Coca Cola Vs Pepsico Which Is The Better Investment Seeking Alpha

Coca Cola Vs Pepsico Which Is The Better Buy For Dividend Income In addition to that, pepsico’s 24m beta of 0.50 is even lower than the one of coca cola (24m beta of 0.60), which serves as evidence that you can further reduce the volatility of your investment. Coca cola is a much better balance sheet than pepsico, even managing to have more cash on hand than debt during much of this time frame. coca cola is a clear winner. now, here is the final tally:.

Coca Cola Vs Pepsico Which Is The Better Investment Seeking Alpha Ko generates $8.46 of revenue per share, and its share price is $56.77, placing its p s ratio at 6.71. pep generates $54.01 of revenue per share with a share price of $156.95, placing its p s. There aren't many places you can visit globally and not run into products from coca cola (ko 0.40%) or pepsico (pep 0.91%). they both have a stronghold on nonalcoholic beverages, and pepsico has. Pepsico, for instance, showcased impressive financial muscle, reporting revenue of $22.32 billion, comfortably surpassing the projections of $21.73 billion. coca cola was not far behind. This has resulted in a higher interest expense for pepsico $854 million in the past 12 months, compared to coca cola's $545 million. in terms of valuation, coca cola is slightly better priced.

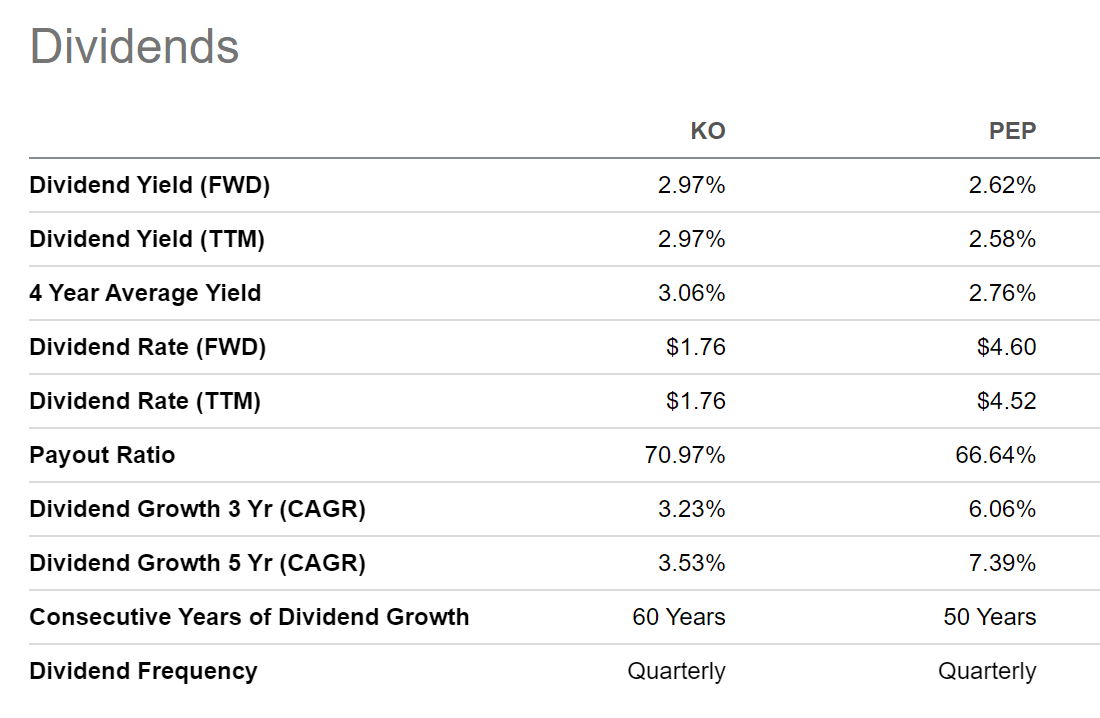

Coca Cola Vs Pepsico Which Is The Better Buy For Dividend Income Pepsico, for instance, showcased impressive financial muscle, reporting revenue of $22.32 billion, comfortably surpassing the projections of $21.73 billion. coca cola was not far behind. This has resulted in a higher interest expense for pepsico $854 million in the past 12 months, compared to coca cola's $545 million. in terms of valuation, coca cola is slightly better priced. Coca cola currently pays a forward dividend yield of 2.7%, which is slightly higher than pepsico's forward yield of 2.6%. both stocks trade at 26 times forward earnings. those p e ratios are a bit. Coke has a yield of 3.10%, while that of pepsi is 2.89%. in fact, there are significant differences between the two businesses, and that even holds true regarding the areas in which they are most.

Comments are closed.