Consumer Reporting Agency Data

Consumer Reporting Agency Data Your consumer report. outside of employment screening, adverse action notifications are provided after the fact, say, when maybe it’s too late and you have already been . rejected for a loan, residential rental property or auto lease. the accuracy and completeness of your consumer reporting data, therefore, is extremely important. You are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companies—equifax, transunion, and experian. you can request a copy through annualcreditreport . as a result of a 2019 settlement, all u.s. consumers may also request up to six free copies of their equifax credit report.

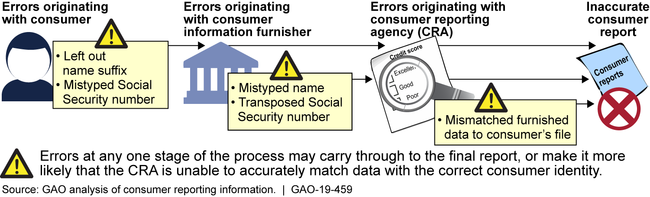

Consumer Reporting Agencies Cfpb Should Define Its Supervisory Below is a list of consumer reporting companies updated for 2022.1 consumer reporting companies collect information and provide reports to other companies about you. these companies use these reports to inform decisions about providing you with credit, employment, residential rental housing, insurance, and in other decision making situations. This includes credit reports through the three nationwide consumer reporting companies – equifax, transunion, and experian – as well as a number of other companies that collect your information and provide specialized consumer reports. as a result of the covid 19 pandemic, it’s now more important than ever to ensure the information in. With the exception of employment screening reports, you can be rejected without warning based on the information in your consumer report. when you know a consumer report is going to be used in a decision about you, check your consumer reporting information ahead of time. useful identity verification information about how consumer reporting. The big three—experian, transunion and equifax—collect and organize data to create consumer credit reports. the bureaus don't make lending decisions or determine your credit scores. however, when you apply for a loan or line of credit, the creditor will often purchase a credit report and a score based on the report from a credit bureau.

Patent Us8117101 Database Structure For A Consumer Reporting Agency With the exception of employment screening reports, you can be rejected without warning based on the information in your consumer report. when you know a consumer report is going to be used in a decision about you, check your consumer reporting information ahead of time. useful identity verification information about how consumer reporting. The big three—experian, transunion and equifax—collect and organize data to create consumer credit reports. the bureaus don't make lending decisions or determine your credit scores. however, when you apply for a loan or line of credit, the creditor will often purchase a credit report and a score based on the report from a credit bureau. Bureau of consumer protection. the ftc’s bureau of consumer protection stops unfair, deceptive and fraudulent business practices by collecting reports from consumers and conducting investigations, suing companies and people that break the law, developing rules to maintain a fair marketplace, and educating consumers and businesses about their. Credit agencies can receive a wide range of information and data included in a credit report. experian, equifax, and transunion are the three largest credit reporting providers in the united states.

Exhibit 2 Components Of Consumer Reporting Systems Agency For Bureau of consumer protection. the ftc’s bureau of consumer protection stops unfair, deceptive and fraudulent business practices by collecting reports from consumers and conducting investigations, suing companies and people that break the law, developing rules to maintain a fair marketplace, and educating consumers and businesses about their. Credit agencies can receive a wide range of information and data included in a credit report. experian, equifax, and transunion are the three largest credit reporting providers in the united states.

Nationwide Specialty Consumer Reporting Agencies Doctor Of Credit

Comments are closed.