Defined Benefit Pension Plan

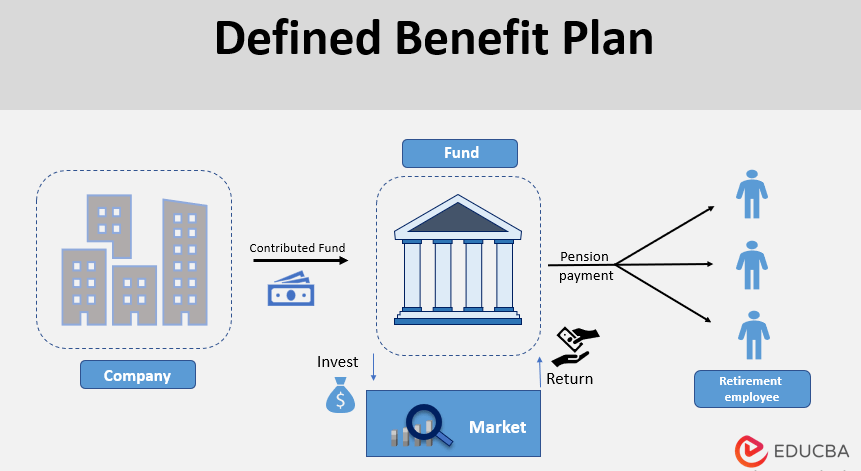

What Is A Defined Pension Plan A defined benefit plan is often referred to as a traditional pension. “a defined benefit plan is a type of pension plan that is fully funded by employer contributions and is a promise to pay. A defined benefit plan is a retirement plan where the employer guarantees a specific benefit amount based on factors such as salary and service. learn how these plans work, how they differ from 401 (k) plans, and what payout options are available.

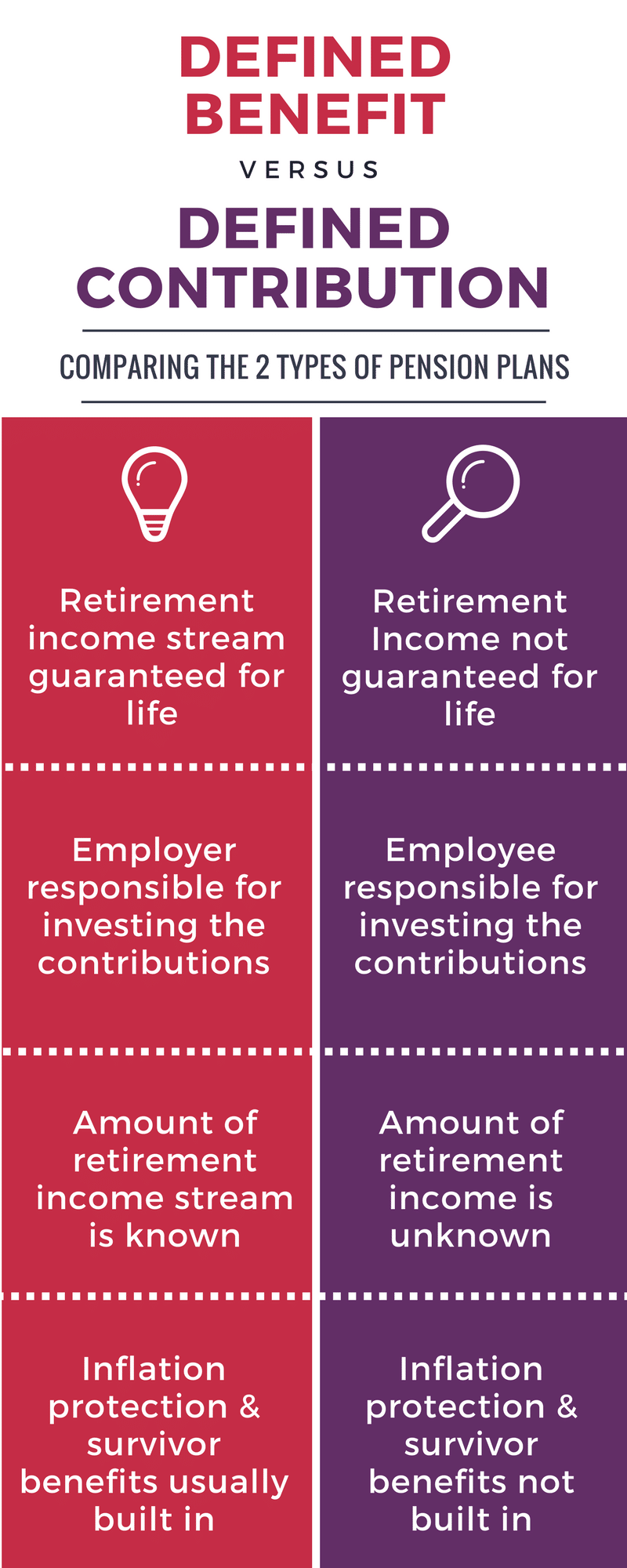

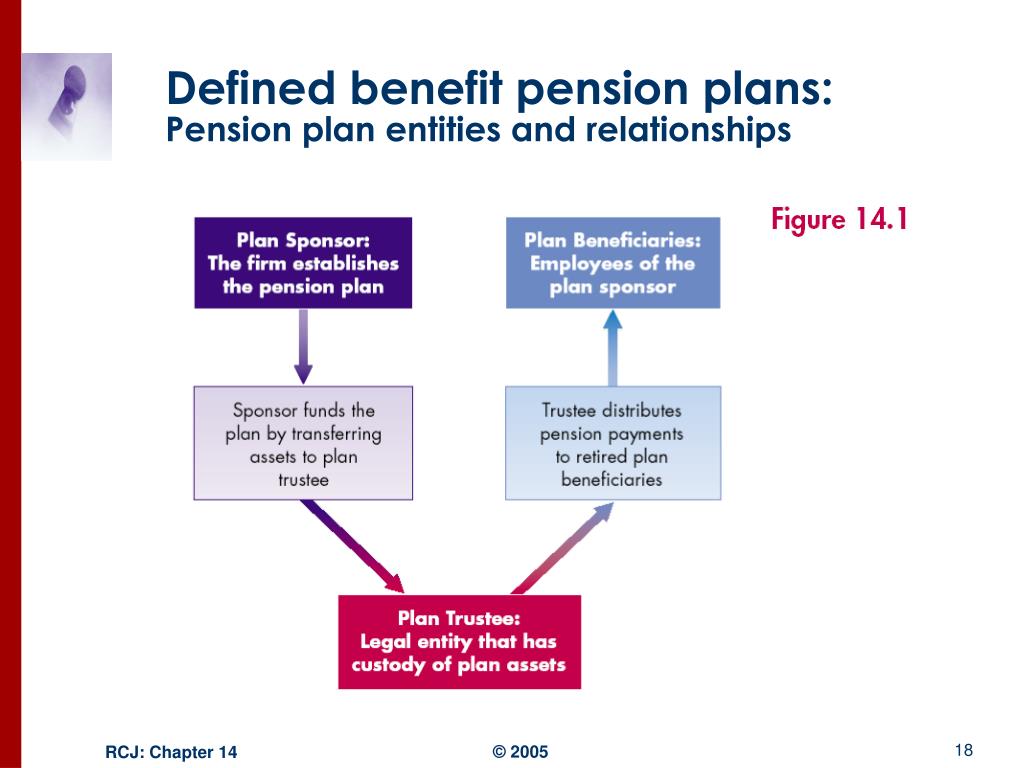

Defined Benefit Pension Plan Defined benefit plans, also known as pensions, offer guaranteed retirement benefits for employees based on a formula that considers salary, age and tenure. learn how these plans are funded, calculated, paid out and protected by federal insurance. A defined benefit plan is an employer sponsored retirement plan that guarantees a fixed payout to qualifying employees. learn about the types, rules, pros and cons of this plan, and how it differs from a defined contribution plan. Learn about the features, benefits, and requirements of a defined benefit retirement plan that provides a fixed, pre established benefit for employees at retirement. find out the pros and cons, contribution and benefit limits, filing requirements, and other resources for this type of plan. Learn the differences between defined benefit and defined contribution plans, two types of employer sponsored retirement plans. find out how they affect the employer, the employee, and the investment risks and costs.

Makersvery Blog Learn about the features, benefits, and requirements of a defined benefit retirement plan that provides a fixed, pre established benefit for employees at retirement. find out the pros and cons, contribution and benefit limits, filing requirements, and other resources for this type of plan. Learn the differences between defined benefit and defined contribution plans, two types of employer sponsored retirement plans. find out how they affect the employer, the employee, and the investment risks and costs. Learn what a defined benefit plan is, how it works, and its advantages and disadvantages. compare pension and cash balance plans, and explore payment options for retirees. A defined benefit plan is an employer provided retirement program that pays employees fixed income payments when they retire. here's how these plans work.

Defined Benefit Pension Plan Learn what a defined benefit plan is, how it works, and its advantages and disadvantages. compare pension and cash balance plans, and explore payment options for retirees. A defined benefit plan is an employer provided retirement program that pays employees fixed income payments when they retire. here's how these plans work.

Defined Benefit Pension Plan

Comments are closed.