Consumer Dda Account Wells Fargo

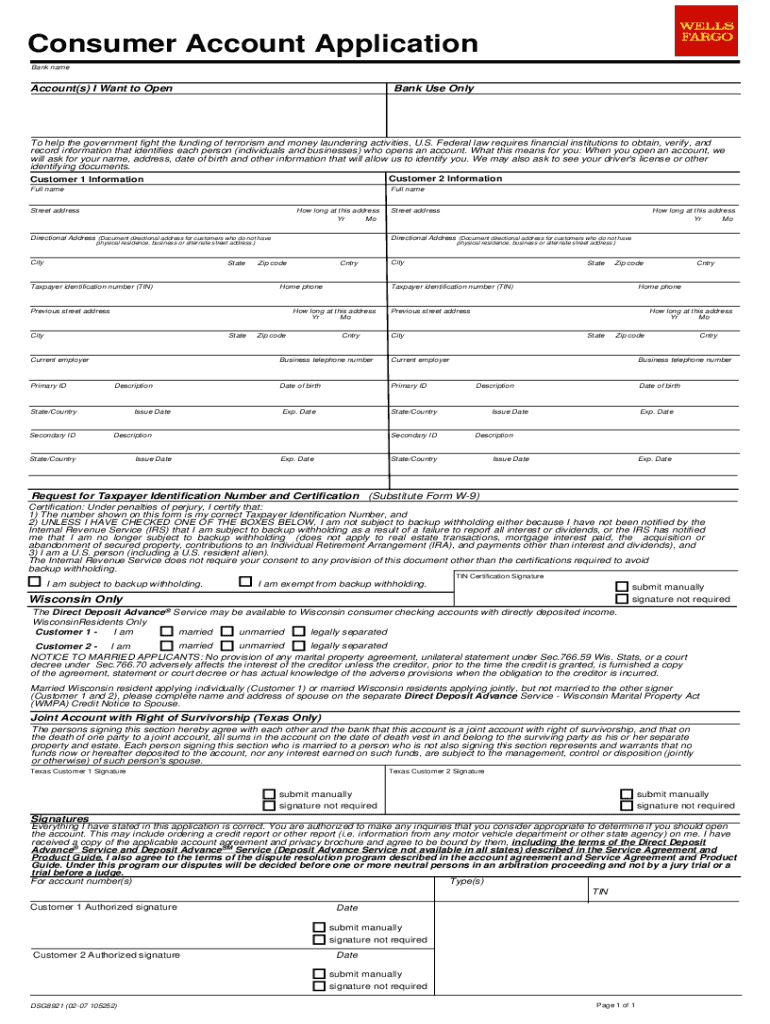

Wells Fargo Consumer Account Application Fill Out Sign Online Dochub If you have selected to open your account in a state in which wells fargo does not have a physical banking location, your account will be considered as opened in california and subject to the california account disclosures. deposit products offered by wells fargo bank, n.a. member fdic. qsr 05152025 6102328.1.1. lrc 1123. Getty. a demand deposit account (dda) is a type of bank account that offers access to your money without requiring advance notice. in other words, money can be withdrawn from a dda on demand and.

Wells Fargo Consumer Account Application Here S Why You Ah Studio Blog Consumer account fee and information schedule addenda. these addenda change the consumer account fee and information schedule (“consumer schedule”). all terms defined in the consumer schedule will have the same meaning when used in these addenda. if there is a conflict between these addenda and the consumer schedule, these addenda will control. Getty images. a demand deposit account, or dda, is a type of bank account that you can withdraw from on demand. the most common types of ddas are checking and savings accounts, but money market. Assuming it’s just dda debit and once the system catches up it’ll tell you the merchant. over the weekend it was a holiday something that you did friday after 10pm shows for tuesdays business date. i recently checked my account today, which i have with citizens, and it said i had a “dda d” charge for $26. i’ve noticed dda d charges in. A demand deposit account is just a different term for a checking account. the difference between a demand deposit account (or checking account) and a negotiable order of withdrawal account is the amount of notice you need to give to the bank or credit union before making a withdrawal.

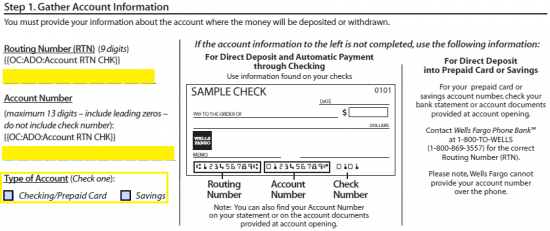

Free Wells Fargo Direct Deposit Authorization Form Pdf Assuming it’s just dda debit and once the system catches up it’ll tell you the merchant. over the weekend it was a holiday something that you did friday after 10pm shows for tuesdays business date. i recently checked my account today, which i have with citizens, and it said i had a “dda d” charge for $26. i’ve noticed dda d charges in. A demand deposit account is just a different term for a checking account. the difference between a demand deposit account (or checking account) and a negotiable order of withdrawal account is the amount of notice you need to give to the bank or credit union before making a withdrawal. This deposit account agreement applies to consumer and business accounts and, together with the following documents, is your contract with wells fargo and constitutes the “agreement” that governs your account with wells fargo: the consumer account fee and information schedule (“consumer schedule”) or the business account fee and. A demand deposit account (dda) is a bank account from which deposited funds can be withdrawn at any time, without advance notice. dda accounts can pay interest on the deposited funds but aren’t.

Comments are closed.