Consumer Reporting Agencies Cfpb Should Define Its Supervisory

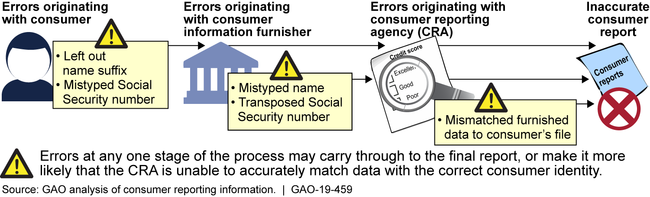

Consumer Reporting Agencies Cfpb Should Define Its Supervisory Cfpb described actions it has taken to provide information to cras. gao maintains that communicating expectations in these two areas is beneficial, as discussed in the report. view gao 19 459. for more information, contact anna maria ortiz at (202) 512 8678 or. [email protected]. Cfpb should communicate to cras its expectations regarding (1) reasonable procedures for assuring maximum possible accuracy and (2) reasonable investigations of consumer disputes. cfpb described actions it has taken to provide information to cras. gao maintains that communicating expectations in these two areas is beneficial, as discussed in.

Cfpb Issues Updated Disclosures Employers Consumer Reporting Agencies On january 3, 2019, the good accounting obligation in government act (gao ig act or act) was enacted as public law number 115 414. this report is published by the consumer financial protection bureau (bureau or cfpb) in compliance with that law.1. the gao ig act requires agencies to annually submit a report to congress on the status of certain. The findings in this report cover select examinations in connection with credit reporting and furnishing that were completed from april 1, 2023, through december 31, 2023. to maintain the anonymity of the supervised institutions discussed in supervisory highlights, references to institutions generally are in the plural and related findings may. The bureau of consumer financial protection (bureau) is issuing this compliance bulletin and policy guidance (bulletin) on supervision and enforcement priorities regarding housing insecurity in light of heightened risks to consumers needing loss mitigation assistance in the coming months as the covid 19 foreclosure moratoriums and forbearances. Agency affected recommendation status; consumer financial protection bureau : the director of the consumer financial protection bureau should jointly establish or adapt an existing formal coordination mechanism with cftc, fdic, the federal reserve, ncua, occ, and sec for collectively identifying risks posed by blockchain related products and services and formulating a timely regulatory response.

Cfpb S Spring Edition Of Its Supervisory Highlights Focuses On Consumer The bureau of consumer financial protection (bureau) is issuing this compliance bulletin and policy guidance (bulletin) on supervision and enforcement priorities regarding housing insecurity in light of heightened risks to consumers needing loss mitigation assistance in the coming months as the covid 19 foreclosure moratoriums and forbearances. Agency affected recommendation status; consumer financial protection bureau : the director of the consumer financial protection bureau should jointly establish or adapt an existing formal coordination mechanism with cftc, fdic, the federal reserve, ncua, occ, and sec for collectively identifying risks posed by blockchain related products and services and formulating a timely regulatory response. The cfpb has released the spring 2024 edition of supervisory highlights. the report discusses cfpb examinations in connection with credit reporting and furnishing that were completed from april 1, 2023 through december 31, 2023. key findings by cfpb examiners are described below. It also sets forth recent supervisory program and enforcement developments concerning furnishers and consumer reporting agencies (cras). the supervisory highlights’ focus on consumer reporting issues is unsurprising in light of the cfpb’s recently published consumer response annual report, which reflects that consumer reporting, including.

Comments are closed.