Credit Lock Vs Credit Freeze Differences And Uses Explained Self

Credit Lock Vs Credit Freeze Differences And Uses Explained Self Pros and cons of credit freezes. credit freezes offer many of the same benefits you get with a credit lock, but there are some key differences. pros: cost: a credit freeze is free under federal law. credit score: like a credit lock, a freeze will have no impact on your credit score. recourse: a freeze offers legal protections you may not get. The main difference between a credit lock and a credit freeze is that credit locks can carry a monthly fee, while credit freeze options are free. another difference is that unlocking your credit.

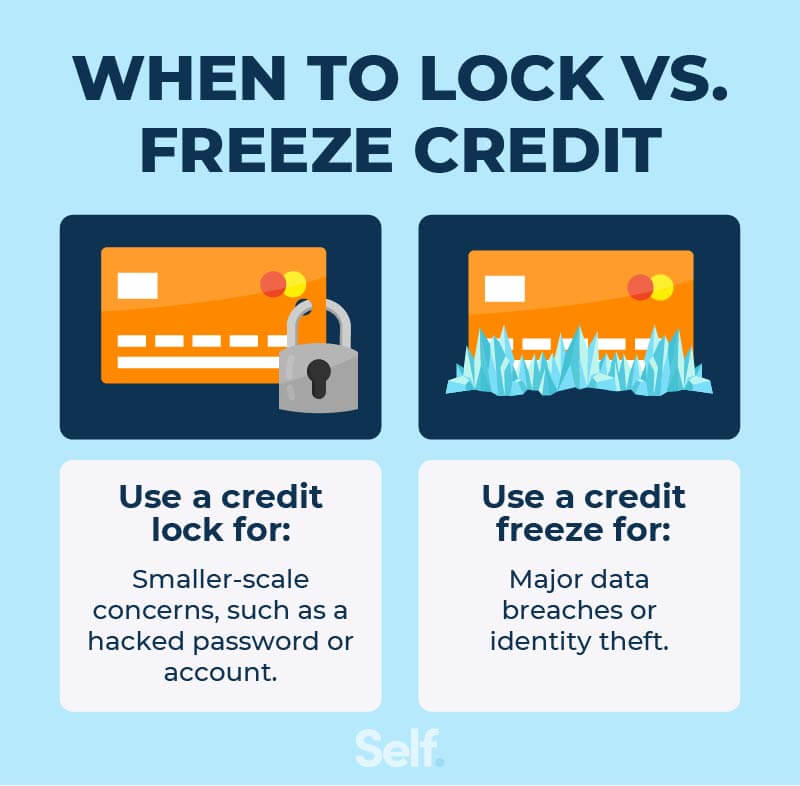

Credit Lock Vs Credit Freeze Differences And Uses Explained Self A security freeze (also known as a credit freeze) and a credit lock both achieve the same main goal: preventing the use of your credit report for processing a loan or credit application. both are security measures that can be helpful if criminals impersonating you attempt to borrow money in your name. credit freezes and credit locks are offered. 08 14 2024. blog. summary: credit freezes and credit locks function similarly, but there are some differences. both a credit freeze and a credit lock can help prevent unauthorized access to your credit reports. credit freezes are always free, but credit locks may be a part of a paid service offered by a credit monitoring service. Key considerations. both credit locks and credit freezes prevent fraudulent accounts by restricting access to your credit report. credit locks are often paid services, while credit freezes are free and subject to specific federal laws. other tools for protecting your credit report include credit monitoring and fraud alerts. While credit lock vs. freeze might sound different, they function similarly: a credit freeze is a free service that stops new accounts from being opened, while a credit lock is a service from the credit bureaus that lets you lock and unlock your credit faster than a freeze. both options can help when you’re worried that someone has stolen.

Credit Lock Vs Credit Freeze Differences And Uses Explained Self Key considerations. both credit locks and credit freezes prevent fraudulent accounts by restricting access to your credit report. credit locks are often paid services, while credit freezes are free and subject to specific federal laws. other tools for protecting your credit report include credit monitoring and fraud alerts. While credit lock vs. freeze might sound different, they function similarly: a credit freeze is a free service that stops new accounts from being opened, while a credit lock is a service from the credit bureaus that lets you lock and unlock your credit faster than a freeze. both options can help when you’re worried that someone has stolen. Yes. no. both credit freezes and credit locks prevent companies from running a hard inquiry on your credit to approve you for a new account. the freeze or lock makes it impossible for criminals to. To sum it up, credit freezes provide strong security with clear legal protections and may take longer to take effect, but are free. credit locks can be more user friendly, but may not offer the same level of protection and some have a monthly fee. here’s a side by side comparison.

Credit Freeze Vs Credit Lock Differences Explained Lexington Law Yes. no. both credit freezes and credit locks prevent companies from running a hard inquiry on your credit to approve you for a new account. the freeze or lock makes it impossible for criminals to. To sum it up, credit freezes provide strong security with clear legal protections and may take longer to take effect, but are free. credit locks can be more user friendly, but may not offer the same level of protection and some have a monthly fee. here’s a side by side comparison.

Credit Lock Vs Credit Freeze Differences And Uses Explained Self

Comments are closed.