Consumer Driven Healthcare Plans

The Evolution Of Consumer Driven Health Plans A cdhp is a consumer directed health plan. cdhps use a high deductible, paired with a tax advantages health spending account, or has, to increase the amount of accountability that is in place for personalized health care spending. cdhps include flexible spending arrangements, health reimbursement arrangements, and medical savings accounts. The irs defines an hdhp as any plan with a deductible minimum of: $1,400 for an individual. $2,800 for a family. an hdhp’s total annual in network out of pocket expenses (including deductibles.

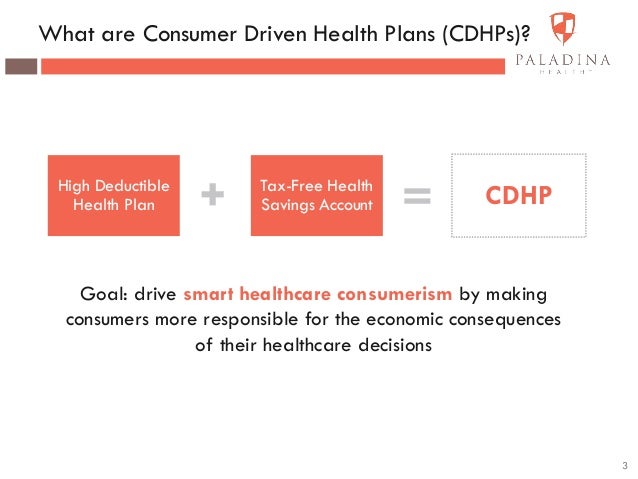

Consumer Driven Healthcare Plans Ppt Powerpoint Presentation Portfolio Originally posted: october 25, 2010. some employers are considering the switch to consumer driven health plans (cdhps) in order to reduce the cost of providing health insurance benefits to their employees. because cdhps generally have lower premiums, they might be a popular choice for some employees. employers and employees will need to. Consumer driven healthcare (cdhc), or consumer driven health plans (cdhp) refers to a type of health insurance plan that allows employers or employees to utilize pretax money to help pay for medical expenses not covered by their health plan. these plans are linked to health savings accounts (hsas), health reimbursement accounts (hras), or. While consumer driven health plans might have negative influences on enrollees' utilization of care, they may successfully lower costs for employers and payers. overall spending among consumer driven health plan enrollees was 13 percent lower than individuals not enrolled in a consumer driven health plan in 2016, the last time that the health. A consumer driven health plan is a health insurance plan that allows employers, employees, or both to set aside pretax money to help pay for qualified medical expenses not covered by their health plan. cdhps are linked to health savings accounts (hsas) and integrated health reimbursement arrangements (hras), which allow participants to save.

What Is A Consumer Driven Health Plan Cdhp While consumer driven health plans might have negative influences on enrollees' utilization of care, they may successfully lower costs for employers and payers. overall spending among consumer driven health plan enrollees was 13 percent lower than individuals not enrolled in a consumer driven health plan in 2016, the last time that the health. A consumer driven health plan is a health insurance plan that allows employers, employees, or both to set aside pretax money to help pay for qualified medical expenses not covered by their health plan. cdhps are linked to health savings accounts (hsas) and integrated health reimbursement arrangements (hras), which allow participants to save. Cdhp stands for consumer directed health plan. it's a type of health plan that gives you more control of your health care expenses. a cdhp most often pairs with a health savings account (hsa), or some other tax advantaged account. an hsa is a savings account that lets you use pre tax dollars to pay for a wide range of qualified health care. One plan worth a close look is the consumer directed health plan (cdhp) – sometimes called a consumer driven health plan and high deductible health plan (hdhp). with a cdhp, you must pay your medical costs before your health plan does. here’s an example. with a ppo and an hmo, you typically have a copay when you visit a doctor.

Optimize Your Consumer Driven Health Plan For The 2021 2022 Plan Year Cdhp stands for consumer directed health plan. it's a type of health plan that gives you more control of your health care expenses. a cdhp most often pairs with a health savings account (hsa), or some other tax advantaged account. an hsa is a savings account that lets you use pre tax dollars to pay for a wide range of qualified health care. One plan worth a close look is the consumer directed health plan (cdhp) – sometimes called a consumer driven health plan and high deductible health plan (hdhp). with a cdhp, you must pay your medical costs before your health plan does. here’s an example. with a ppo and an hmo, you typically have a copay when you visit a doctor.

Comments are closed.