Common Types Of Mutual Funds Ramseysolutions

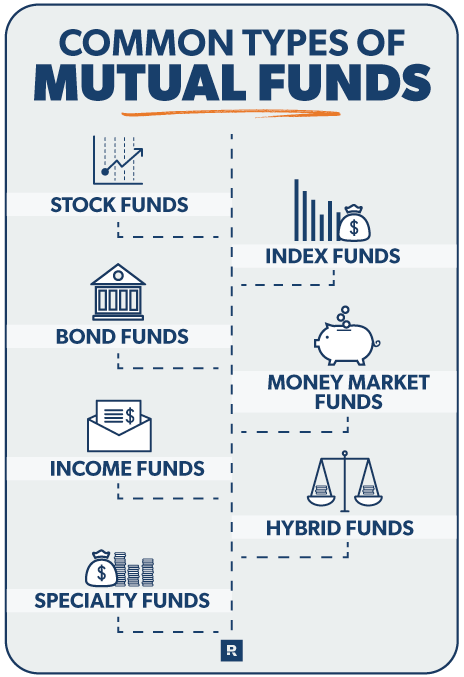

Common Types Of Mutual Funds Ramseysolutions 1. stock funds. stock funds—also called equity funds—are made up of (you guessed it) stocks, which are publicly traded shares of a company. if you own stock in a company, you own a tiny piece of that company. when you invest in a stock mutual fund, you own a tiny piece of all the companies that mutual fund invests in. Like we said earlier, the mutual fund’s prospectus or online profile will tell you a lot of what you need to know. here are six important features you’ll need to review as you select funds to invest in: 1. objective. this is a summary of the fund’s goal and how its management team plans to achieve that goal.

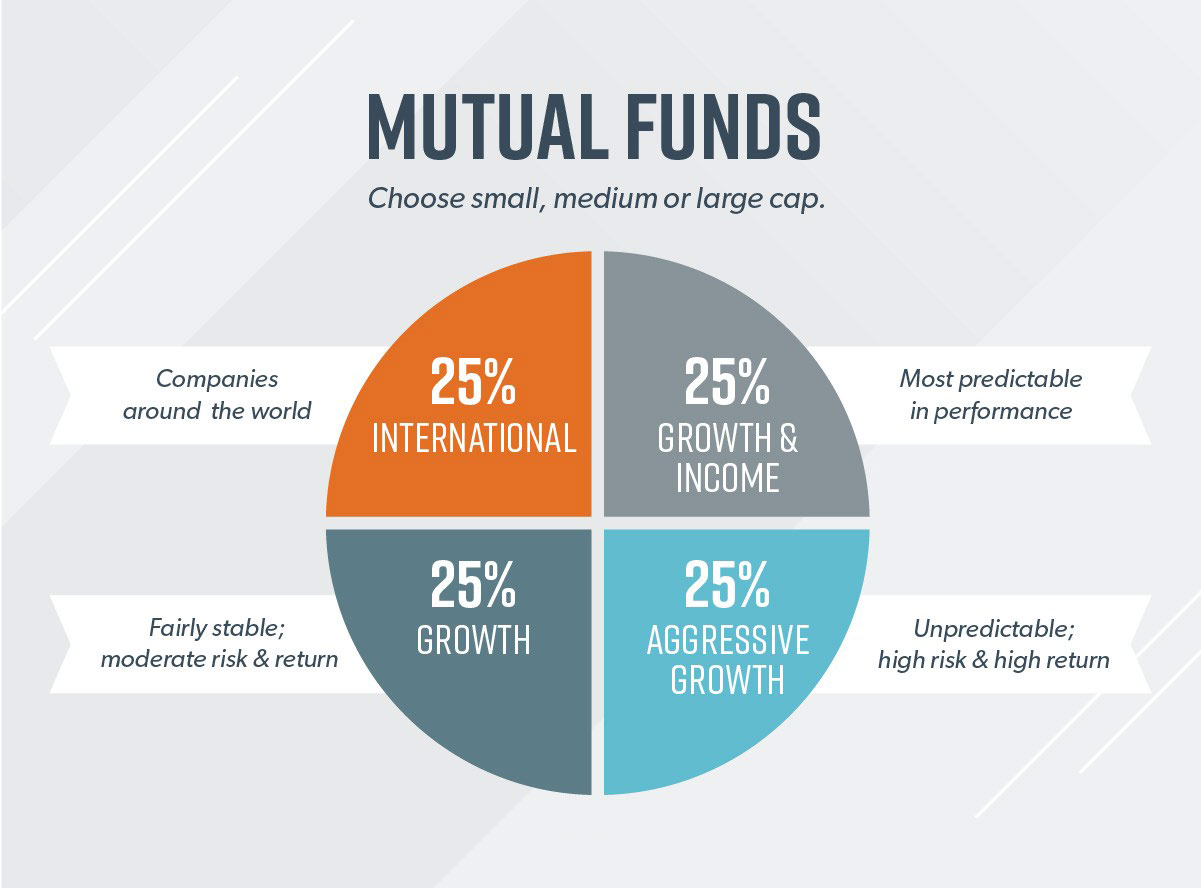

Common Types Of Mutual Funds Ramsey If you’re ready to start investing in mutual funds, just follow these simple steps and you’ll be well on your way: 1. calculate your investing budget. after you’ve paid off all debt (except for your house) and built a solid emergency fund, invest 15% of your gross income every month for retirement. 4 types of mutual funds. there are four broad types of mutual funds: equity (stocks), fixed income (bonds), money market funds (short term debt), or both stocks and bonds (balanced or hybrid funds). Index funds, a specific type of mutual fund, offer the advantages of low expense ratios, simplicity, and a passive investment strategy designed to replicate the performance of a market index, like the s&p 500. they stand out among other types of mutual funds for their cost effectiveness and straightforward approach to market performance tracking. An investor may choose equity funds for a few reasons. first, equities historically grow at a higher rate than inflation and most fixed income investments like bonds. second, equity funds provide.

What Are Stocks And How Do They Work Ramsey Index funds, a specific type of mutual fund, offer the advantages of low expense ratios, simplicity, and a passive investment strategy designed to replicate the performance of a market index, like the s&p 500. they stand out among other types of mutual funds for their cost effectiveness and straightforward approach to market performance tracking. An investor may choose equity funds for a few reasons. first, equities historically grow at a higher rate than inflation and most fixed income investments like bonds. second, equity funds provide. 1. mutual funds and etfs are managed differently. this is one of the main differences between etfs and mutual funds: etfs are managed passively (the fund just follows the market index) while mutual funds are managed actively by investment professionals. this keeps etf fees low since there’s no team of managers selecting companies. These funds offer stability and steady growth. mid cap funds: invest in mid sized companies with a market capitalization between $2 billion and $10 billion. these funds balance growth potential and stability. small cap funds: invest in small companies with a market capitalization of less than $2 billion.

Common Types Of Mutual Funds Ramsey 1. mutual funds and etfs are managed differently. this is one of the main differences between etfs and mutual funds: etfs are managed passively (the fund just follows the market index) while mutual funds are managed actively by investment professionals. this keeps etf fees low since there’s no team of managers selecting companies. These funds offer stability and steady growth. mid cap funds: invest in mid sized companies with a market capitalization between $2 billion and $10 billion. these funds balance growth potential and stability. small cap funds: invest in small companies with a market capitalization of less than $2 billion.

Common Types Of Mutual Funds 2023

Comments are closed.