Common Types Of Mutual Funds Rohstoff Etf

Common Types Of Mutual Funds Rohstoff Etf Etfs offer transparency, allowing investors to review holdings daily and monitor portfolio risk exposures more frequently than with traditional open ended mutual funds. for the active investor, etfs may may satisfy the investor's need for more trading flexibility and holdings transparency. 4 types of mutual funds. there are four broad types of mutual funds: equity (stocks), fixed income (bonds), money market funds (short term debt), or both stocks and bonds (balanced or hybrid funds).

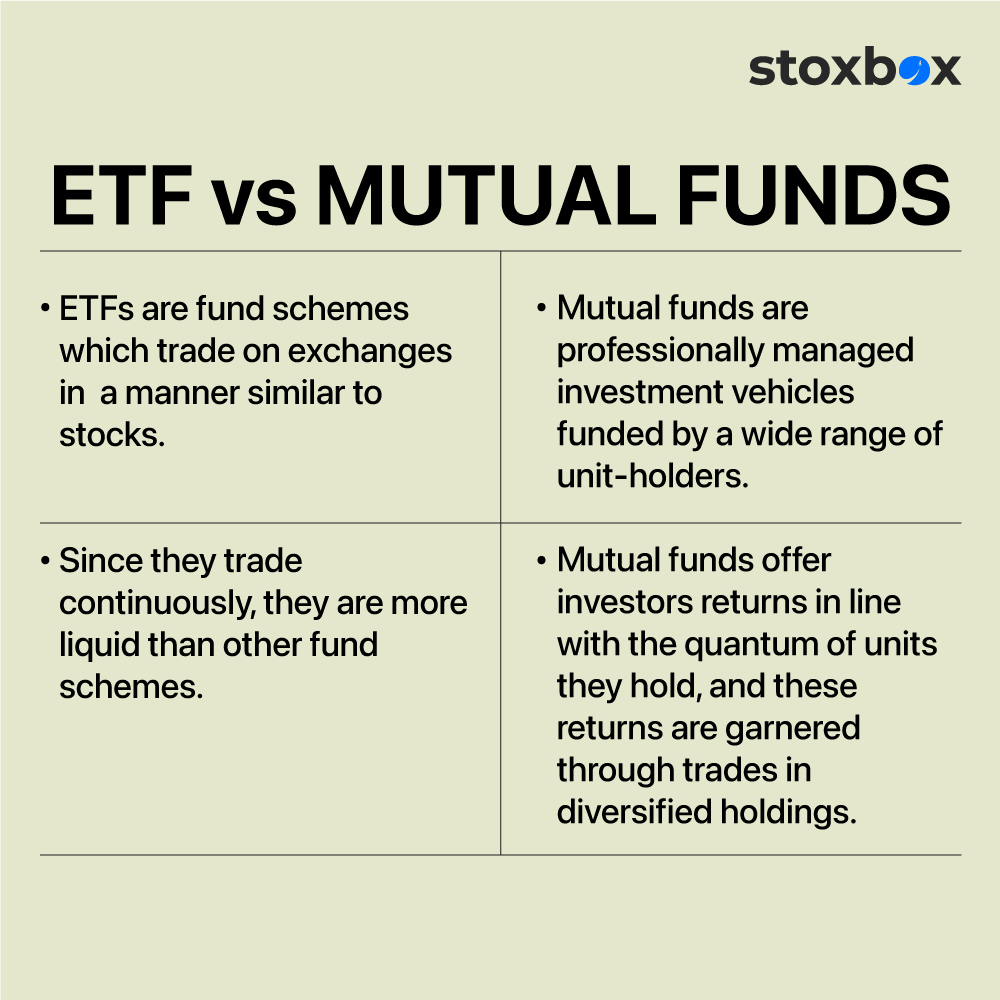

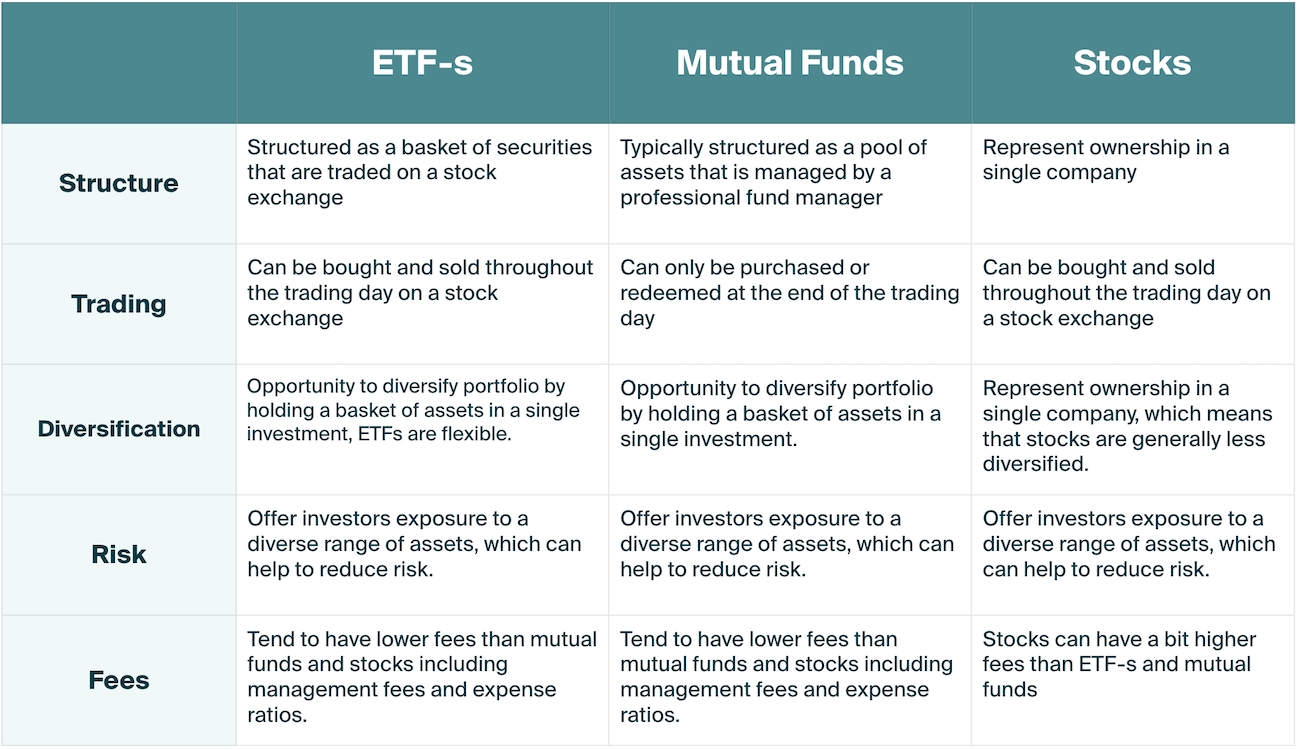

Etf Vs Mutual Fund What S The Difference Rohstoff Etf Mutual funds distribute taxable capital gains and dividends to shareholders each year. mutual funds trade once a day, resulting in reduced portfolio visibility during trading hours. expenses are deducted from the fund, which reduces the value of the portfolio. past performance measures such as 3 and 5 year returns, though past performance is. Types include money market funds, stock funds, bond funds, and target date funds. blackwaterimages e via getty images. different mutual funds have different risk makeups, by investing in a. This is part of the reason why the average etf costs half as much as the average mutual fund (0.50% vs 1.01%). if you’re comparing an etf and a mutual fund that track the same index, the fee. Mutual funds are usually actively managed. index funds are passively managed and have become more popular. etfs are usually passively managed and track a market index or sector sub index. etfs can.

Etf Vs Mutual Fund What S The Difference Rohstoff Etf This is part of the reason why the average etf costs half as much as the average mutual fund (0.50% vs 1.01%). if you’re comparing an etf and a mutual fund that track the same index, the fee. Mutual funds are usually actively managed. index funds are passively managed and have become more popular. etfs are usually passively managed and track a market index or sector sub index. etfs can. Class c share. class c mutual fund shares charge a level sales load set as a fixed percentage assessed each year. this is different from front load shares that charge investors at purchase or back. Etfs provide intraday trading and may be more tax efficient, while mutual funds offer simplicity and convenience for regular investments. having a mix of both types of funds allows investors to.

Common Types Of Mutual Funds Mutuals Funds Fund Mutual Class c share. class c mutual fund shares charge a level sales load set as a fixed percentage assessed each year. this is different from front load shares that charge investors at purchase or back. Etfs provide intraday trading and may be more tax efficient, while mutual funds offer simplicity and convenience for regular investments. having a mix of both types of funds allows investors to.

Etf Vs Mutual Funds Difference What Is Types Versus Returns Best

Grünfin Financial Blog Full Etf Guide All You Need To Know About Etf S

Comments are closed.