Coca Colako Vs Pepsicopep Which Dividend King Is A Buy

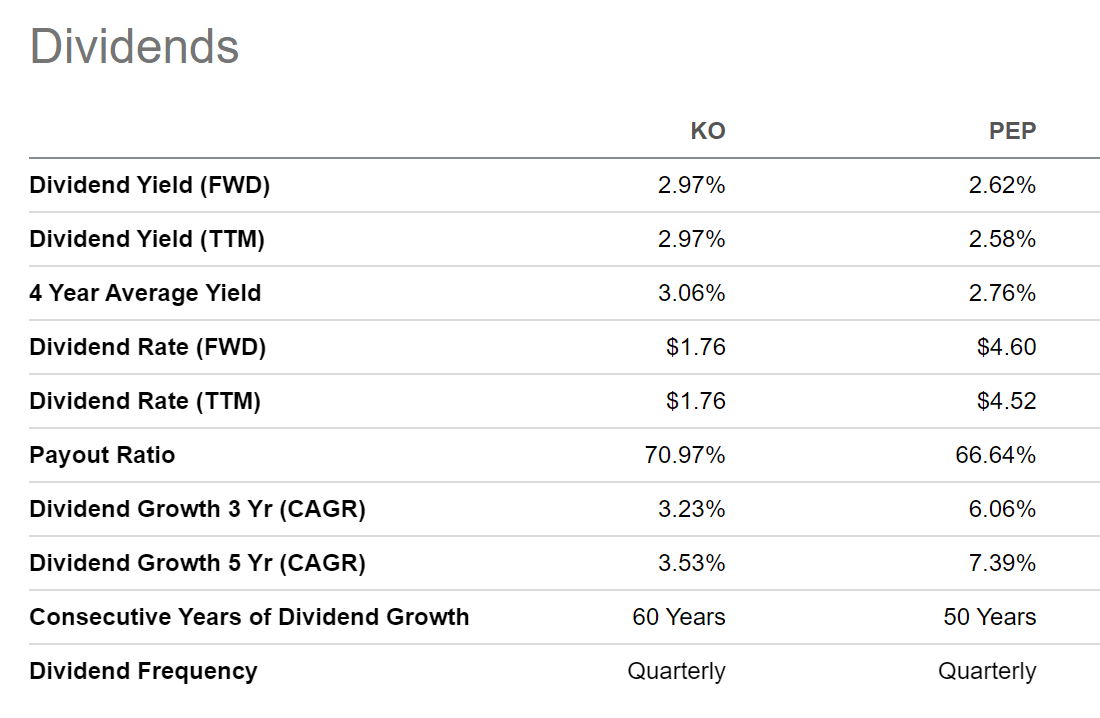

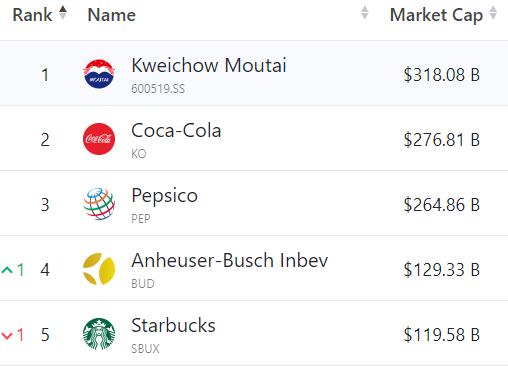

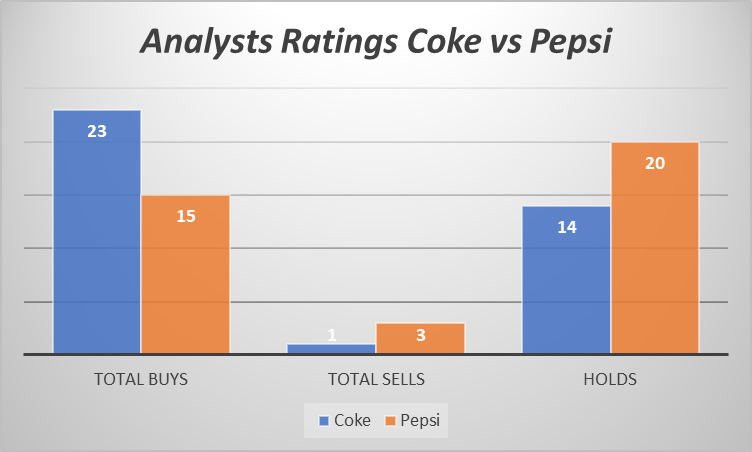

Coca Cola Ko Vs Pepsico Pep Which Dividend King Is A Buy Youtube Coca cola currently pays a forward dividend yield of 2.7%, which is slightly higher than pepsico's forward yield of 2.6%. both stocks trade at 26 times forward earnings. those p e ratios are a bit. Plus, forward eps growth for pep is estimated at 9.21%, edging out ko's 6.54%. in fact, over the past 10 years, pepsi has reported revenue and eps at compounded annual growth rates (cagrs) of 3.29.

Coca Cola Ko Vs Pepsico Pep Which Dividend King Is A Buy Youtube Lastly, it is one of the most reliable dividend stocks on the market, having raised its payout each year for 52 years, making it a dividend king. it now has a dividend yield of 3.2%. if you're. As previously noted, both are dividend aristocrats, but ko is a dividend king, while pep is a year away from obtaining that mark. coca cola has a yield of 3.10%, a payout ratio of 77.09%, and a 5. Currently, coca cola pays a quarterly dividend of $0.485 per share, representing a dividend yield of 2.7%. the stock is in the exclusive dividend kings club, having paid and increased its dividend. One advantage that coca cola has is that it generates better margins than pepsico, and that can make it easier for the company to grow its bottom line. ko profit margin (quarterly) data by ycharts.

Coca Cola Ko Vs Pepsi Pep Which Stock Is Better Dividend Stock Currently, coca cola pays a quarterly dividend of $0.485 per share, representing a dividend yield of 2.7%. the stock is in the exclusive dividend kings club, having paid and increased its dividend. One advantage that coca cola has is that it generates better margins than pepsico, and that can make it easier for the company to grow its bottom line. ko profit margin (quarterly) data by ycharts. Coca cola has raised its dividend for 62 consecutive years with pepsi at 52 years and counting. at the moment coca cola’s 3.08% annual dividend yield slightly tops pepsi’s 2.97%. image source. Ko was last rated a bargain in 2010 and has risen 77% since. pep has only recently recorded a bargain price at the end of 2018 when the price was $109.28 and has grown to $142.91, an almost 31%.

Coca Cola Vs Pepsico Which Is The Better Buy For Dividend Income Coca cola has raised its dividend for 62 consecutive years with pepsi at 52 years and counting. at the moment coca cola’s 3.08% annual dividend yield slightly tops pepsi’s 2.97%. image source. Ko was last rated a bargain in 2010 and has risen 77% since. pep has only recently recorded a bargain price at the end of 2018 when the price was $109.28 and has grown to $142.91, an almost 31%.

Coke Vs Pepsi Which Is The Better Buy For Dividends Nasdaq Pep

Coke Vs Pepsi Which Is The Better Buy For Dividends Nasdaq Pep

Comments are closed.