Consumer Finance Gov Mortgage Estimate

Free 7 Sample Loan Estimate Forms In Pdf Ms Word 3. check to see if your interest rate is locked. some lenders may lock your rate as part of issuing the loan estimate, but some may not. check at the top of page 1 on your loan estimate to see whether your rate is locked, and until when. if your rate is not locked, it can change at any time. if your interest rate is locked, your rate won’t. A loan estimate tells you important details about a mortgage loan you have requested. use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. if something looks different from what you expected, ask why. request multiple loan estimates from different lenders so you can compare and choose the loan.

Good Faith Estimate Template A loan estimate is a three page form that you receive after applying for a mortgage. the loan estimate tells you important details about the loan you have requested. the lender must provide you a loan estimate within three business days of receiving your application. the form provides you with important information, including the estimated. Share this. we're the consumer financial protection bureau (cfpb), a u.s. government agency that makes sure banks, lenders, and other financial companies treat you fairly. learn how the cfpb can help you. sign up for the latest financial tips and information right to your inbox. hear one homebuyer’s story about how the cfpb’s tools helped her. Section 1: choosing a mortgage 6 monthly estimate (continued) mortgage insurance mortgage insurance is often required for loans with less than a 20% down payment. $ property taxes the local assessor or auditor’s office can help you estimate property taxes for your area. if you know the yearly amount, divide by 12 and write in the monthly. First, estimate your total monthly home payment. second, look at the percentage of your income that will go toward your monthly home payment. third, look at how much money you will have available to spend on the rest of your monthly expenses. step 1. estimate your total monthly home payment by adding up the items below.

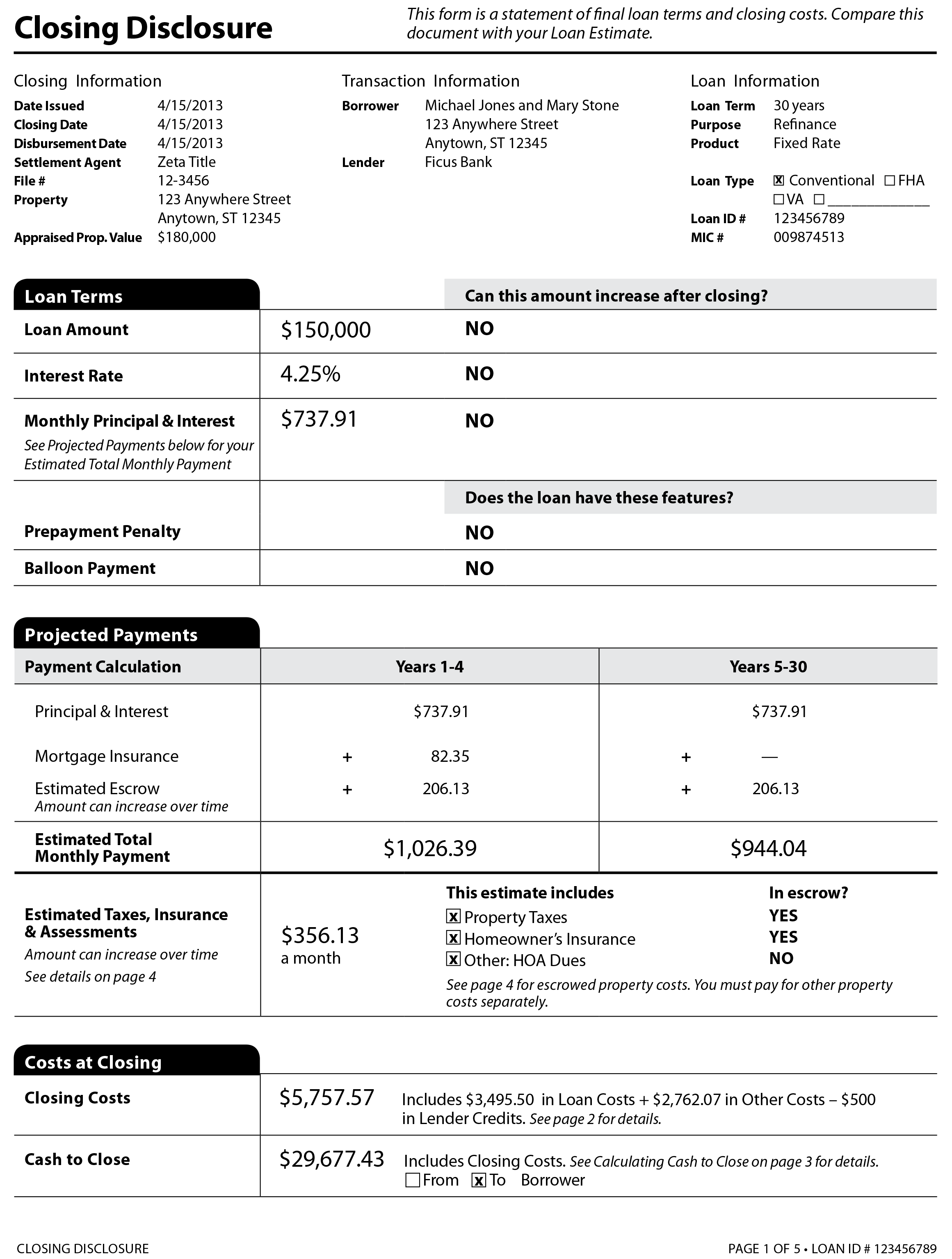

Understanding Loan Estimates And Closing Costs Course Hero Section 1: choosing a mortgage 6 monthly estimate (continued) mortgage insurance mortgage insurance is often required for loans with less than a 20% down payment. $ property taxes the local assessor or auditor’s office can help you estimate property taxes for your area. if you know the yearly amount, divide by 12 and write in the monthly. First, estimate your total monthly home payment. second, look at the percentage of your income that will go toward your monthly home payment. third, look at how much money you will have available to spend on the rest of your monthly expenses. step 1. estimate your total monthly home payment by adding up the items below. Choosing a loan offer. review your loan estimates. the loan estimate form gives you important information about the loan a lender is offering you. you can use the loan estimate to compare offers and choose the right loan for you. review your loan estimates to make sure the details accurately reflect the loan you asked for. Estimated taxes, insurance & assessments amount can increase over time before closing, your interest rate, points, and lender credits can change unless you lock the interest rate. all other estimated closing costs expire on save this loan estimate to compare with your closing disclosure. loan estimate page 1 of 3 • loan id # 1330172608.

Fillable Online Www Consumerfinance Govforms Samplesloan Estimate And Choosing a loan offer. review your loan estimates. the loan estimate form gives you important information about the loan a lender is offering you. you can use the loan estimate to compare offers and choose the right loan for you. review your loan estimates to make sure the details accurately reflect the loan you asked for. Estimated taxes, insurance & assessments amount can increase over time before closing, your interest rate, points, and lender credits can change unless you lock the interest rate. all other estimated closing costs expire on save this loan estimate to compare with your closing disclosure. loan estimate page 1 of 3 • loan id # 1330172608.

Comments are closed.