Consumer Credit Collections

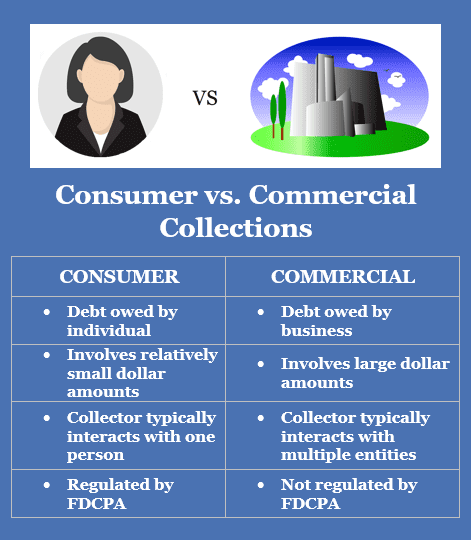

Consumer Credit Collection Approach The fair debt collections practices act regulates what debt collectors are allowed to do. under this law, debt collectors can: contact you via phone, letter, email or text message unless you ask them to stop in writing. leave you a voicemail message about your debt. contact you via social media: effective november 30, 2021, debt collectors can. About us. we're the consumer financial protection bureau (cfpb), a u.s. government agency that makes sure banks, lenders, and other financial companies treat you fairly. learn how the cfpb can help you. call us if you still can’t find what you’re looking for. (855) 411 2372.

All About Commercial Collections Creditors Adjustment Bureau This can be a helpful way to know more about the debt, as well as tell whether or not it’s a scam. to verify a debt collector, ask them to provide: their name. company name. company street address. telephone number. professional license number, if your state licenses debt collectors. to help you verify this information, you can find out more. The fair debt collection practices act, which sets rules for consumer debt collection, generally applies to third party collectors only. 6 steps for dealing with a debt collector 1. In some states, if you pay any amount on a time barred debt, or even promise to pay, the debt is “revived.”. that means the clock resets, and a new statute of limitations begins. the collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. pay off the debt. The law says that debt collectors: can’t contact you before 8 a.m. or after 9 p.m., unless you agree to it. can’t tell anyone else about your debt — except to find out your address, home phone number, or where you work. can’t harass you — like curse at you or threaten to hurt you. can’t lie to you.

What Is Credit And Collections Management Ccm Facts Figures In some states, if you pay any amount on a time barred debt, or even promise to pay, the debt is “revived.”. that means the clock resets, and a new statute of limitations begins. the collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. pay off the debt. The law says that debt collectors: can’t contact you before 8 a.m. or after 9 p.m., unless you agree to it. can’t tell anyone else about your debt — except to find out your address, home phone number, or where you work. can’t harass you — like curse at you or threaten to hurt you. can’t lie to you. Learn about debt collection, harassment, and more. The ftc enforces the fair debt collection practices act (“fdcpa”), which prohibits deceptive, unfair, and abusive debt collection practices. among other things, the fdcpa bars collectors from using obscene or profane language, threatening violence, calling consumers repeatedly or at unreasonable hours, misrepresenting a consumer’s legal.

Understanding The Debt Collection Process Credit Card Help 4u Learn about debt collection, harassment, and more. The ftc enforces the fair debt collection practices act (“fdcpa”), which prohibits deceptive, unfair, and abusive debt collection practices. among other things, the fdcpa bars collectors from using obscene or profane language, threatening violence, calling consumers repeatedly or at unreasonable hours, misrepresenting a consumer’s legal.

Ppt Chapter 5 Introduction To Consumer Credit Powerpoint Presentation

Comments are closed.