Credit Scores And Reports 101 Credit Card And Loan Basics 2 3

Credit Reports And Credit Scores 101 Payactiv In this video, you'll learn everything you need to know about your credit score and report, including what it is and how to improve it. Base scores: 300 to 850. industry specific scores: 250 to 900. 300 to 850. recent scoring models. fico ® score 8, 9, 10 and 10 t. vantagescore 3, 4 and 4plus™. minimum scoring requirements. a credit account that's at least six months old, and. activity on a credit account during the previous six months, and.

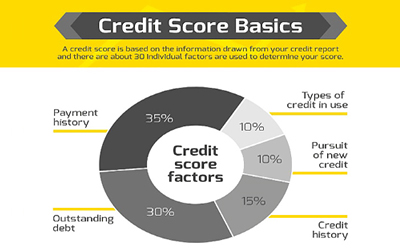

Credit Report And Credit Score Basics Fair: 601 to 660. good: 661 to 780. excellent: 781 to 850. if your lender is pulling your score from experian, they will see your fico credit score. you would need to score between 670 and 739 to. Lenders and creditors often use credit scores to help determine the likelihood that someone will pay back what they owe on loans, credit cards and mortgages. higher credit scores generally result in more favorable loan terms and lower interest rates. understanding the facts about what will and won’t help credit scores is a good first step. There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of. A score of 690 to 719 is considered good credit. scores of 630 to 689 are fair credit. and scores of 629 or below are bad credit. in addition to your credit score, factors like your income and.

Credit Score Basics Explained Credit 101 Youtube There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of. A score of 690 to 719 is considered good credit. scores of 630 to 689 are fair credit. and scores of 629 or below are bad credit. in addition to your credit score, factors like your income and. When you get a credit score from experian, you get more than just the number. you’ll also get a list of the risk factors — often both positive and negative — affecting the score. because of the information it includes, a credit score report can be an excellent tool to help you improve your creditworthiness and, therefore, all credit scores. The national average fico credit score was 717 as of october 2023. vantagescore 3.0 and 4.0 also use the same 300 to 850 range as fico, but scores are categorized a bit differently: excellent is.

Credit Scores 101 The Penny Hoarder Academy When you get a credit score from experian, you get more than just the number. you’ll also get a list of the risk factors — often both positive and negative — affecting the score. because of the information it includes, a credit score report can be an excellent tool to help you improve your creditworthiness and, therefore, all credit scores. The national average fico credit score was 717 as of october 2023. vantagescore 3.0 and 4.0 also use the same 300 to 850 range as fico, but scores are categorized a bit differently: excellent is.

Comments are closed.