Consumer Credit Reports Explained Centrix

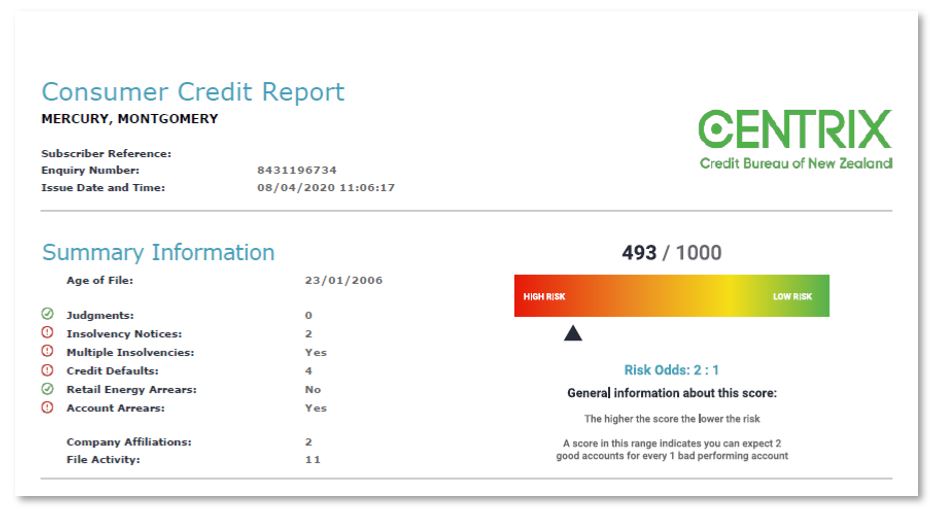

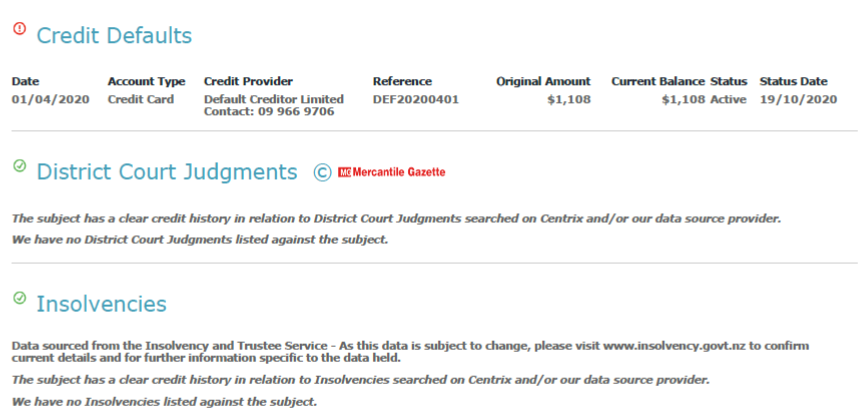

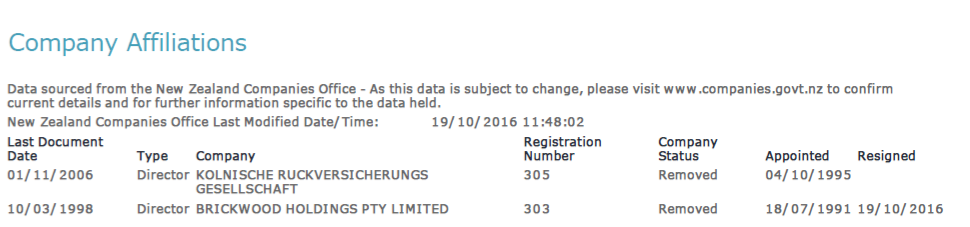

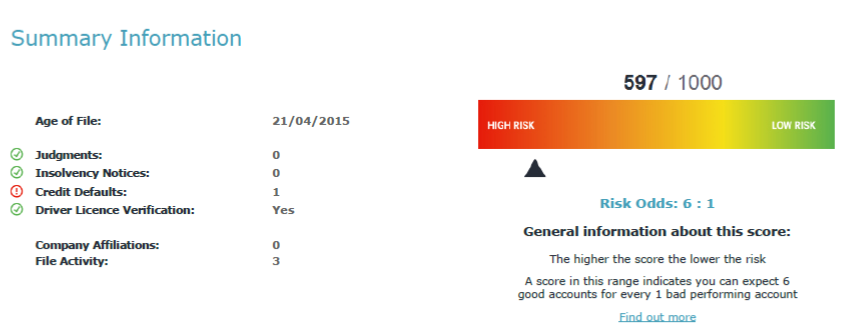

Consumer Credit Reports Explained Centrix Centrix consumer credit reports include personal information, credit score, and information on any defaults and judgements. they can also include payment history, id verification, and information about any companies with which the person is affiliated, either as a shareholder or director. the report features a credit score, which is a number. A centrix consumer credit report is a document you can access on a potential or existing customer that helps you to make smarter business, payment, and lending decisions by providing you with a comprehensive data driven credit score. the score consolidates risk outcomes and gives you a snapshot of a consumer’s creditworthiness, helping you.

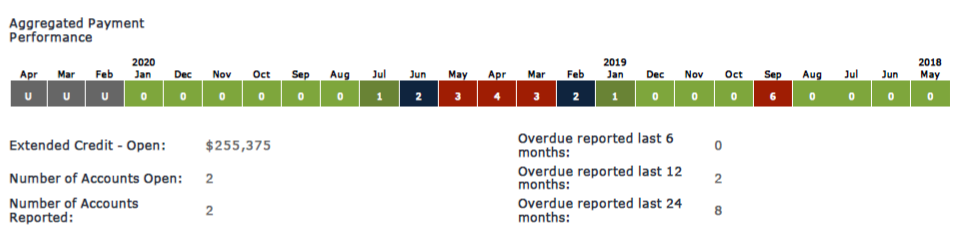

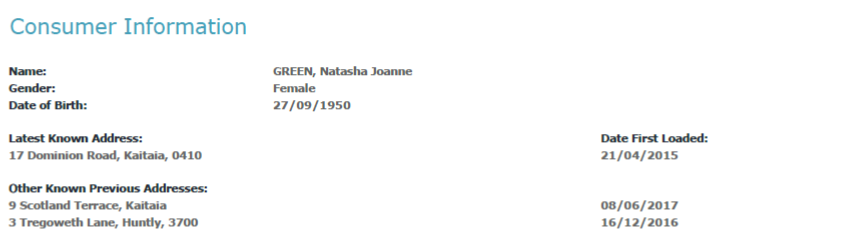

Consumer Credit Reports Explained Centrix Understanding your personal credit report. your personal credit report is a summary of how often you’ve bought products or services on credit, and how well you’ve paid your bills on time. it’s not just credit card, loan and mortgage information; the information in your consumer credit report is collected from multiple sources. You can request your credit report in spanish directly from each of the three major credit bureaus: · transunion: call 800 916 8800. · equifax: visit the link or call 888 378 4329. · experian. Credit inquiries are records of when someone requested a copy of your credit report. they can stay on your credit report for up to two years. a hard inquiry may appear on your credit report when you apply for a new credit account or ask for a higher credit limit on an existing credit card. these inquiries can affect your credit scores. Know the data on your credit report. you know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. use our list of credit reporting companies to request and review each of your reports. browse the list.

Consumer Credit Reports Explained Centrix Credit inquiries are records of when someone requested a copy of your credit report. they can stay on your credit report for up to two years. a hard inquiry may appear on your credit report when you apply for a new credit account or ask for a higher credit limit on an existing credit card. these inquiries can affect your credit scores. Know the data on your credit report. you know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. use our list of credit reporting companies to request and review each of your reports. browse the list. Typically shown as a number out of 1000, your score is on a file held by credit reporting agencies such as centrix, equifax and illion. every time a company runs a credit check about you, it goes on the file. credit reporting agencies can collect and hold personal information on you for up to five years. The three nationwide credit bureaus — transunion, equifax, and experian — collect credit and other information about you. in your credit report, you’ll find information like. your name, address, and social security number. your credit cards. your loans. how much money you owe. if you pay your bills on time or late.

Consumer Credit Reports Explained Centrix Typically shown as a number out of 1000, your score is on a file held by credit reporting agencies such as centrix, equifax and illion. every time a company runs a credit check about you, it goes on the file. credit reporting agencies can collect and hold personal information on you for up to five years. The three nationwide credit bureaus — transunion, equifax, and experian — collect credit and other information about you. in your credit report, you’ll find information like. your name, address, and social security number. your credit cards. your loans. how much money you owe. if you pay your bills on time or late.

Consumer Credit Reports Explained Centrix

Consumer Credit Reports Explained Centrix

Comments are closed.