Credit Counseling Professional Guidance For Debt Management Financialeducation Moneymatters

Credit Counseling Professional Guidance For Debt Management A critical part of the debt counseling process is learning how to manage money and avoid future debt problems. your debt counseling session will include guidance on creating a budget that aligns with your monthly expenses. the credit counselor will also help you develop skills for money management and improving your credit score. what to expect:. What is credit counseling? english. español. credit counseling organizations can advise you on your money and debts, help you with a budget, develop debt management plans, and offer money management workshops. working with a credit counselor can be a great way of getting free or low cost financial advice from a trusted professional.

The Role Of Credit Counseling In Debt Management Credit counseling, also called debt counseling, is a process that helps people manage their finances and solve problems with debt. credit counselors (people like me!) work with people to: manage money and debt. create a budget or spending plan. understand credit scores. learn about options, tools and educational resources for getting out of debt. The uniform debt management services act (udmsa) requires certification for those who provide education and assistance to individuals in connection with debt management services. the executive office of the u.s department of justice also requires that counselors providing the mandated pre bankruptcy filing credit counseling be certified. Debt counseling also includes a comprehensive budget analysis but with more of a focus on debt resolution and management. credit and debt counseling are free. don’t wait to talk with a counselor. call us at 1 (800) 431 8157. monday friday 6:00 am – 6:00 pm pacific. American consumer credit counseling is a nonprofit credit counseling agency that helps consumers take control of their financial lives through credit counseling, debt consolidation, and financial education. since 1991, we have been improving lives and providing solutions to people in need of financial help. 2. initial consultation.

How Credit Counseling And Debt Management Plans Really Work Youtube Debt counseling also includes a comprehensive budget analysis but with more of a focus on debt resolution and management. credit and debt counseling are free. don’t wait to talk with a counselor. call us at 1 (800) 431 8157. monday friday 6:00 am – 6:00 pm pacific. American consumer credit counseling is a nonprofit credit counseling agency that helps consumers take control of their financial lives through credit counseling, debt consolidation, and financial education. since 1991, we have been improving lives and providing solutions to people in need of financial help. 2. initial consultation. Consumer credit counseling foundation (cccf) offers personalized credit counseling, debt management solutions, and financial education programs to help individuals and families achieve financial stability and freedom. our certified credit counselors provide expert guidance and support, creating tailored action plans for debt management, budgeting, and credit score improvement. with a. Debt counseling is a practical and effective way to regain control of your financial situation, manage credit issues, and improve your overall financial health. with the help of a credit counseling organization, you can enroll in a debt management program, reduce your monthly payments, and avoid the pitfalls of bankruptcy.

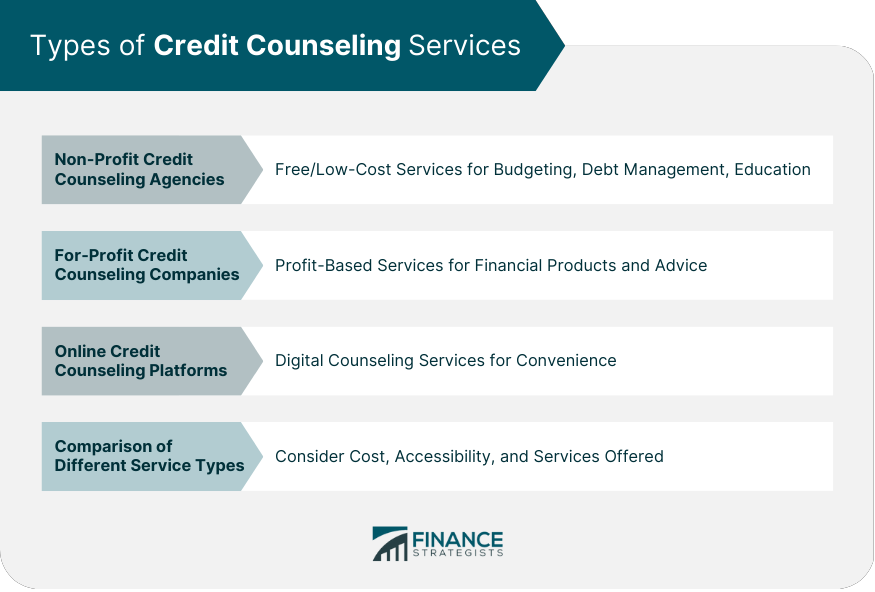

Credit Counseling Meaning Types Process Agency Selection Consumer credit counseling foundation (cccf) offers personalized credit counseling, debt management solutions, and financial education programs to help individuals and families achieve financial stability and freedom. our certified credit counselors provide expert guidance and support, creating tailored action plans for debt management, budgeting, and credit score improvement. with a. Debt counseling is a practical and effective way to regain control of your financial situation, manage credit issues, and improve your overall financial health. with the help of a credit counseling organization, you can enroll in a debt management program, reduce your monthly payments, and avoid the pitfalls of bankruptcy.

Credit Counseling And Debt Management Plan Debt Consolidation Made

Comments are closed.