Defined Contribution Vs Benefit Pension Plan For Employees Accuracy

Defined Contribution Vs Benefit Pension Plan For Employees Accuracy Whereas defined benefit plans offer a guaranteed income in retirement, defined contribution plans place the responsibility to save on the employees—and simply put, many don't. an estimated 40%. Here is a comparison of defined benefit and defined contribution plans to understand the pros and cons of each.

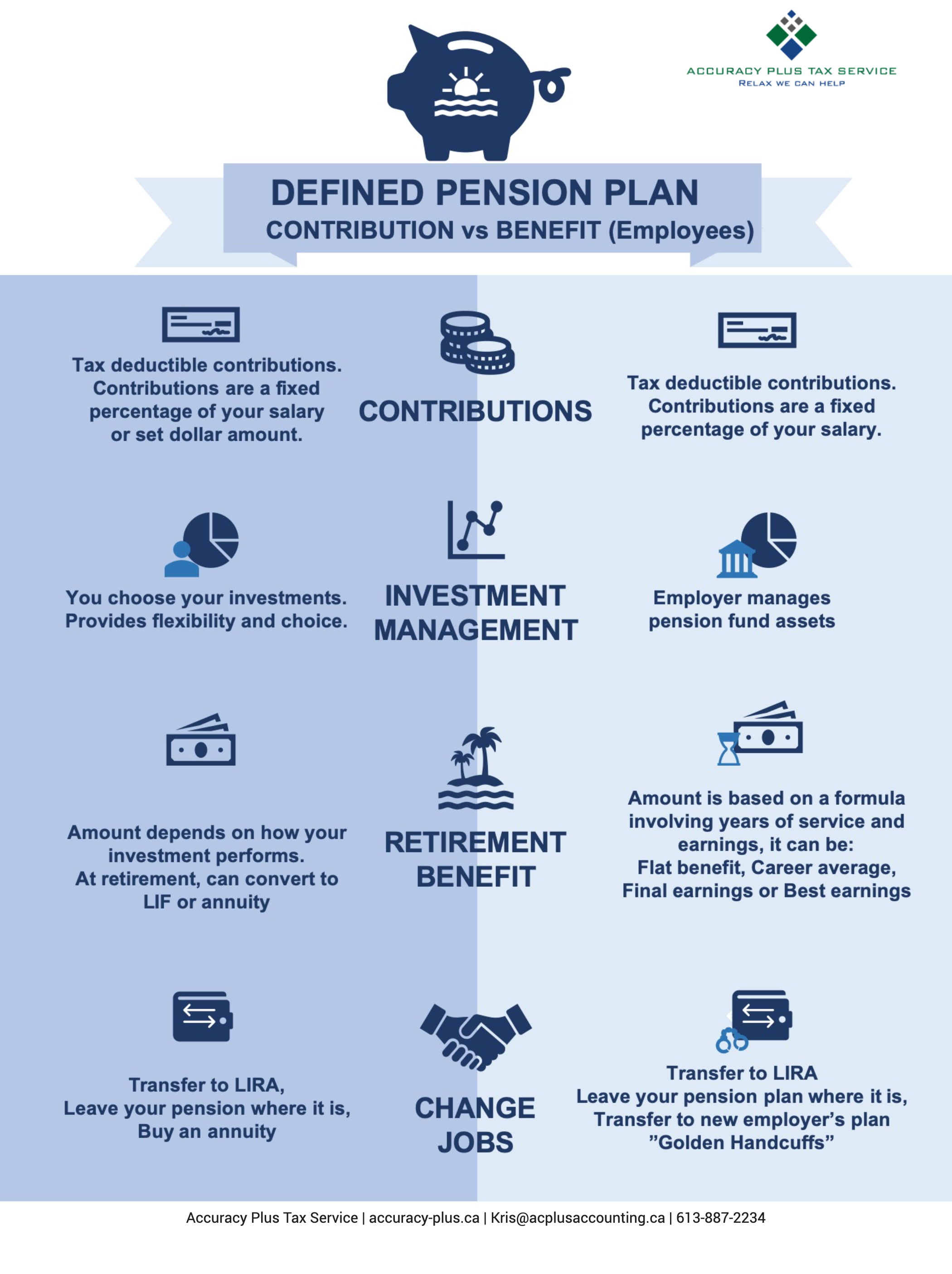

Infographic Defined Benefit Vs Defined Contribution Pension Plan Defined contribution plan s are employer sponsored retirement plans where money is put in regularly over time, either by you or your employer. common types of defined contribution plans where employees do most of the contributing include 401 (k)s, 403 (b)s and 457 (b)s. these can be supplemented with employer contributions as well. For most canadians, the average salary from ages 25 to 64 is $62,833. if you were part of the pension plan for 30 years with a 2% benefit percentage, your annual pension would be: $62,833 x 30 x 2% = $37,700 or $3,141 a month, before taxes. flat benefit – in this case, the formula uses a fixed monthly rate that is multiplied by the number of. Defined benefit plans are commonly known as pensions. defined contribution plans are commonly known as 401 (k)s. these plans differ according to who makes contributions to the plan, the maximum contribution amount allowed, and if you can withdraw early. most employers offer a retirement plan as a benefit to their employees. A defined benefit plan is a retirement pension scheme in which employers promise to provide their employees with a specific, pre determined income during their retirement years. this type of plan may even specify the exact dollar payout (for instance, $200 or $300 per month) after retirement.

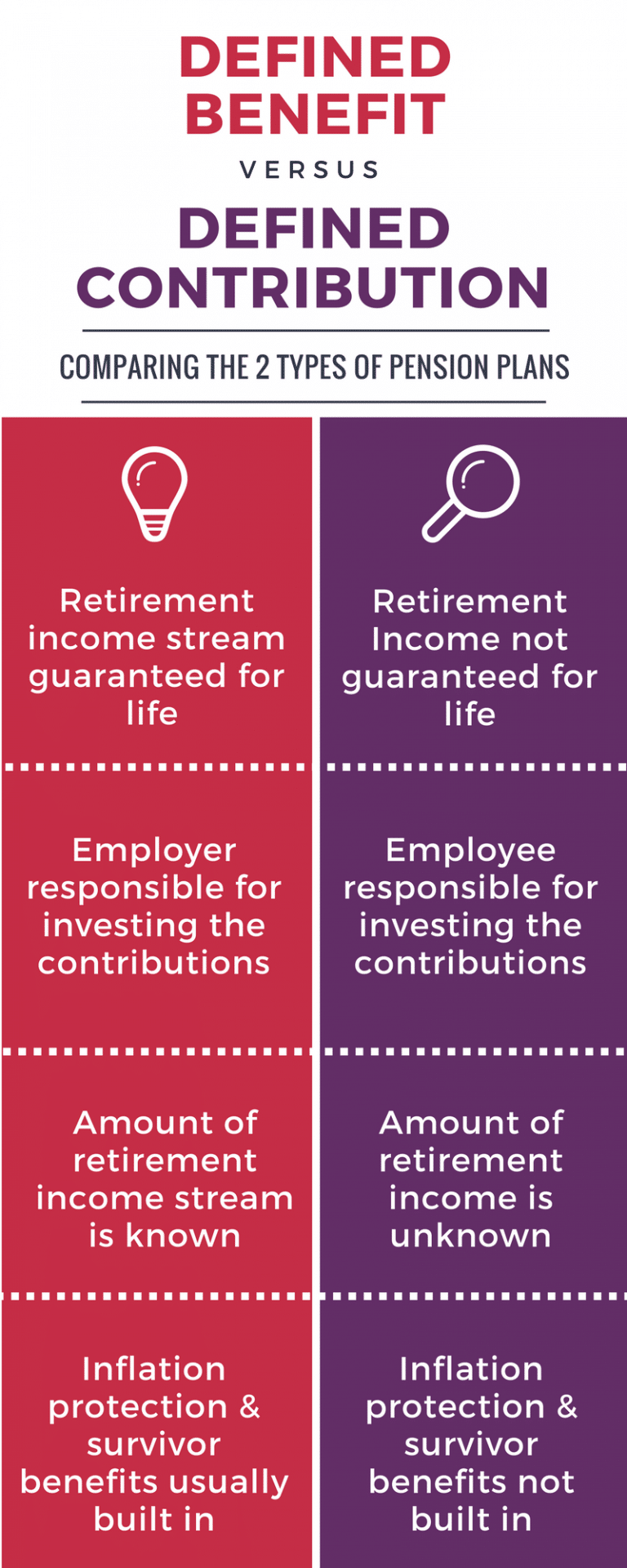

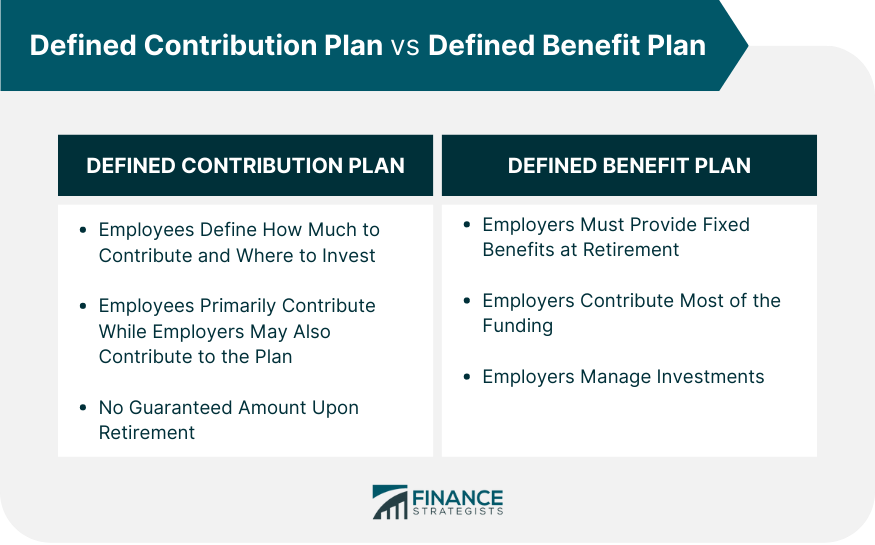

Defined Contribution Plan Meaning How It Works Pros Cons Defined benefit plans are commonly known as pensions. defined contribution plans are commonly known as 401 (k)s. these plans differ according to who makes contributions to the plan, the maximum contribution amount allowed, and if you can withdraw early. most employers offer a retirement plan as a benefit to their employees. A defined benefit plan is a retirement pension scheme in which employers promise to provide their employees with a specific, pre determined income during their retirement years. this type of plan may even specify the exact dollar payout (for instance, $200 or $300 per month) after retirement. Defined benefit plan payouts have become less popular as a private sector tool for attracting and retaining employees. 1. defined contribution plan advantages. deferred contribution plans rely on employee contributions and can include employer matching funds. the most common defined contribution plans are regular and roth iras and 401(k) plans. Defined contribution plans, such as 401 (k) and 403 (b) accounts, offer tax advantages to employees and are commonly used for retirement savings. on the other hand, defined benefit plans, commonly known as pension plans, are solely funded by the employer and do not offer the same tax benefits as defined contribution plans.

Defined Contribution Plan Vs Defined Benefit Plan What S The Defined benefit plan payouts have become less popular as a private sector tool for attracting and retaining employees. 1. defined contribution plan advantages. deferred contribution plans rely on employee contributions and can include employer matching funds. the most common defined contribution plans are regular and roth iras and 401(k) plans. Defined contribution plans, such as 401 (k) and 403 (b) accounts, offer tax advantages to employees and are commonly used for retirement savings. on the other hand, defined benefit plans, commonly known as pension plans, are solely funded by the employer and do not offer the same tax benefits as defined contribution plans.

Comments are closed.