Consumer Spending During Covid

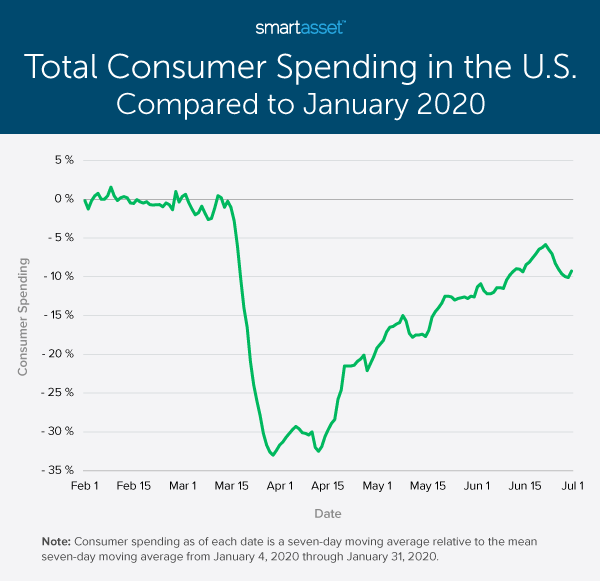

Consumer Spending During Covid 19 2020 Study Smartasset After the covid 19 pandemic began, consumer spending in the second quarter of 2020 was down 9.8 percent from the same period in 2019. one year later, in the second quarter of 2021, the pandemic was still affecting the economy, but businesses and consumers had begun to adapt. Fear of covid 19, social distancing measures, and outright closures enforced locally at various times in 2020 resulted in a tangible shift in the amount and nature of consumer spending. real personal consumption expenditure (pce) 5 fell in 2020 as options for spending declined and the economic impact of the pandemic cut into people’s wallets.

How Consumers Are Spending Differently During Covid 19 Double digit declines. 25%. cosmetics. makeup sales have taken a hit this year as staying in and working from home became the new normal. globally, l’oréal said the beauty market had fallen 13 14% in the first half of the year, with luxury beauty, professional beauty, makeup and fragrance sales all falling around 25%. The onset of the coronavirus disease 2019 (covid 19) pandemic led to considerable changes in consumer spending behavior in the united states. using data from the household pulse survey, this article examines the extent of pandemic related behavioral changes reported in august 2020. Consumer expenditures in 2021. the year 2020 was marked by the onset of the covid 19 pandemic and an associated decline in consumer spending. as covid 19 restrictions were repealed and the economy began to open, one would expect 2021 to have been welcomed as the beginning of a strong recovery to pre pandemic levels for expenditures on entertainment, travel, food, apparel, gasoline, healthcare. Spending on home improvement and maintenance is still growing: it’s 11 percent higher than pre covid 19 projections even after adjusting for inflation. given the overall shift in the way people have used their homes during the pandemic as well as many people’s expectations of continuing to work from home at least one day a week, companies.

Consumer Spending Trends After Covid 19 Deloitte Insights Consumer expenditures in 2021. the year 2020 was marked by the onset of the covid 19 pandemic and an associated decline in consumer spending. as covid 19 restrictions were repealed and the economy began to open, one would expect 2021 to have been welcomed as the beginning of a strong recovery to pre pandemic levels for expenditures on entertainment, travel, food, apparel, gasoline, healthcare. Spending on home improvement and maintenance is still growing: it’s 11 percent higher than pre covid 19 projections even after adjusting for inflation. given the overall shift in the way people have used their homes during the pandemic as well as many people’s expectations of continuing to work from home at least one day a week, companies. Conclusion. the onset of the covid 19 pandemic changed consumer spending habits. people substituted meals purchased at restaurants with meals cooked at home. as the economy entered a recession, the demand for both types of goods and services decreased. also, people traveled less and the demand for hotel services decreased. Overall optimism and spend remained strong with 44 percent of us consumers feeling optimistic and spend increasing 11 percent year on year. high income consumers are the most optimistic (61 percent) but all income groups contribute to the spend growth. similarly, all generations are contributing to the growth even though millennials are most.

Consumer Spending Trends After Covid 19 Deloitte Insights Conclusion. the onset of the covid 19 pandemic changed consumer spending habits. people substituted meals purchased at restaurants with meals cooked at home. as the economy entered a recession, the demand for both types of goods and services decreased. also, people traveled less and the demand for hotel services decreased. Overall optimism and spend remained strong with 44 percent of us consumers feeling optimistic and spend increasing 11 percent year on year. high income consumers are the most optimistic (61 percent) but all income groups contribute to the spend growth. similarly, all generations are contributing to the growth even though millennials are most.

Consumer Spending Trends After Covid 19 Deloitte Insights

Comments are closed.