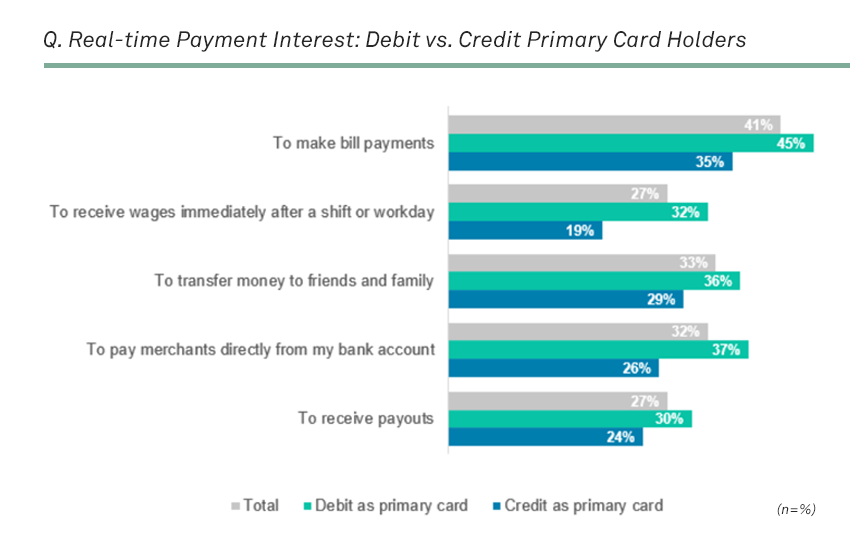

Debit Cardholders Exhibit Strongest Appetite For Real Time Payments

Debit Cardholders Exhibit Strongest Appetite For Real Time Payments U.s. consumers that prefer debit as their primary payment card show the strongest appetite for real time payments, suggesting that this type of payment could threaten debit volume and, subsequentially, banks’ debit interchange revenue. ignoring the trend is not an option, as many consumers have indicated they will simply open new accounts. Real time payments are those made between banks or other financial institutions that are initiated, cleared, and settled almost immediately at any time of the day or night, seven days a week, 365 days a year. this contrasts with checks, which often take several days to clear through the banking process, or cash which, although immediate, is not.

Debit Cardholders Exhibit Strongest Appetite For Real Time Payments Our data shows that 64% of consumers say that they have at least one debit card that is contactless. shoppers are increasingly tapping to pay with debit cards and mobile phones, especially for everyday purchases.” more forward looking statements by tavilla reveal that as more financial institutions adopt real time payments, funds will move a. Do real time payments cost more for businesses and consumers to use? no. real time payments cost about the same as non instant electronic payments overall, at about $1.95 for 10 transactions per capita, according to a 2019 report. this is significantly less than checks, at $2.79 per 10 transactions. Real time payments same day ach wire debit card check cash retail manufacturing insurance real time payments, with large retailers most likely to say so, at 69% . 68 .8% 46 .0%. The instant or real time payments market is a promising innovation to the financial sector. with prudent risk management from the many stakeholders involved in the payments, clearing, and settlement processes, it has the potential to greatly benefit the economy and consumers. 1 s.n. jha. global real time payments market outlook (2022 2032).

Real Time Payments Gain A Competitive Edge Fifth Third Bank Real time payments same day ach wire debit card check cash retail manufacturing insurance real time payments, with large retailers most likely to say so, at 69% . 68 .8% 46 .0%. The instant or real time payments market is a promising innovation to the financial sector. with prudent risk management from the many stakeholders involved in the payments, clearing, and settlement processes, it has the potential to greatly benefit the economy and consumers. 1 s.n. jha. global real time payments market outlook (2022 2032). Real time payments are here, and banks, consumers and commercial customers all can benefit from transactions settling instantly. the clearing house real time payment network (rtp) started processing in 2017, and the federal reserve’s fednow service is expected to go live in 2023. rtp uses a shared pre funded joint account to settle. Real time payments are a powerful payment option to add to your toolbox. rtp complements, rather than replaces, ach and wires. popular use cases for rtp: b2c —refund your customers immediately, allowing them to validate receipt during your conversation. b2b —pay your suppliers faster, improving relationships and reducing time spent on.

What S The Big Deal With Real Time Payments Real time payments are here, and banks, consumers and commercial customers all can benefit from transactions settling instantly. the clearing house real time payment network (rtp) started processing in 2017, and the federal reserve’s fednow service is expected to go live in 2023. rtp uses a shared pre funded joint account to settle. Real time payments are a powerful payment option to add to your toolbox. rtp complements, rather than replaces, ach and wires. popular use cases for rtp: b2c —refund your customers immediately, allowing them to validate receipt during your conversation. b2b —pay your suppliers faster, improving relationships and reducing time spent on.

The Technology And Benefits Of Real Time Payments Thunes

Comments are closed.