Deductible Versus Out Of Pocket Difference Between Deductible

Deductible Vs Out Of Pocket What S The Difference 2023 Getty. a deductible is what you pay for healthcare services before your health insurance plan begins paying for care. the out of pocket maximum is the most you can pay for in network care during a. Updated oct 18, 2024. a deductible is the amount you'll have to pay for medical care at the beginning of your insurance policy. the out of pocket max is the most you'll pay for medical expenses in a year. for each policy year, you'll pay the full cost of most medical care until your total spending reaches the deductible amount.

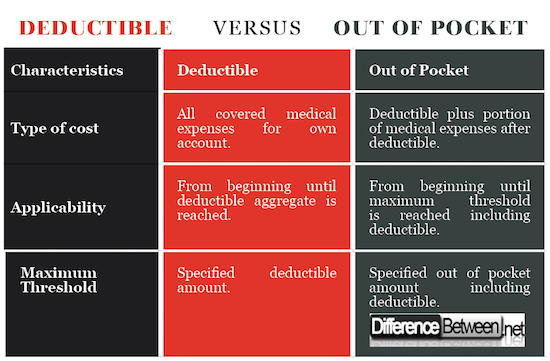

Health Insurance Deductible Vs Out Of Pocket Maximum India Dictionary There are different out of pocket maximums for individuals and family plans that have two or more members. in 2016, your out of pocket maximum can be no more than: $6,850 for an individual plan. A deductible is what you pay for healthcare before your insurance kicks in. your out of pocket maximum is the most you will pay during the year. a higher premium often comes with a lower deductible and out of pocket max. health insurance terms can often be confusing. you might be among the many looking for clarity on the difference between. See the out of pocket vs. deductible infographic below for an overview of some of the ways in which deductibles and out of pocket maximums are similar and what the major differences between them are. Key takeaways. you must hit your deductible limit before your insurer begins sharing the cost of your health expenses. on average, a silver marketplace plan has a deductible of $4,236. your out of pocket max is the most you’ll spend on health care each year. typically, marketplace plans have an average moop limit of $7,954.

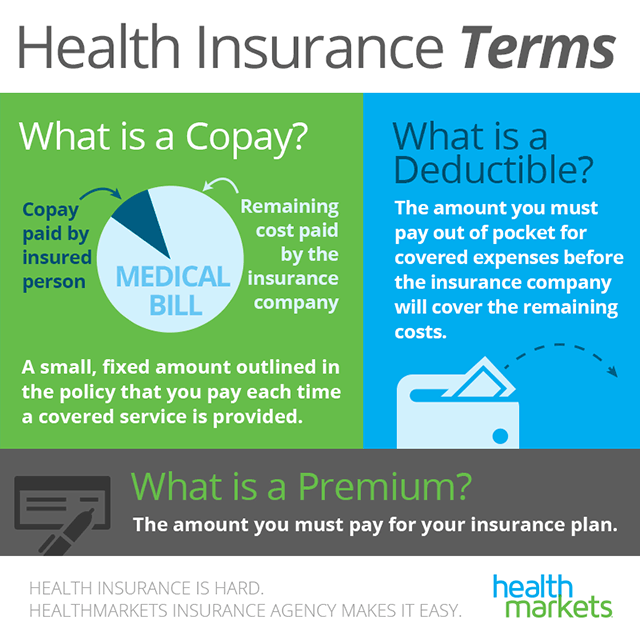

Difference Between Deductible And Out Of Pocket Difference Between See the out of pocket vs. deductible infographic below for an overview of some of the ways in which deductibles and out of pocket maximums are similar and what the major differences between them are. Key takeaways. you must hit your deductible limit before your insurer begins sharing the cost of your health expenses. on average, a silver marketplace plan has a deductible of $4,236. your out of pocket max is the most you’ll spend on health care each year. typically, marketplace plans have an average moop limit of $7,954. The policy holder pays 20 percent for that visit, or $20, while the insurance policy covers the remaining 80 percent, or $80. it’s important to know that a number of out of pocket costs don’t apply to the deductible. take brandon as an example again. brandon pays a monthly $250 premium for his plan. that amount doesn’t apply to his $1,000. Coinsurance. a fixed percentage you pay for medical expenses after the deductible is met. for example, if your coinsurance is 80 20, it means that your insurance pays 80% and you pay 20% of the bill after you’ve met your annual deductible. in september, you break your arm. total bill for emergency room visit, doctors, x ray, and cast = $2,500.

Comments are closed.