Compare The Sources Of Consumer Credit

Ppt Consumer Credit Its Advantages Disadvantages Sources And Consumer credit is based on trust in the consumer's ability and willingness to pay bills when due. it works because people, by and large, are honest and responsible. in fact, personal credit, if used wisely, has its advantages. of course, personal credit usually can't help you get financing for your business. Consumer credit, often referred to as consumer debt, is a financial tool that individuals use to make immediate purchases of goods and services. unlike secured loans, consumer credit is not collateralized, making it a flexible option for smaller amounts. while various types of personal loans can fall under consumer credit, it’s commonly.

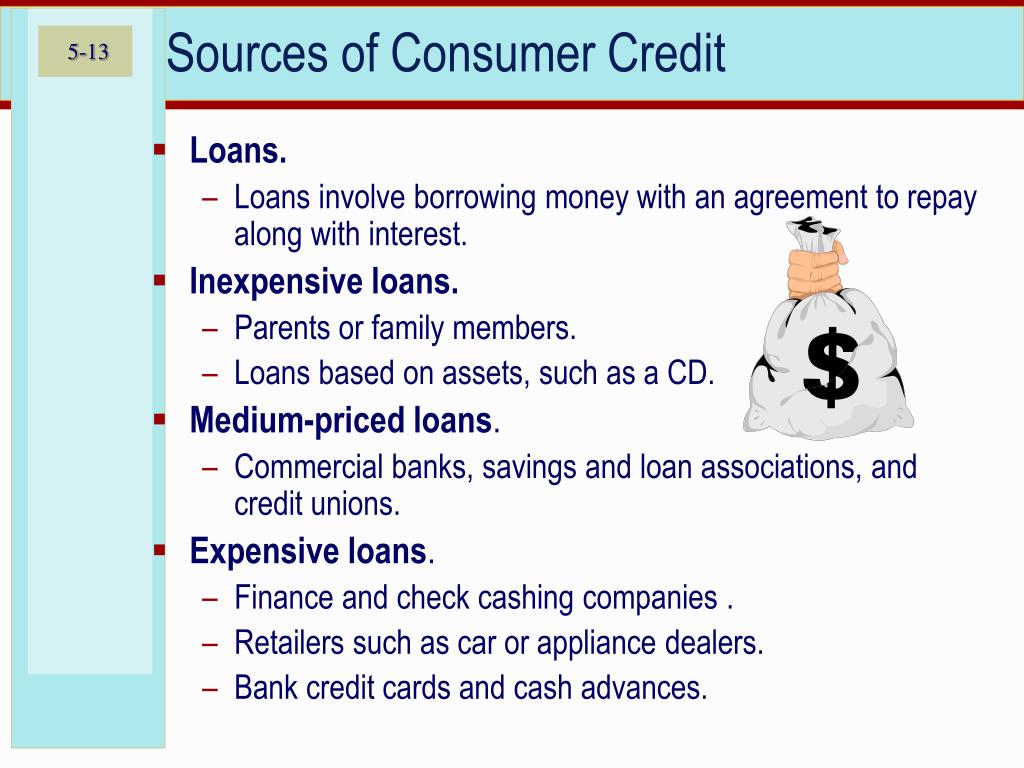

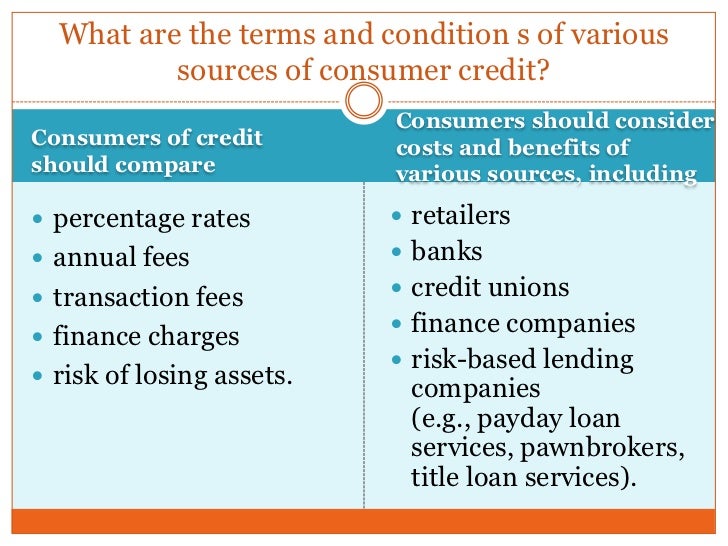

Compare Sources Consumer Credit In Powerpoint And Google Slides Cpb Like other loans, the interest rate and terms depend on your credit history. here is a look at some facts you should know about personal loans: common personal loan term: 12 60 months. apr interest range: 6% to 36%. minimum loan: $1,000 $3,000, based on lender. maximum loan: $25,000 $100,000 based on lender. Next, two types of consumer credit—closed end credit and open end credit—are differentiated, and major sources of consumer credit are explained. then, general rules of measuring credit capacity such as debt payments to income ratio and debt to equity ratio are explained. this is followed by coverage of building and maintaining a credit rating. Consumer credit in financial services is personal debt taken on to purchase goods and services. learn more about the different types of consumer credit. article sources. best credit repair. Board of governors of the federal reserve system. " consumer credit g.19." accessed june 8, 2021. consumer credit refers to credit extended to consumers through credit cards, lines of credit, and loans. outstanding credit is repaid over time, usually with interest.

Consumer Credit Consumer credit in financial services is personal debt taken on to purchase goods and services. learn more about the different types of consumer credit. article sources. best credit repair. Board of governors of the federal reserve system. " consumer credit g.19." accessed june 8, 2021. consumer credit refers to credit extended to consumers through credit cards, lines of credit, and loans. outstanding credit is repaid over time, usually with interest. When a lender extends unsecured credit, it typically charges a higher interest rate than it would for secured credit. that's because a lender assumes more risk with unsecured credit than secured credit. lending sources for consumer credit. consumer credit is available from a variety of lending sources, such as: banks; credit unions; online lenders. The three nationwide credit bureaus — transunion, equifax, and experian — collect credit and other information about you. in your credit report, you’ll find information like. your name, address, and social security number. your credit cards. your loans. how much money you owe. if you pay your bills on time or late.

Consumer Credit When a lender extends unsecured credit, it typically charges a higher interest rate than it would for secured credit. that's because a lender assumes more risk with unsecured credit than secured credit. lending sources for consumer credit. consumer credit is available from a variety of lending sources, such as: banks; credit unions; online lenders. The three nationwide credit bureaus — transunion, equifax, and experian — collect credit and other information about you. in your credit report, you’ll find information like. your name, address, and social security number. your credit cards. your loans. how much money you owe. if you pay your bills on time or late.

Comments are closed.