Contribution Limit Cost Sharing Limits Hdhp Hdhp Limit Hsa Hsa

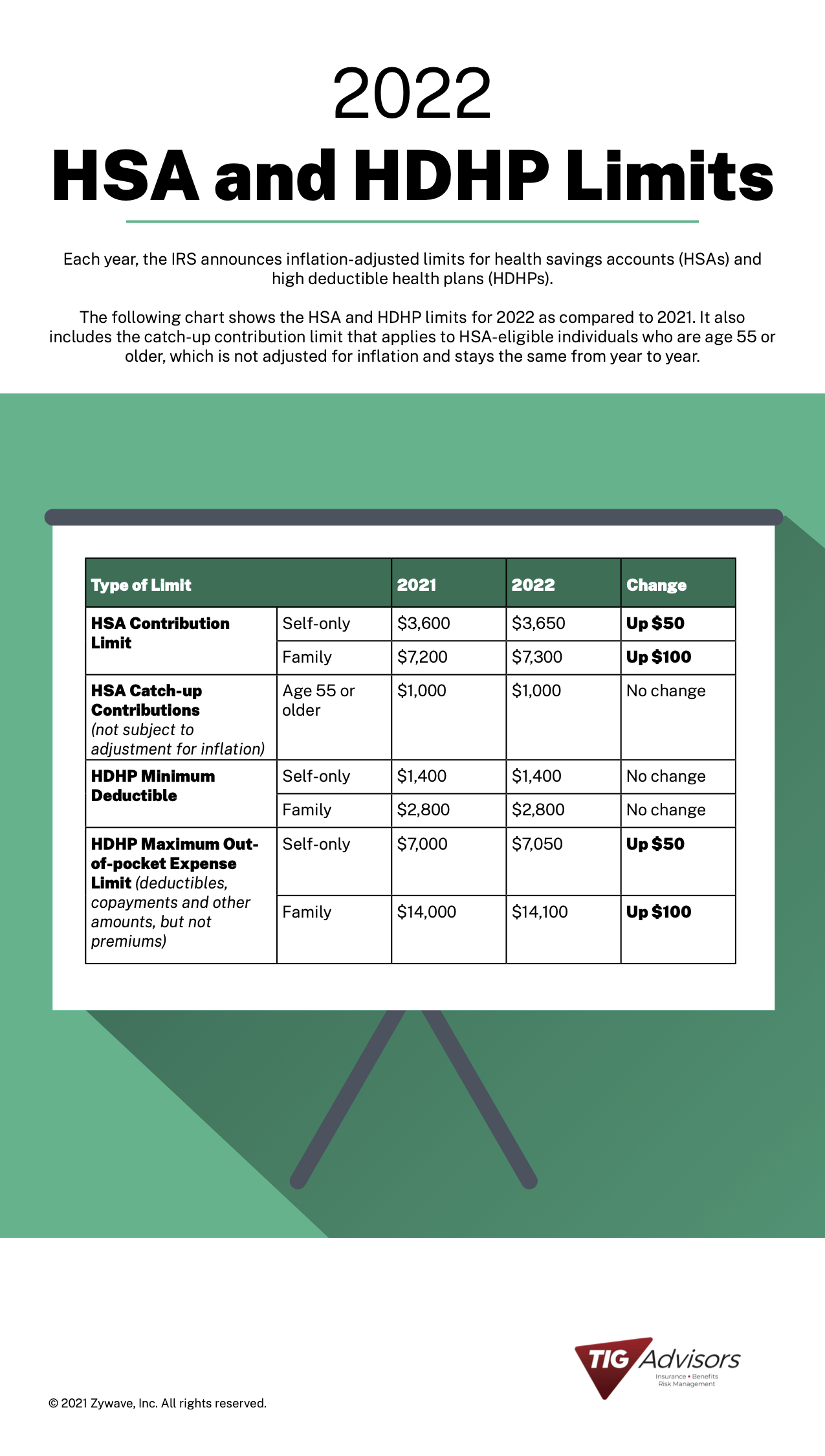

How Do Your 2022 Hsa Hdhp Limits Compare To 2021 S Tig Advisors The irs sets the maximum contribution limits. the maximum annual contribution limit for hdhps in the fehb program are $3,600 for self only coverage and $7,200 for self plus one or self and family coverage. if your hdhp is effective on january 1st, the total amount you can contribute to your account is the maximum contribution amount set by the irs. The limitation shown on the line 3 limitation chart and worksheet in the instructions for form 8889, health savings accounts (hsas); or. the maximum annual hsa contribution based on your hdhp coverage (self only or family) on the first day of the last month of your tax year.

2020 Hsa Hdhp Contribution Limits Bhgp S Hsa contribution limits. the 2025 annual hsa contribution limit is $4,300 for individuals with self only hdhp coverage (up from $4,150 in 2024), and $8,550 for individuals with family hdhp coverage (up from $8,300 in 2024). hdhp minimum deductibles. Ebia comment: because the increases to the hdhp out of pocket maximums are larger than the increases to the hsa contribution limits, some individuals may have to pay more out of pocket expenses without the benefit of the hsa tax break. the catch up contribution limit (for hsa eligible individuals aged 55 or older) is set forth in code § 223(b. The hsa contribution limits for 2025 are $4,300 for self only coverage and $8,550 for family coverage. those 55 and older can contribute an additional $1,000 as a catch up contribution. hsa eligibility. to contribute to an hsa, you must be enrolled in an hsa eligible health plan. for 2024, this means: it has an annual deductible of at least. The annual limit on hsa contributions for self only coverage in 2025 will be $4,300, a 3.6 percent increase from the $4,150 limit in 2024, the irs announced may 9. for family coverage, the hsa.

Contribution Limit Cost Sharing Limits Hdhp Hdhp Limit Hsa Hsa The hsa contribution limits for 2025 are $4,300 for self only coverage and $8,550 for family coverage. those 55 and older can contribute an additional $1,000 as a catch up contribution. hsa eligibility. to contribute to an hsa, you must be enrolled in an hsa eligible health plan. for 2024, this means: it has an annual deductible of at least. The annual limit on hsa contributions for self only coverage in 2025 will be $4,300, a 3.6 percent increase from the $4,150 limit in 2024, the irs announced may 9. for family coverage, the hsa. Hsa annual contribution limit. self only plan: $4,300, up from $4,150 in 2024; family plan: $8,550, up from $8,300 in 2024; catch up contribution (for those aged 55 and older): $1,000 (unchanged) hdhp minimum annual deductible. individual plan: $1,650, up from $1,600 in 2024; family plan: $3,300, up from $3,200 in 2024 . hdhp annual out of. These updates are crucial for individuals and employers to understand as they impact contribution limits and cost sharing measures for healthcare plans. key changes for 2025 the irs, in revenue procedure 2024 25, released new limits which include the maximum hsa contribution limit, the minimum deductible amount for hdhps, and the maximum out of.

Irs Announces Hsa Limits For 2019 Sima Financial Group Hsa annual contribution limit. self only plan: $4,300, up from $4,150 in 2024; family plan: $8,550, up from $8,300 in 2024; catch up contribution (for those aged 55 and older): $1,000 (unchanged) hdhp minimum annual deductible. individual plan: $1,650, up from $1,600 in 2024; family plan: $3,300, up from $3,200 in 2024 . hdhp annual out of. These updates are crucial for individuals and employers to understand as they impact contribution limits and cost sharing measures for healthcare plans. key changes for 2025 the irs, in revenue procedure 2024 25, released new limits which include the maximum hsa contribution limit, the minimum deductible amount for hdhps, and the maximum out of.

Irs Announces 2023 Hsa Limits Blog Medcom Benefits

Irs Announces 2023 Hsa Contribution Limits

Comments are closed.