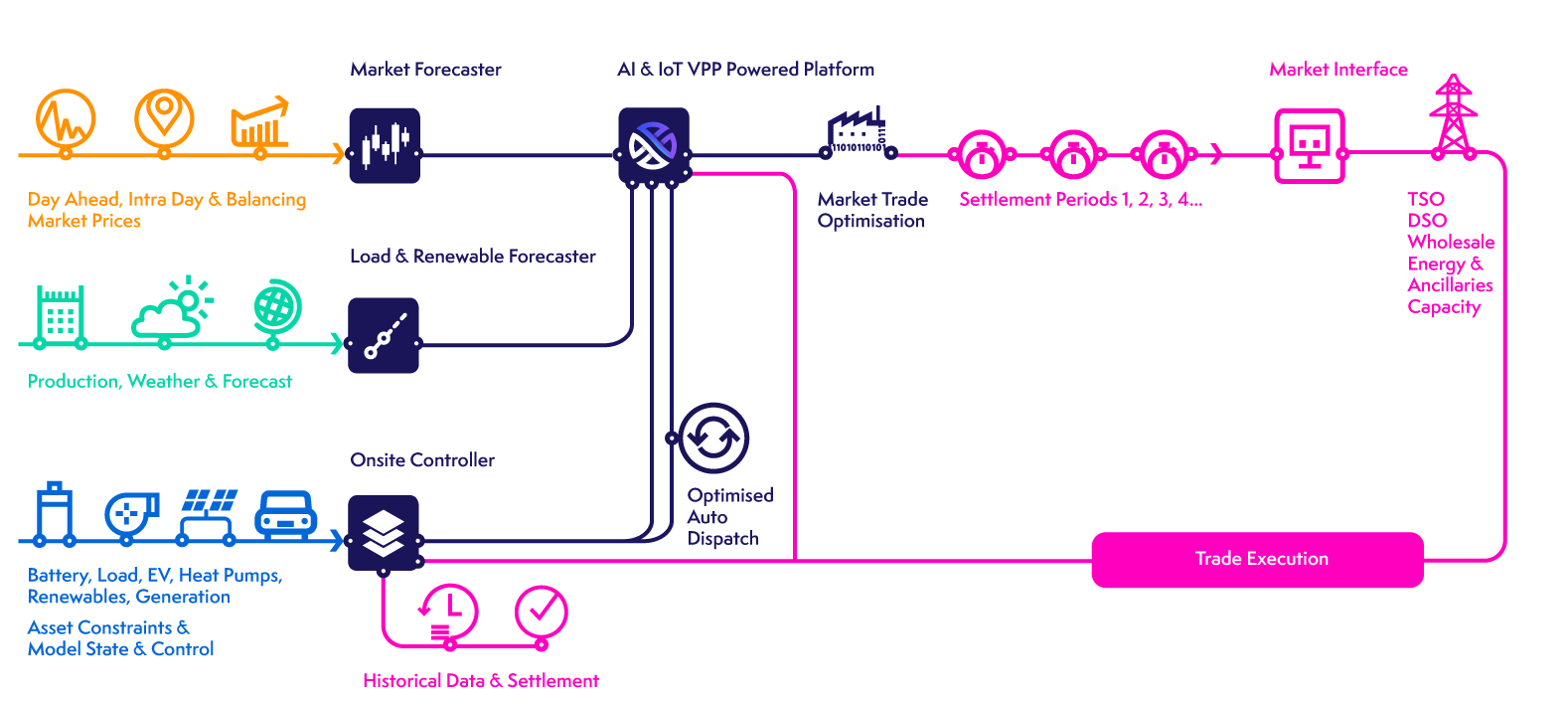

Demand Side Response Gridbeyond Gridbeyond point analyses over 70 data sources and uses ai and machine learning to ascertain the best way to use your energy flexibility on your site and within the energy market in real time. these include: asset optimisation. price optimisation. balancing services & demand side response. energy market trading. 3. Demand side response (dsr) provides a solution to that problem, while simultaneously enhancing your organisation’s energy strategy and helping you to optimise your energy use. dsr is an umbrella term for a type of energy service that large scale industrial and commercial consumers of electricity (such as manufacturers) can use to help keep.

Demand Side Response Technology Gridbeyond Demand side response is best understood through the context of the grid’s requirements. the electric grid is responsible for maintaining the balance between electricity supply and electricity demand. put more simply, the grid’s job is to ensure that the country is generating as much power as its consumers (commercial and domestic) are using. Quentin is joined by michael phelan, chief executive and co founder of gridbeyond. over the course of the conversation, they discuss: the state of demand side response (dsr), its impact in balancing the grid and the differences between uk and ercot markets. gridbeyond’s market expansion and the challenges that come with it. With gridbeyond you can benefit from: full management by our team of energy market experts and engineers. smart asset management and access to new revenue streams. access to the full range of dsr in ancillary and wholesale markets, imbalance and network charge avoidance. automation and aggregation to access more energy markets. Ideally, one should connect i&c demand assets with the batteries to create hybridised units that can deliver sophisticated sub second response, whilst being more resilient to the failure than storage only units. could you tell me a little about gridbeyond entering the dynamic containment auctions?.

Demand Side Response Technology Gridbeyond With gridbeyond you can benefit from: full management by our team of energy market experts and engineers. smart asset management and access to new revenue streams. access to the full range of dsr in ancillary and wholesale markets, imbalance and network charge avoidance. automation and aggregation to access more energy markets. Ideally, one should connect i&c demand assets with the batteries to create hybridised units that can deliver sophisticated sub second response, whilst being more resilient to the failure than storage only units. could you tell me a little about gridbeyond entering the dynamic containment auctions?. Book a 20 minute meeting demo to determine whether your company is eligible. during the chat, our energy experts will be able to explain the process and answer any questions. gridbeyond offer the technology and expertise to participate in demand side response and energy services for significant rewards. Customer centric demand response a key solution for japan’s energy transition challenges. japan’s electricity sector is facing the triple challenges in the energy transition of energy security, cost and decarbonisation, writes james tedd from gridbeyond. since the 2011 great east japan earthquake, the nuclear power generation fleet has had.

Intelligent Demand Side Response White Paper Gridbeyond Book a 20 minute meeting demo to determine whether your company is eligible. during the chat, our energy experts will be able to explain the process and answer any questions. gridbeyond offer the technology and expertise to participate in demand side response and energy services for significant rewards. Customer centric demand response a key solution for japan’s energy transition challenges. japan’s electricity sector is facing the triple challenges in the energy transition of energy security, cost and decarbonisation, writes james tedd from gridbeyond. since the 2011 great east japan earthquake, the nuclear power generation fleet has had.

Comments are closed.